In August, the global power battery market still presents a "tripod" pattern of Ningde era, LG and Panasonic. The market share of Ningde era has further increased to 34.1%, and the gap between Ningde and LG and Panasonic is widening, and its dominant situation is about to take shape.

BYD pressed Panasonic and is expected to surpass Panasonic into the top three by the end of the year. Honeycomb Energy is increasing the layout and research and development of power batteries, and it is expected to be on the global power battery TOP10, for the first time.

In August, the global installed capacity of power batteries was 25.2GWh, up 11.5 per cent from a month earlier, according to SNE Research, a South Korean market research firm. From January to August, the global installed capacity of power batteries was 137.1 GWH, a month-on-month increase of 20.2%.

In August, the Ningde era continued to advance by leaps and bounds, firmly sitting on the title of champion, with LG and Panasonic being the third and second runner-up respectively. BYD and SKI, which are slowly approaching Panasonic, are in the top five, while Samsung SDI, AVIC Lithium, Guoxuan Hi-Tech, Vision AESC and Honeycomb Energy are in the top 10.

It is worth mentioning that Honeycomb Energy topped the list and ranked 10th on the list.

Compared with the same period last year, Chinese enterprises Ningde era, BYD, AVIC Lithium, Guoxuan Hi-Tech and Honeycomb Energy have all achieved triple-digit growth, which is much higher than the market average and the market share has further increased.

Among the three Korean enterprises, LG and SK have achieved triple-digit growth, SDI has achieved double-digit growth, and the market share of SK and SDI is declining.

From a month-on-month point of view, in the Ningde era, BYD and Guoxuan Hi-Tech both achieved double-digit growth, especially Guoxuan Hi-Tech rose 40% month-on-month. While South Korean companies LG and SKI achieved single-digit growth, Samsung SDI fell 10 per cent month-on-month.

Specifically, in terms of Chinese enterprises, the installed capacity of Ningde era was 8.6 GWH, an increase of 16.2% over the previous month, and the market share increased again to 34.1%. The surge in installed capacity in the Ningde era is due to the hot sales of Hongguang MINIEV, GAC Ean models and Mercedes-Benz E-Star models.

BYD is struggling to catch up with Panasonic, with 2.5 GWH installed in August, up 19% from the previous month, and the gap between Panasonic and Panasonic is getting smaller and smaller. The month-on-month increase in its installed capacity is due to the hot sales of BYD models, such as BYD Han and DM-i models.

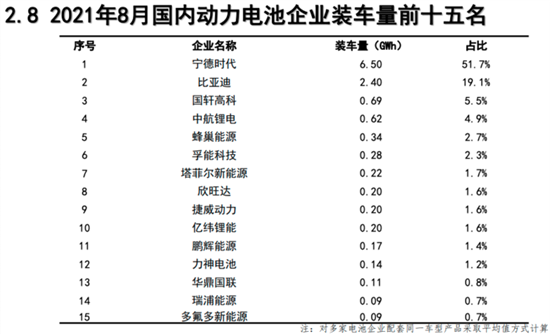

Guoxuan Hi-Tech installed 0.7 GW, up 40% month-on-month, and has caught up with AVIC Lithium and tied for seventh place on the list. In the Chinese market, Guoxuan Hi-Tech surpassed AVIC Lithium for the first time to become the third in August with the installed capacity of 0.69GWh.

Honeycomb Energy, which successfully completed the financing of 10 billion yuan in round B, has achieved great-leap-forward development this year. Honeycomb installed 0.2 GWH in August, surpassing PEVE to enter the top 10 of the global list for the first time. Honeycomb Energy ranked in the top five for the first time in the Chinese market, up from 10th at the beginning of the year.

Yang Hongxin, chairman and CEO of Honeycomb Energy, said that Honeycomb Energy began to send test samples to global partners last year, including a number of foreign companies are testing its cobalt-free batteries; at present, Honeycomb Energy has received orders for cobalt-free batteries from Geely cars and will carry out supporting shipments at the end of the year. Yang Hongxin said: "other domestic and international customers will also place orders one after another recently."

According to the plan, by 2025, the production capacity of Honeycomb Energy will exceed 200GWH, and the capacity under construction has already exceeded 100GWh. "We will have more capacity than 20GWh by the end of this year and more than 120GWh by the end of next year. In 2023, Honeycomb Energy shipments have the opportunity to break through 20GWh. "

The installed capacity of prospective AESC is 0.3 GWH, which is the same as that in July. With the large-scale shipment of cobalt-free batteries from Honeycomb Energy, the prospective AESC is likely to be surpassed by Honeycomb Energy.

Let's take a look at the three major South Korean enterprises, the installed capacity of LG is 5.4GWH, up 5.9% from the previous month, with a market share of 21.4%, ranking second. Tesla's rapid growth has been driven by strong sales of China Model Y, Volkswagen ID.4 and Ford Mustang Mach- E. The installed capacity of SK was 1.4 GWH, up 7.7% from the previous month, ranking fifth steadily. Due to the increase in sales of Kia Niro EV, Hyundai Ioniq 5 and Mercedes-Benz Gle PHEV, its installed capacity has increased steadily. Samsung SDI installed 0.9 GWH, down 10% from the previous month. Volkswagen's installed capacity has fallen sharply as a result of a sharp decline in Volkswagen's e-Golf sales.

Panasonic, the only Japanese company with a power battery TOP10, has an installed capacity of 2.8 GWH, up 12% from a month earlier, ranking third. The gap between Panasonic and BYD is slowly narrowing. PEVE, which ranked 10th in July, fell off the list in August when it was replaced by Honeycomb Energy.

From a cumulative point of view, the global installed capacity of power batteries from January to August was 162GWH, an increase of 18.2% over the previous month. The installed capacity of the top 10 power battery enterprises in the world is 151.7 GWH, with a market share of 93.6%, and market concentration has further increased, with Ningde Times, LG, Panasonic, BYD and SKI firmly in the top five.

In the Ningde era, BYD and AVIC Lithium increased by more than 2 times compared with the same period last year, LG, Guoxuan Hi-Tech and SK achieved more than 100% growth, Panasonic, Samsung SDI, AESC and PEVE achieved double-digit growth. From a month-on-month point of view, with the exception of BYD and Guoxuan Hi-Tech, all other enterprises have achieved double-digit growth.

In the Ningde era, the installed capacity from January to August was 49.1GWH, with a market share of 30.3%, an increase of nearly 7 percentage points over the same period last year. The installed capacity of LG is 39.7GWH, with a market share of 24.5%, which is gradually larger than that of the Ningde era, with a difference of only 0.4 percentage points between the two in the same period last year and 5.8 percentage points from January to August this year.

In the end: thanks to the rapid growth of China's new energy vehicle market, China's power battery market is also growing by leaps and bounds, driving the upsurge of the global power battery market. In August, the most noteworthy is that Honeycomb Energy replaced PEVE to become the 10th on the list for the first time, and is expected to surpass the vision AESC to become the ninth in the world in the future. In addition, the gap between BYD and Panasonic has narrowed further, with a gap of only 0.3 GWH, making it one of the top three power batteries in the world, which is just around the corner.