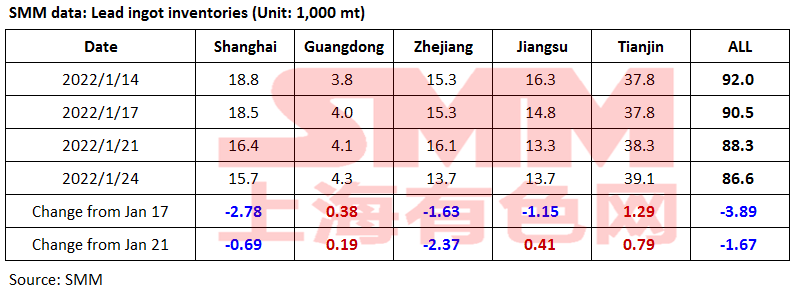

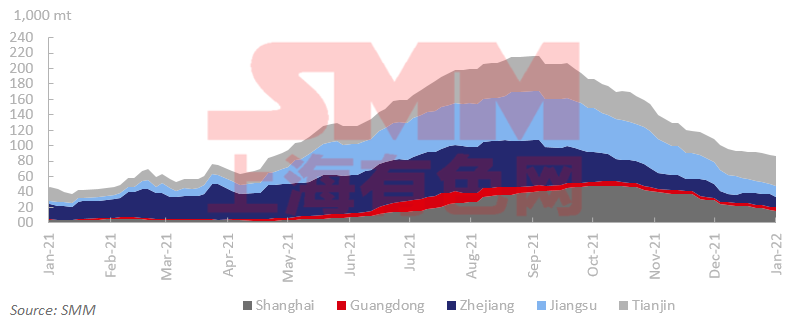

SHANGHAI, Jan 24 (SMM) – The social inventory of lead ingots across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin decreased 1,700 mt from last Friday January 21 and fell 3,900 mt from last Monday January 17, to 86,600 mt as of January 24.

The logistics will be out of services soon as the Chinese New Year approaches, and was disrupted by the heavy snow in Henan. As such, the major consuming markets in Zhejiang and Jiangsu of lead ingots chose to purchase from surrounding areas due to difficulties of purchasing from remote suppliers. As such, the inventories in Shanghai and Zhejiang kept dropping. Meanwhile, the downstream still carried some restocking demand as they will mostly close for the holiday during January 26-30.

The lead ingot inventory is expected to fall slowly amid stagnated logistics and a quiet downstream market as is the last week ahead of the CNY.