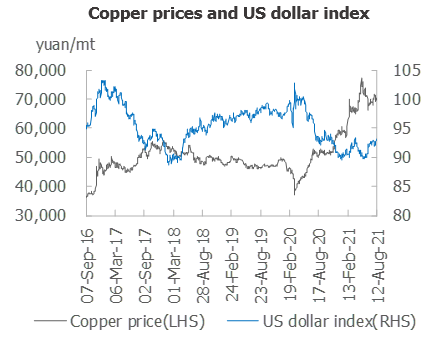

US CPI in July stabilised, basically in line with market expectations. Some Fed officials believe that the inflation rate will not surge for a long time, and will return to the 2% target. The labour market is expected to improve in light of the employment data two weeks ago.

As such, the market believes that the conditions for reducing debt purchases will be met within a few months, supporting a hawkish sentiment. But the US Senate passed the $550 billion infrastructure construction bill, which once again boosted short-term bullishness. This bolstered copper prices slightly.

Q2 GDP in the eurozone, CPI on an annual basis in Canada and the US housing starts in July will be the focus of markets this week. Market sentiment will be further suppressed should the eurozone tighten its monetary policy.

On fundamentals, the labour union at BHP Escondida Copper Mine accepted the new wage proposal to avoid a strike at the global largest copper mine, abating concerns over supply shortages of copper concentrate. But a strike at Codelco’s Andina copper mine occurred on August 12, while Codelco failed to make progress in early negotiations between its El Teniente mine and five unions.

Andina and El Teniente mines yielded 443 kt and 184 kt of output respectively in 2020. El Teniente is the third largest mine in Chile. However, market sentiment remained stable as the mines would maintain stable supply amid government's needs for economic development and high profits.

Domestic inventories remained low amid the impact from power restrictions in south China on smelters, sharp inventory declines in Guangdong and transportation issues across global ports due to the pandemic as well as the absence of continued influx of imported copper. Meanwhile, tight supply of copper scrap from Malaysia has boosted copper cathode consumption. Consumption in August is expected to remain strong, which will underpin copper prices.

70,000 yuan/mt is likely to be the resistance for copper prices. SHFE copper is expected to trade at 69,200-70,700 yuan/mt this week and LME copper at $9,350-9,600/mt.

Arbitrage operations by traders were brisk last Friday, while downstream buying interest was weak as prices hovered around 70,000 yuan/mt. Spot premiums are likely to rise this week in view of purchasing costs last Friday, moving between 180-300 yuan/mt this week.