SUZHOU, Dec 4 (SMM)—On today’s Shanghai Metals Market’s 2020 Nonferrous Metals Industry Chain Annual Conference held in Suzhou, Leo Yi, senior analyst at SMM, explained the challenges posed by the new solid waste law to China’s aluminium scrap supply and operations at secondary aluminium producers.

According to Yi, the new solid waste law will lead to an increase in aluminium ash processing costs due to insufficiency of qualified processing capacity and greater difficulties in trans-provincial transport of hazardous waste.

“But there are several measures for producers to take to tackle the problem, such as building their own aluminium ash treatment capacity, waiting for the commissioning of new technologies and new processing capacities or reducing production to lower aluminium ash output,” Yi suggested.

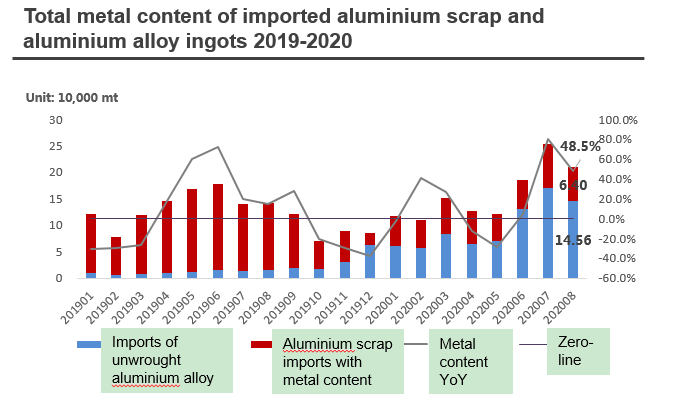

Yi also gave his insights on profits of imported secondary aluminum amid under the new solid waste import policy and COVID-19 pandemic. He said that the abolition of tariffs on secondary aluminium ingots is likely to expand aluminium ingots imports.

Source: SMM

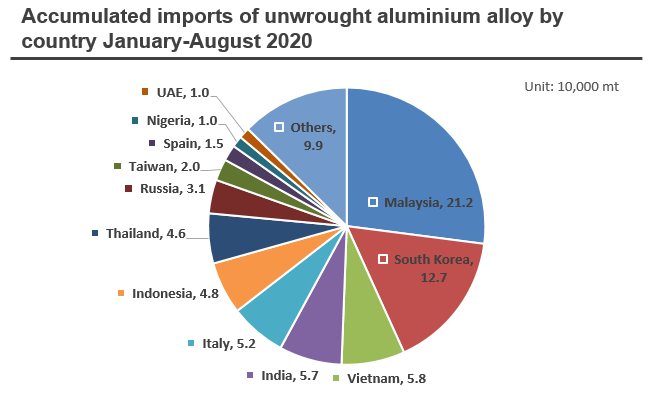

Among the countries that account for over 1% of Chinese unwrought aluminium alloy imports, agreed tariffs in Malaysia, Vietnam, Indonesia, Thailand and other ASEAN countries as well as South Korea stood at zero, with imports of 490,000 mt, accounting for 62.6%; the Asia-Pacific Trade Agreement tariff for India stood at 4.6%, with an import volume from India of 57,000 mt, accounting for 7.3%; imports from the countries with agreed tariffs stood at 547,000 mt, accounting for 69.9% of the total. Imports of aluminium alloy ingots from Italy, Russia, Taiwan, Spain, Nigeria and the United Arab Emirates, which top the list of China’s suppliers, should increase significantly if the import tariffs for secondary aluminium ingots are abolished.

Source: SMM

The import window for aluminium alloy ingots shrank significantly and closed at one point in August 2020, resulting in a sharp decline in new import orders of aluminium alloy ingot. This will reduce aluminium alloy ingots imports noticeably from September to November. If tariffs on imported aluminium alloy ingots are cancelled in November, the window for aluminium alloy ingots imports will expanded, increasing new import orders significantly. In this scenario, aluminium alloy ingots imports from December to January are expected to exceed 100,000 mt, giving an impact on domestic aluminium alloy ingots.

“Import opportunity for non-standard aluminium alloy and aluminium scrap increased amid weaker profits of imported ADC12,” Yi said, “Although aluminium scrap import has been freed up, requirements remain strict. At present, most of the overseas aluminium scrap cannot meet the requirements for direct import. Overseas aluminium scrap processing capacity will be insufficient in the short term. Profits are expected to drive imports of non-standard aluminium alloy due to pricing based on discounts and premiums of aluminium, ensuring profits without risk. Overseas aluminium scrap that has not been processed or is of low quality are likely to be imported in the form of non-standard ingots.”

![2026 Arrangements for Secondary Aluminum Alloy Enterprises During Chinese New Year Break [SMM Analysis]](https://imgqn.smm.cn/production/admin/votes/imageskkgTu20240508153005.png)

![Costs Drag Down Supply-Demand Pressure, Aluminum Auxiliary Material Prices Under Pressure and Weaken [SMM Analysis]](https://imgqn.smm.cn/usercenter/NQyKF20251217171655.jpg)