Lithium salt plants

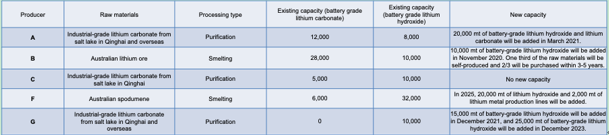

At present, the capacity of lithium carbonate (industrial grade and battery grade) smelters in Sichuan accounts for 20% of the China's total capacity, and the capacity of lithium hydroxide accounts for 37% of the country's total. Expansion is in progress.

Jiajika mine

60% of the tax from the mine is given to Ganzi Prefecture. The mine was fully put into operation in 2019 with government support. Spodumene concentrates stocks at the mine currently stand between 70-80,000 mt. Mining is under way. The mine is about to expand capacity, and a beneficiation plant will be built in 2020.

Price outlook of lithium salt products

With increasing demand for energy storage and two-wheeled vehicles and rising prices of industrial-grade lithium carbonate, prices of battery-grade lithium carbonate also rose, which is expected to continue in 2021. 50,000-80,000 yuan/mt is considered a reasonable price range for lithium carbonate, but the actual prices will depend on demand. Rising prices of lithium carbonate will also boost the price of lithium hydroxide. The overseas demand for lithium hydroxide is expected to increase rapidly in 2022.

Comments on lithium carbonate market

With the explosive growth of the new energy market in the future, demand for lithium products is set to be far greater than the current capacity and lithium resources will be insufficient. Competition in the lithium carbonate market is fierce. Lithium carbonate supply began to increase rapidly in July. Production and sales are expected to be in a balance in 2021, and lithium carbonate prices may rise above costs. Smelters have chosen to produce lithium hydroxide with ore as it is unprofitable to make lithium salt.

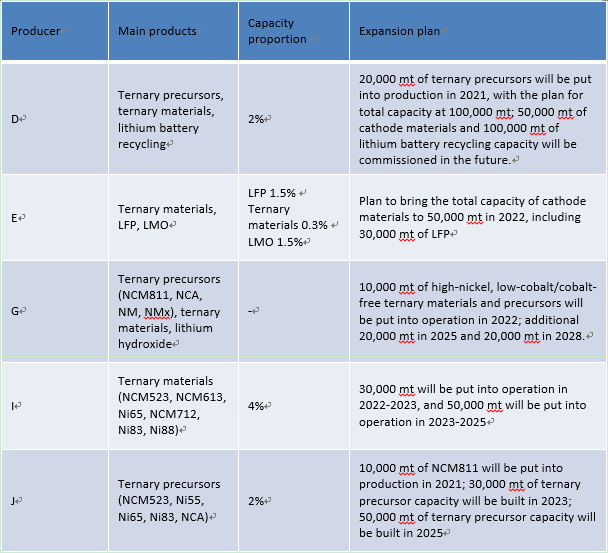

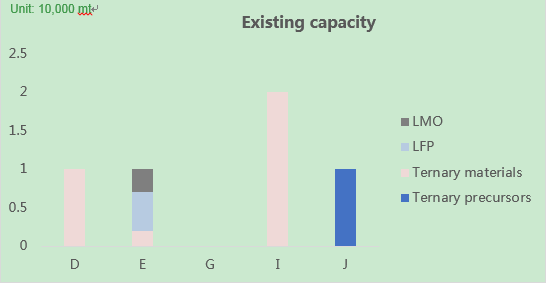

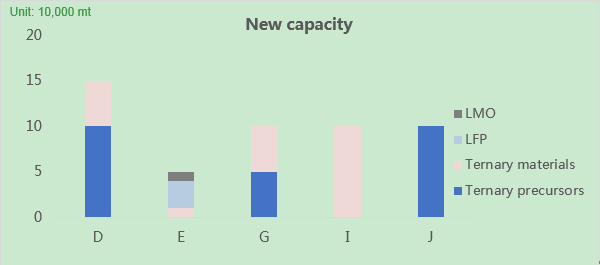

Cathode material factories