Since the acceptance of gem IPO on December 28,2021, the IPO details of Tianjin Guoan Guli New material Technology Co., Ltd. (referred to as "Mengguli") have entered the stage of "inquiry".

Photo source: Shenzhen Stock Exchange

As can be seen from the above picture, the sponsor agency of Menggu gem IPO is Huatai United Securities, with an estimated financing amount of 700 million yuan. Unlike many other enterprises, the funds raised by Mengguli this time will not be used to supplement liquidity or for multiple projects, but all 700 million yuan will be invested in the industrialization project with an annual production capacity of 10,000 tons of cathode materials for lithium-ion batteries.

Photo: prospectus

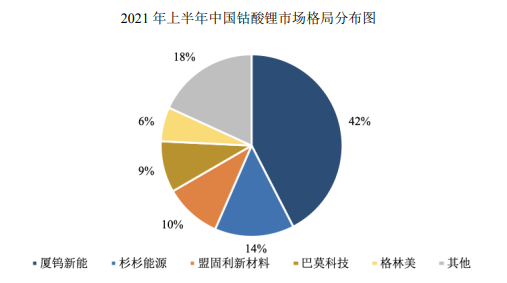

Data show that Mengguli's main business is the research and development, production and sales of cathode materials for lithium-ion batteries, and its main products are lithium cobalt and ternary materials. After nearly 20 years of research and development, production and sales accumulation, it has become one of the major lithium battery cathode material enterprises in China.

In terms of lithium cobalt, during the reporting period of the Menggu prospectus (2018-2020 and January-June 2021), the sales volume of each period accounted for 11%, 8%, 10% and 11% of the national market, respectively, ranking among the top four in the industry.

Among them, in the first half of 2021, the sales scale of Mengguli lithium cobalt accounted for 10% of the national market share, ranking among the top three in the industry.

Photo: prospectus

It is understood that Mengguli 4.4V, 4.45V high-voltage lithium cobalt has become the company's main products of lithium cobalt series, while continuing to explore the high voltage of lithium cobalt products, in order to strive to break through the 4.48V, 4.50V technical bottleneck, of which 4.48V lithium cobalt products have been verified by some large domestic customers and formed a small batch supply.

In terms of ternary materials, Menggu began mass production in 2014 and entered the supply chain of power battery enterprises, mainly from Ni5 series and Ni6 series single crystals, conventional particles and other directions of development, while launching Ni8 series high nickel products.

With the help of the first-mover advantages accumulated over the years of technical research and development and production experience, Menggu Li has expanded many well-known lithium battery customers.

In the field of 3C consumer batteries, Mengguli has established a solid cooperative relationship with Zhuhai Guanyu, BYD, Lishen, Ningbo Vico Battery and other well-known battery companies.

In the field of power batteries, Mengguli has established a solid cooperative relationship with Yiwei Lithium Energy, Lishen, BYD and other well-known battery companies, and has passed the supplier certification of Ningde era.

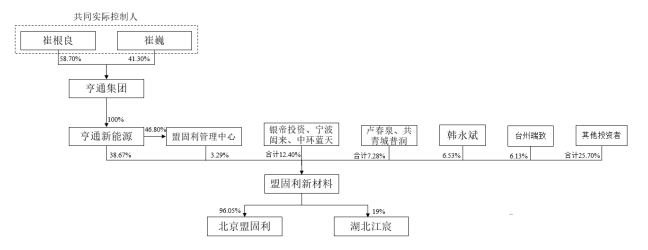

Cui's father and son hold more than half of the shares.

According to the prospectus, as of the date of signing of the prospectus, Menggu's shareholding structure is shown in the following figure:

Photo: prospectus

"Mr. Cui Genliang and Mr. Cui Wei, father and son, together hold a 100% stake in Hengtong Group, which is the joint actual controller of Mengguli."

Among them, Mr. Cui Genliang, who owns 58.70% of Hengtong Group, has served as party secretary and chairman of the board of directors of Hengtong Group since April 2001, vice chairman of Suzhou Federation of Industry and Commerce since April 2012, vice chairman of Jiangsu Federation of Industry and Commerce since August 2012, and deputy to the 12th and 13th National people's Congress since January 2013.

Mr. Cui Wei, who holds a 41.30% equity stake in Hengtong Group, has been the general manager of Jiangsu Hengtong Venture Capital Co., Ltd., the chairman of Jiangsu Hengxin Technology Co., Ltd since May 2016, and the director and chairman of Jiangsu Hengtong since May 2017. since September 2017, he has been the general manager of Jiangsu Hengtong Intelligent things system Co., Ltd., and has served as assistant to the executive president, director of operations management and vice president of Hengtong Group since September 2017. He has been a director of Mengguli New Materials since July 2017.

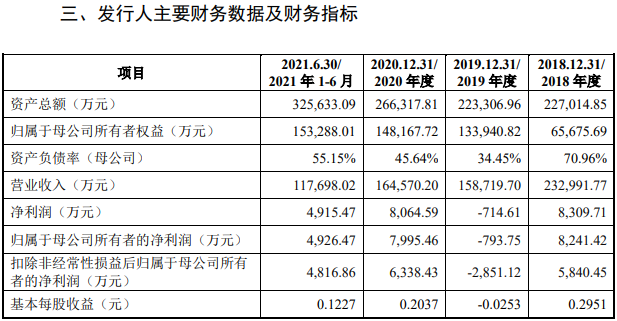

The listing standard chosen by Menggu is: "it is estimated that the market capitalization is not less than 1 billion yuan, the most recent year's net profit is positive and the operating income is not less than 100 million yuan."

The performance has been rising in the past three years.

In terms of performance, the prospectus shows that from January to June 2018-2021, Menggu realized revenue of 2.33 billion yuan, 1.59 billion yuan, 1.65 billion yuan and 1.18 billion yuan, and net profit of 80.39 million yuan,-7.15 million yuan, 80.64 million yuan and 49.15 million yuan respectively.

Photo: prospectus

Without counting 2018, Menggu's performance has improved significantly since 2019. As the net profit of 49.15 million yuan has been realized from January to June in 2021, and the second half of 2021 is the peak season for lithium materials enterprises, the net profit of Menggu is expected to exceed 100 million yuan in 2021.

In terms of products, the revenue realized by selling lithium cobalt oxide products by Couli during the reporting period was 1.68 billion yuan, 990 million yuan, 1.32 billion yuan and 970 million yuan respectively, accounting for 72.97%, 63.30%, 81.17% and 83.88% of the company's main business income, respectively. The proportion of ternary materials in its main business income is 26.75%, 36.27%, 18.56% and 15.84%, respectively.

This shows that Menggu's current positive business is mainly concentrated in the 3C digital battery field, but it is expanding the production capacity of ternary materials, especially high nickel capacity, which means that the power market will become its next key development target.

In terms of capacity, during the reporting period, the capacity utilization rate of Mengguli lithium cobalt was 71.96%, 65.26%, 87.83% and 91.70%, respectively. Affected by the company's capacity expansion and production mode and other factors, there are certain fluctuations.

Mengguri said that in 2018 and 2019, the company's capacity utilization of lithium cobalt was relatively low, mainly due to the expansion of the third workshop of the first phase of the company's project in August 2018, resulting in a significant increase in lithium cobalt production capacity; at the same time, the company adopts the production mode of fixed production by sales, and it takes a certain amount of time to release capacity, so capacity utilization has declined.

In the first half of 2021, the capacity utilization rate of Mengguli lithium cobalt is relatively high, mainly due to the continuous growth of demand for downstream 3C electronic products, the sales volume of lithium cobalt products continues to improve, and the company adopts the production mode of fixed production on the basis of sale. the current output has increased significantly.

During the reporting period, the capacity utilization of Mengguli ternary materials was 81.88%, 87.60%, 45.94% and 63.78%, respectively.

Mengguli said that in 2020, the capacity utilization of ternary materials declined greatly, mainly due to the decline in the price of lithium iron phosphate materials and the decline of the state's subsidy policy for new energy vehicles. From the point of view of cost advantage, BYD, one of the company's main customers of ternary materials, chose lithium iron phosphate and NCM6515 single crystals with lower cobalt content in ternary materials as the main cathode materials. However, there is a large gap between the available production capacity of the company's NCM6515 single crystal products and BYD's bidding share, so its supply is reduced, resulting in a sharp decline in the company's ternary material production and sales, and a decline in capacity utilization, which is reasonable.

"the company is actively exploring new customers and expanding the demand of existing customers, and capacity utilization has rebounded in the first half of 2021."

It is worth noting that the second phase of Mengguli has an annual output of 13000 tons of cathode materials for lithium-ion batteries and the industrialization project of 10, 000 tons of cathode materials for lithium-ion batteries is to increase the production capacity of ternary materials.

After the above projects are completed and put into production, the comprehensive production capacity of Menggu will reach about 34900 tons / year, of which the production capacity of ternary materials will reach about 22500 tons / year.

In terms of R & D investment, during the reporting period, the proportion of operating income of Menggu's R & D expenses was 3.07%, 4.95%, 2.97% and 3.59%, respectively. As of the date of signing of this prospectus, Mengguli has led and participated in the formulation and issuance of 11 national standards and 9 industry standards, with a total of 78 authorized patents, including 34 invention patents.

In addition, Menggu's business is also extending upstream: in December 2020, Menggu acquired a 19% stake in Hubei Jiangchen, and Hubei Jiangchen's main business is the research and development, production and sales of ternary precursors and battery cathode materials.

In addition to the existing products, Mengguli is also actively developing new materials such as lithium-rich manganese-based, sulfur composite electrode materials and solid electrolytes.

Finally, Menggu Li said that the implementation of this fund-raising investment project will help the company to enhance the production capacity of existing products, give full play to the company's existing advantages, and stabilize its cooperative relationship with downstream leading enterprises. consolidate the company's dominant position in the field of ternary cathode materials.