On May 24th, the chairman of Ningde Times made a speech that it would release sodium battery in July. For a time, the discussion on whether sodium batteries will replace the current booming lithium batteries is in full swing, and on the same day, there are several sodium battery concept stocks, including China Salt Chemical and Shengyang shares, which have risen by the daily limit.

However, after a day of cooling, many organizations have issued comments that sodium batteries are temporarily difficult to shake the status of lithium batteries, but will be used as a supplement and support for lithium batteries. But even so, the sodium battery is still hot. Under this background, the every move of the leading enterprises in the lithium battery industry has naturally attracted the attention of people in the industry.

On May 24, investors asked Ganfeng Lithium Industry on the interactive platform whether the company had carried out related research and layout of sodium battery. Ganfeng Lithium Industry admitted that the company had not laid out the sodium battery business for the time being.

On the same day, as a major domestic manufacturer of lithium-ion battery materials and a godsend material that mainly supplies lithium battery electrolyte and cathode material lithium iron phosphate, I also accepted questions from investors about whether the company has the layout of research and development of sodium-ion battery electrolyte. Unlike the answer of Ganfeng lithium industry, Tianzhi material said that the electrolyte of sodium ion battery is similar to that of lithium ion battery, and the biggest difference between the two is that the former electrolyte is composed of sodium hexafluorophosphate, while the latter is lithium hexafluorophosphate.

At present, Divine material has already had the mass production technology of sodium hexafluorophosphate, and the products have been recognized by customers. Considering that the production reaction process and the equipment and process cost of sodium hexafluorophosphate are basically the same as that of lithium hexafluorophosphate, the only difference is that the raw material is replaced by lithium carbonate by sodium salt. therefore, the production system of sodium ion battery electrolyte can all use the company's existing lithium ion battery system. Therefore, on the whole, it is expected that the market demand for sodium ion battery electrolyte has no impact on the company's existing technology / industry chain layout.

However, it should be noted that, considering that sodium hexafluorophosphate and lithium hexafluorophosphate need to share production line capacity, the actual output of sodium hexafluorophosphate will eventually be limited by the excess capacity of lithium hexafluorophosphate.

In fact, although sodium battery has the advantages of low cost and good safety compared with lithium battery, the current energy density of sodium battery can only reach about 130wh/kg, which is much lower than the lithium iron phosphate battery of 170wh/kg on the market, so in the field of power battery with high energy density, sodium battery is difficult to replace lithium battery, so Tianfeng Securities believes that sodium battery and lithium battery are complementary rather than competitive. In the field of power batteries, sodium batteries have no conditions to compete with lithium batteries; in the field of energy storage, distributed energy storage lithium batteries have great advantages, and sodium batteries have certain advantages in large-scale energy storage. Therefore, sodium batteries do not pose a threat to lithium batteries, and the two can complement each other in the field of energy storage. It is worth mentioning that, according to SMM research statistics, the current increase in demand for lithium in the market is mainly from the electric vehicle and energy storage industry.

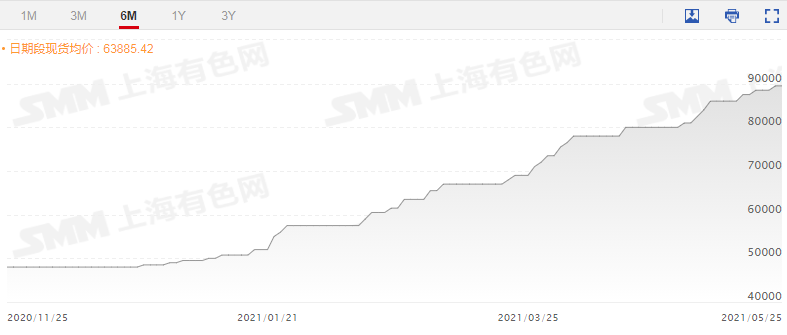

With the increasing popularity of the new energy vehicle industry, lithium salt as an important part of power batteries, the price performance of major lithium salts such as battery-grade lithium carbonate and lithium hydroxide is also very excellent. In particular, lithium hydroxide, SMM predicts that considering that new overseas high-end models will be on the market in the second half of 2021, the orders of battery factories in Japan and South Korea will increase significantly, while the demand for domestic high-end lithium hydroxide will increase significantly, and the domestic export volume will increase to 60%. Superimposed by the export volume of some large domestic smelters, the export volume will also increase to about 90%, and their domestic supply will be significantly reduced in the future. The upward demand season promotes the upward price of lithium hydroxide. So overall, lithium prices are expected to remain high in 2021. "View details

Tianfeng Securities also made it clear that the demand for high-nickel ternary cathode materials at home and abroad has increased significantly, while the release of lithium hydroxide production capacity is not as expected, strongly supporting the price of lithium hydroxide, and it is expected that in the peak season of demand in the second half of this year, the supply of lithium hydroxide may be tight, and the price of lithium hydroxide will continue to rise.

As of May 25, the average price of battery-grade lithium hydroxide in China was 89500 yuan / ton, up 40000 yuan / ton or 80% from the beginning of the year.

"Click to see more SMM metal spot prices.