According to the data of the China Automobile Association, in 2021, the production and sales of cars in the Chinese market completed 26.082 million and 26.275 million respectively, an increase of 3.4% and 3.8% respectively over the same period last year, ending three consecutive years of decline since 2018. At the same time, the total volume of production and sales ranked first in the world for 13 years in a row. Although China's car market has grown steadily throughout the year, the sales of multinational car companies in China have shown two trends: half rising and half falling.

The overall market share of multinational car companies in China has declined, and Volkswagen is still the top seller.

According to official data released by various car companies, Galaxy collated the sales of 12 multinational car companies in the Chinese market in 2021. Six of them saw a rise in sales in China, while sales of the other six fell. The vast majority of traditional car companies have not performed well in China, and only Toyota has outperformed the market in China. The vast majority of luxury carmakers are doing well in China, with only Mercedes-Benz sales falling slightly.

In terms of specific sales, Volkswagen remains the leader in the Chinese market, selling more than 3.3 million vehicles, but Volkswagen's sales in China fell 14.1 per cent year-on-year last year due to a shortage of semiconductors. However, the Volkswagen electric car offensive is paying off in China, with the strongest growth in pure electric vehicle sales, which more than quadrupled to 92700 units. GM also faced disruptions in its semiconductor supply chain in China last year, but the company managed to keep its sales at about the same level as in 2020, falling only 0.3%. This is mainly due to the strong growth momentum of GM's brands of high-end models and new energy vehicles, but the gap between GM and Volkswagen is still 410000, ranking second in China.

Japan's top three (Toyota, Honda and Nissan) still occupy the bottom three of the top five, but there is still a big gap between sales and the top two. Among them, it is particularly worth mentioning that Toyota's sales in China have achieved year-on-year growth for nine consecutive years, reaching an all-time high, which can be said to be one of the brightest multinational car companies in China. On the one hand, Toyota minimizes the negative impact of the chip shortage; at the same time, strong sales of Toyota's hybrid vehicles have driven overall sales growth. In 2021, Toyota sold 475900 hybrid models in China, up 50 per cent from a year earlier and accounting for nearly 25 per cent of total sales.

Ford is the only traditional car company besides Toyota to achieve growth in China, which shows that the transformation of Ford China 2.0 is beginning to bear fruit. In 2021, Ford sold nearly 625000 vehicles in China, up 3.7% from a year earlier, mainly thanks to the Lincoln brand. Last year, the Lincoln brand sold more than 90,000 vehicles in China for the first time, an increase of 48.3% over the same period last year, setting another annual sales record. Among them, Lincoln adventurers sell 50,000 vehicles a year, an increase of 57% over the same period last year, and become a popular style of the same class.

Overall, the overall share of multinational car companies in China has declined due to a year-on-year increase of 23.1 per cent in sales of Chinese branded passenger cars in 2021 and a rise of 6 percentage points to 44.4 per cent in the Chinese car market. According to the China Automobile Association, the market share of Germany and Japan, which have a large share in China, fell to 20.6 per cent in 2021, while the market share of South Korea in China fell to 2.4 per cent. Among them, the decline in German and Japanese car sales and market share is mainly due to chip shortages, resulting in production capacity unable to keep up with sales, and the situation should improve this year.

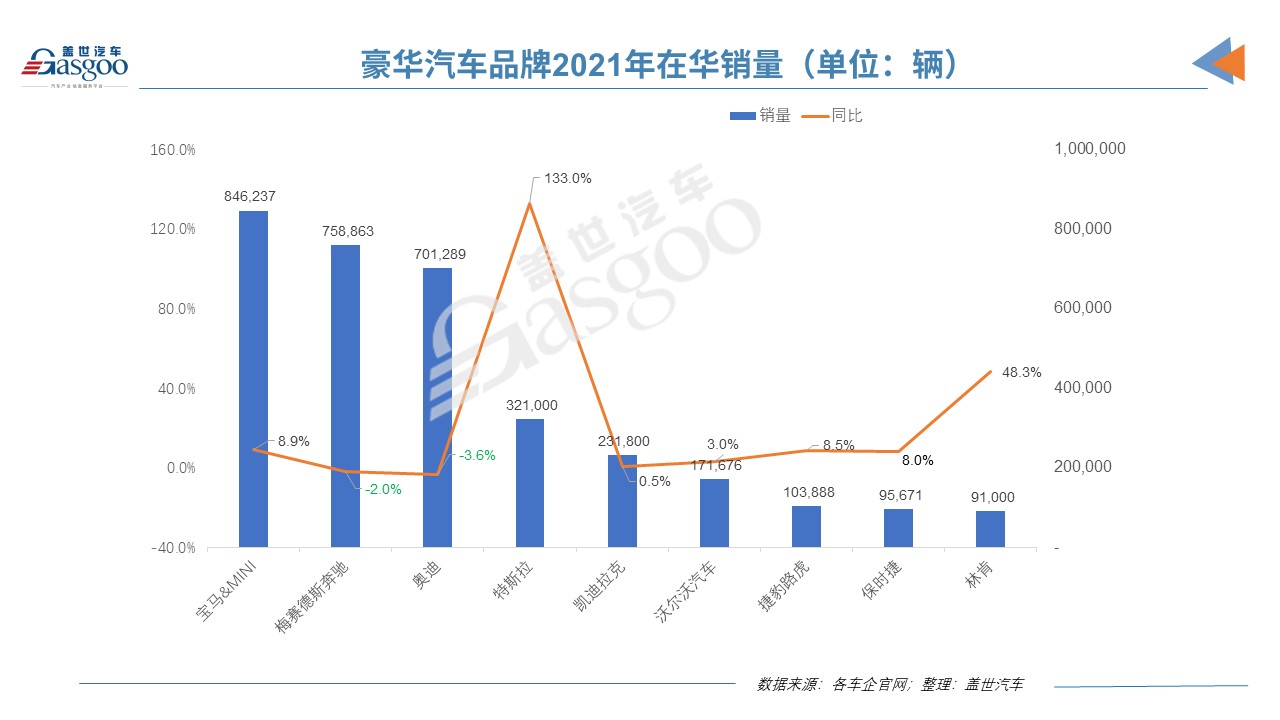

Foreign luxury brands performed strongly in China, with Tesla soaring 133%.

With the continuous improvement of the income level of Chinese residents, China's auto market is also showing an obvious trend of consumption upgrading. Against this background, most foreign luxury brands are doing well in China. The nine largest foreign luxury brands counted by Gus have sold a total of 3.22 million vehicles in China, and sales of most brands have increased, reflecting that Chinese consumer demand for luxury cars is still very strong.

Among them, BMW continues to maintain a leading position in China's luxury car market, once again becoming the best-selling luxury carmaker in China with record sales of 846000 vehicles. BMW 3-Series, 5-Series and X3 all sold more than 150000 vehicles, while the 4-Series sold more than 10, 000 vehicles in the whole year, an increase of 109.7% over the same period last year. BMW X5 sales exceeded 50, 000 vehicles for the first time, and BMW X7 sold more than 10, 000 vehicles for the whole year. As global supply shortages of semiconductor components affected Mercedes-Benz deliveries to customers in the third and fourth quarters, Mercedes-Benz's full-year sales in China fell slightly by 2 per cent, a gap of 90,000 vehicles with BMW. Audi's homegrown models were hit hard by chip shortages in the fourth quarter of last year, causing full-year sales to fall 3.6 per cent from a year earlier, widening the gap with BMW-Benz.

It is worth mentioning that Tesla now shines not only in China's new energy market, but also in China's luxury car market, second only to BBA, 's cumulative delivery volume of about 321000 vehicles in China in 2021, an increase of about 133 per cent compared with about 137000 in 2020. Behind the substantial increase in Tesla's delivery volume in China, the market performance of domestic Model Y plays an important role. Data show that the delivery volume of domestic Model Y in China reached 200100 in 2021, which is obviously better than that of domestic Model 3 in the Chinese market. In addition, Tesla's delivery growth in China has also benefited from an increase in the production capacity of the Shanghai super-factory, where Tesla delivered 484100 vehicles a year in 2021, up 23.5 per cent from a year earlier, according to official figures.

Compared with other car companies that have achieved growth, Tesla's growth rate can be said to be among the best. It is believed that the main reason why Tesla can still achieve substantial growth under the background of "lack of core" is its strategy of highly vertical integration of the supply chain, which enables Tesla to flexibly adjust parts and control the supply chain.

Among other luxury brands, Volvo car sales in China rose 3.1 per cent to 171393 vehicles last year, of which Volvo XC60 sales accounted for 65036 vehicles, up 6 per cent year-on-year; luxury flagship SUV XC90 sales rose 16 per cent year-on-year; luxury car S60 sold a total of 27993 cars, up 29 per cent year-on-year. Jaguar Land Rover also grew steadily by 8.5 per cent in China last year, selling more than 100000 vehicles. Porsche's sales also grew by 8%.

Multinational car companies increase their speed by electrification in China

In 2021, the production and sales of new energy vehicles in China reached 3.545 million and 3.521 million respectively, an increase of 1.6 times over the same period last year, and the market share increased to 13.4%, 8 percentage points higher than that of the previous year. With the rapid development of China's new energy vehicle market, electric vehicle sales have also become a bright spot for major multinational car companies in China.

As mentioned above, Volkswagen's sales of Huazhun electric vehicles soared by 319.5% to 92700 last year; BMW new energy models sold more than 48000 vehicles in China, up 69.6% from the same period last year, of which the pure electric BMW ix3 sold more than 21000 vehicles in its first full sales year; Volvo electrified model sales increased by 96% in China.

As the world's largest automobile market and the world's largest single market for electric vehicles, car companies must continue to increase their electrification offensive in the future if they want to seize the Chinese market. Under the attack of Tesla and the new power of local electric cars, traditional car companies dare not relax for a moment. Looking forward to 2022, car companies will further accelerate the pace of electrification in China, in which Mercedes-Benz will launch eight new electric and plug-in hybrid models; BMW will present seven new energy products in the Chinese market; Ford EVOS, Mustang Mach-E and other new cars will start delivery in China; and Volvo will use 2021 of the funds raised for electrification transformation after the IPO, which will undoubtedly accelerate Volvo's electrification in China.

In addition, the Japanese system, which has lagged behind in electrification, will gradually launch. Toyota will bring new models made by bZ, a new pure electric platform, and a new car in partnership with BYD; Honda will launch two pure electric vehicles in China, e:NP1 and eRENS1; in addition to launching more e-Power models, Nissan also plans to introduce pure electric car Ariya to China. It is conceivable that the competition in China's new energy vehicle market will become more and more fierce in the future.