SHANGHAI, Oct 15 (SMM) - This is a roundup of China's metals weekly inventory as of October 15.

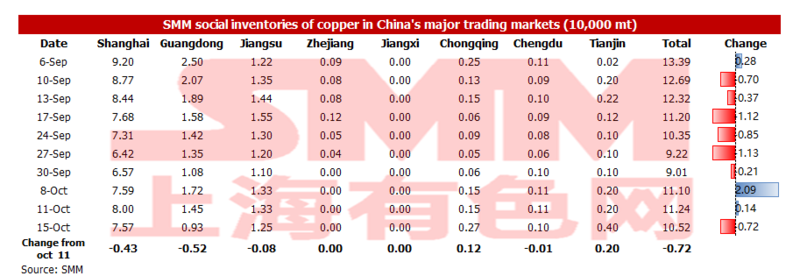

Copper Inventory in Major Chinese Markets Fell 7,200 mt from Monday

As of Friday October 15, the copper inventory in the mainstream Chinese market fell 7,200 mt from Monday October 11 to 105,200 mt. The decrease was mainly contributed by Guangdong, Shanghai and Jiangsu, whose inventory fell 5,200 mt, 4,300 mt and 800 mt to 9,300 mt, 75,700 mt and 12,500 mt, respectively.

The fall in copper inventory was mainly caused by less arrivals of imported copper and the restricted production of domestic smelters. However, the situation has been different in Tianjin, where the operating rates of copper processing companies fell greatly amid power rationing against the downstream sector and wide price spread of copper rod produced by copper cathode and copper scrap. Therefore, the inventory in Tianjin added from the previous session.

Looking forward, the social inventory increased more slowly than expected, and the volume and domestic output and imports have both been at a low level. SMM believes that the situation will extend to next week. The social inventory is likely to fall again as the power rationing is expected to ease in the following weak, and the supply will stay tight amid modest demand.

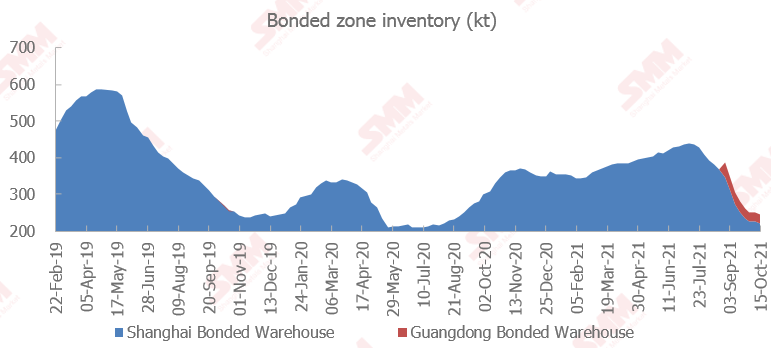

Copper Inventory in China Bonded Zone Dipped 5,600 mt on Week

SHANGHAI, Oct 15 – The copper inventories in the domestic bonded zones dipped 5,600 mt from Friday October 8 to 245,500 mt as of Friday October 15, according to the most recent SMM survey. The inventory in the Shanghai and Guangdong bonded zone decreased 4,100 mt and 1,500 mt to 221,500 mt and 24,000 mt, respectively.

The warehouses have returned to normal operation after the National Day holiday. The lucrative import profits have boosted more customs clearance. While the weekly arrivals at ports decreased, lowing the amount to be warehoused. As such, the inventory in the bonded zone fell on the week.

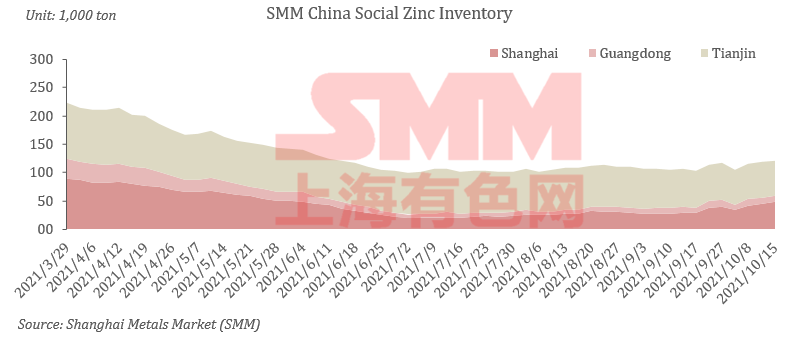

Zinc Social Inventories Up 5,300 mt on Week

Total zinc inventories across seven Chinese markets stood at 139,100 mt as of October 15, up 2,500 mt from October 11 and 5,300 mt from October 8.

The inventory in Shanghai rose sharply amid stable arrivals of goods at smelters and declining purchase demand by downstream buyers on high prices. Guangdong saw a slight decline in stocks amid limited arrivals of goods and falling demand. The arrivals of goods in Tianjin were not high and downstream demand trended lower due to high finished product stocks and soaring prices.

Inventories in Shanghai, Guangdong and Tianjin rose 5,400 mt, and inventories across seven Chinese markets increased 5,300 mt.

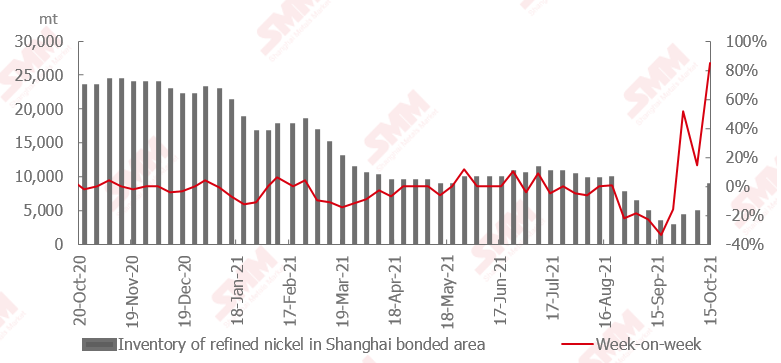

The Import Profits Are Lucrative amid Rising SHFE/LME Nickel Price Ratio

The import profits expanded amid rising SHFE/LME nickel price ration this week. But the market quotations of nickel plate and nickel briquette in US dollar are hardly to be found, and the spot transaction in US dollar has also been sluggish amid high quotations, mainly because most traders chose to do the import business in US dollar directly.

There are likely to be more arrivals of nickel plate and nickel briquette amid the current SHFE/LME price ration. However, as the domestic arrivals are at a high level, the downstream sector will be slow in consuming high-priced products. Therefore, the SHFE/LME price ratio is likely to correct down.

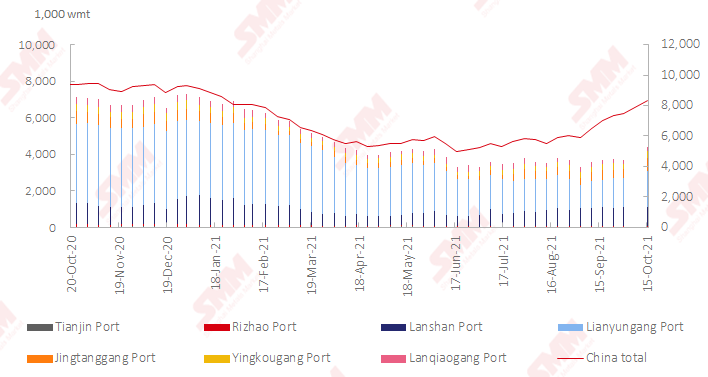

Nickel Ore Inventories at Chinese Ports Surged 827,000 wmt

Nickel ore inventory at Chinese ports grew 827,000 wmt from the week before the National Day holiday to 8.32 million wmt as of October 15. Total Ni content stood at 65,300 mt. Total inventory at seven major ports stood at around 4.39 million wmt, an increase of 707,000 wmt from the week before the National Day holiday. The nickel ore inventory continues to rise, with a cumulative increase of 827,000 mt in two weeks.

The influence of the power rationing will extend to October. The output of downstream NPI is expected to fall again in October. While the port inventory will increase further ahead of the rainy season in the Philippines. The supply of nickel ore has become sufficient due to the power rationing start as early as in end of Q3, which also eased the possible short supply of nickel ore in the rainy season.

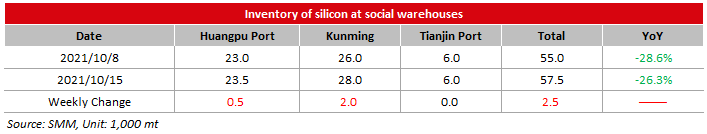

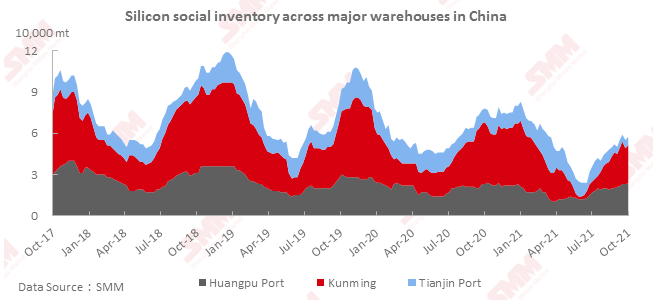

Silicon Metal Social Inventory Up 3,000 Mt on Week

The social inventories of silicon metal across Huangpu port, Kunming city and Tianjin port increased 3,000 mt from the previous week to 58,000 mt as of Friday October 15.

The warehousing and shipment activities of the warehouse in Huangpu port in south China has been more active than those in Tianjin port. The shipment of 4-series silicon metal in Huangpu port has been much better than other specifications.

Generally speaking, the transaction of silicon has been slack amid a weak market. The inventory of silicon metal increased slightly again in the raining season.

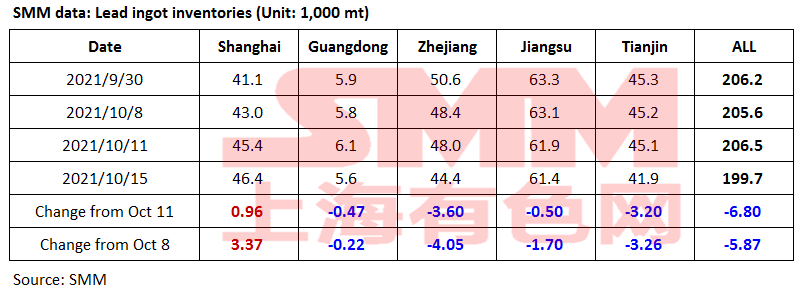

Lead Ingot Inventory in Five Major Regions Continued to Decline amid Maintenance of Deliverable Brand Lead and Power Rationing

According to SMM survey, as of October 15, the total lead ingot inventory in the five major regions stood at 199,700 mt, down 6,800 mt from a week ago and down 5,900 mt from October 11.

Some primary lead smelters are under maintenance this week, and the impact of the power rationing continues, leaving the supply tight in Hunan and other regions. Downstream producers turned to inventories that are stored in social warehouses to meet their rigid demand. Lead prices rose sharply, stimulating downstream purchasing enthusiasm. The pullback of lead prices in the middle of the week attracted more downstream buyers. However, spot transactions slowed down significantly after lead prices exceeded 15,000 yuan/mt in the second half of the week. Smelters in Anhui and Henan have received notices on a new round of power rationing, but the impact in Hunan will wane. With the recovery of profits, more secondary lead smelters will resume work. The overhaul of primary lead smelters has increased, reducing the supply of deliverable brand lead. This will also reduce the possibility of lead ingots being transferred to social warehouses.

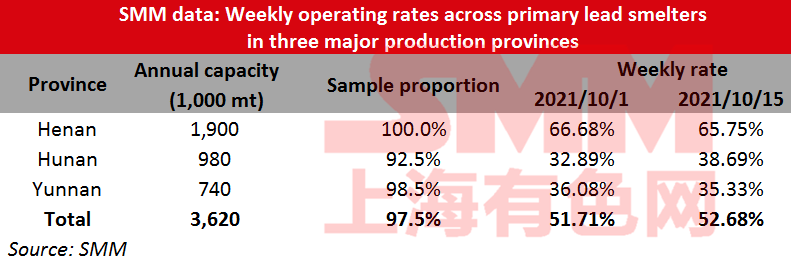

Operating Rates of Primary Lead Smelters Rebounded Slightly on Production Resumption After Power Rationing Ended

According to SMM survey, the average operating rate of primary lead smelters in three provinces was 52.68% this week, up 0.98 percentage point from a week ago.

Henan Hongyang was under maintenance for a week. Yongning Gold and Lead is expected to complete maintenance and resume production around October 20. Jiyuan issued power rationing notice on October 15, so local smelters plan to reduce production slightly next week. The output of Yunnan Tongfu was slightly affected by the power rationing. Some smelters in Hunan have gradually resumed production after the impact of power rationing has ended. However, some smelters in Hunan implemented their autumn maintenance in advance. The tight supply of concentrates in Yunnan has not yet eased, so local smelters have no plans to resume production for the time being. Xing’an Silver and Lead completed overhaul in September and its production will return to normal after the National Day holiday. Jiangxi Jinde has begun to carry out overhaul.

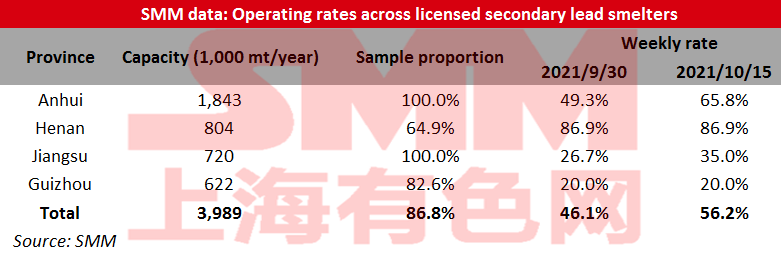

The Operating Rate of Secondary Lead Smelters Up 10.06% On Week

The operating rates across licensed smelters of secondary lead in Jiangsu, Anhui, Henan and Guizhou stood at 56.17% this week, up 10.06% from the previous week, an SMM survey showed.

The operating rates rose sharply as lead prices rose to above 15,000 yuan/mt as lead smelters are active in production on higher profits. In addition, the output of secondary lead smelters that has been affected by power rationing achieved partial recovery amid the phased loosening of the impact of the post-holiday power rationing, which has also led to an increase in the output of secondary lead smelters in the four markets. Anhui Huabo, Chaowei, Jiangsu Xinchunxing were less impacted by power rationing and market conditions, ramping up their output. The maintenance at Anhui Xinda and Dadao ended this week, and the output increased. Some smelters in Guangdong and Jiangxi began to resume production amid the end of environmental protection inspection and rising profits. Although Anhui Tianchang, Shanxi Yichen and Jiangxi Zhenyu suspended production due to equipment maintenance intraweek, the operating rates still trended higher. The power rationing is likely to intensify next week and producers in Anhui and Henan have received notices of power rationing, impacting the secondary lead output across four markets. The operating rates are expected to trend lower.

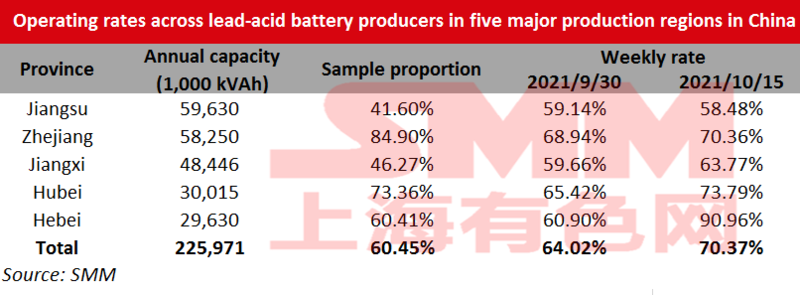

Operating Rate of Lead-Acid Battery Producers Up 6.36% from September 30

The average operating rate across lead-acid battery producers in Jiangsu, Zhejiang, Jiangxi, Hubei and Hebei provinces increased 6.36 percentage points from September 30 to 70.37% as of Friday October 15.

Some producers have resumed production due to the end of National Day holiday. Some producers have started to raise output with consideration of the annual plan of production and sales. The power rationing in Jiangsu and Zhejiang intensifies after the holiday and the output at some small and medium-sized producers has been cut 20-30%, which does not affect the overall growth rate of operating rates.

![Magnesium Market Quotes Edged Up Slightly; Cautious Purchasing Led to Weaker Transactions [SMM Spot Magnesium Ingot Flash Update]](https://imgqn.smm.cn/usercenter/CIcRv20251217171725.jpg)