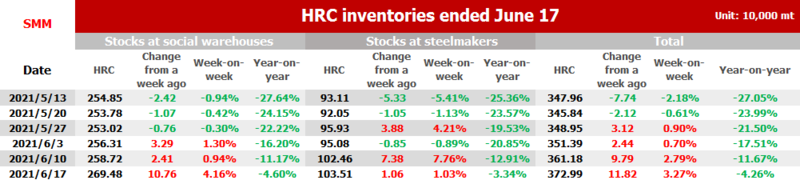

SHANGHAI, Jun 18 (SMM) - SMM data showed that HRC stocks across social warehouses and steel makers rose 118,200 mt or 3.27% on the week, but down 4.26% than a year ago, to 3.73 million mt in the week ended June 17.

The total HRC inventory has risen for the fourth consecutive week, with wider increase on the week.

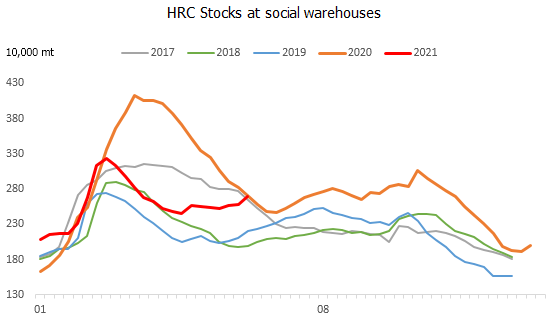

Inventories across social warehouses increased 107,600 mt or 4.16% week on week to 2.69 million mt. This was 4.6% lower than the same period last year.

Steel mills accelerated the delivery of goods under inventory pressure, and more stocks were transferred to the social warehouses. In addition, the shipments from the social warehouses slowed down in holidays and the off-peak season.

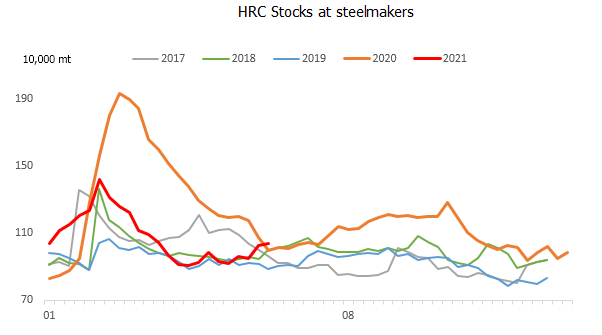

Stocks at Chinese steel makers came in at 1.04 million mt, up 10,600 mt or 1.03% week on week but down 3.34% year on year.

Under the influence of maintenance and regional production restrictions, the output of steel mills fell slightly this week. At the same time, the faster shipments have alleviated the inventory pressure of the mills.

HRC prices was fluctuating sideways after the previous surge and plunge. HRC fundamentals are weakening. Many new hot rolling lines will be put into production from June to August, while the demand of cold rolling and galvanising declines. Some steel mills may switch molten iron production to hot rolling production. The supply will be under pressure.

On the demand side, as the off-season is approaching, the purchase of the automobile, machinery, home appliances and construction industries has weakened from the previous month.

Besides, HRC spot traders have suffered substantial losses since May and are holding prices firmly. Facing the 100 anniversary of the founding of CPC, there are uncertainties in the supply of raw materials and finished products, and the cost and expectations still provide support.

Although domestic steel exports have been suppressed, high overseas prices still boost domestic prices. HRC prices are likely to remain volatile amid insufficient fundamental momentum and the external stimuli such as cost support and regional production restrictions.