SMM: September 1, South Korean energy market analysis company SNE Research released the latest survey results show that in July this year, in the global power battery installation, LG Chemical ranked first with a market share of 26.8%, continued to lead the Chinese power battery supplier Ningde Times (25.4%), and opened the gap with the Japanese supplier Panasonic (13%).

In the 2019 ranking of global power battery installed capacity, LG Chemical ranks third in terms of 13.95GWh installed capacity, with the top two being 32.31GWh (Ningde era) and 29.11GWh (Panasonic). Now, in a short period of more than half a year, LG Chemistry has become the first supplier of installed capacity in the world.

With the help of two positive factors, LG chemistry ranks first in the world.

With regard to the counterattack trend of LG Chemistry in 2020, Luo Xiadi, an analyst at the Global Automotive Research Institute, said that he mainly benefited from two aspects: on the one hand, LG has a large number of customers in Europe, and on the other hand, it is supporting batteries for domestic Tesla in China. "in addition to local car companies, LG Chemical's customers include most of the European electric vehicle brands, and unlike the decline in demand in the Chinese new energy vehicle market, European new energy vehicle sales have set a new record this year, bringing a big increase in the installed capacity of power batteries."

According to EV Sales, sales of new energy passenger vehicles in Europe reached 401000 in the first half of this year, especially nearly 93000 in June, almost double that of the same period last year. It is clear that the new energy vehicle market has been greatly boosted by recent government support and incentives in major markets such as Germany and France. In terms of specific model sales, the more advanced ones are Renault Zoe, Tesla Model 3, Volkswagen e-Golf and so on. The batteries of these best-selling models all have the shadow of LG chemistry. Thanks to this, the cumulative global installed capacity of LG Chemical increased by 97.4% from January to July compared with the same period last year, reaching 13.4GWh.

In addition, as the battery supplier of Tesla's factory in China, the continuous improvement of domestic Tesla Model 3 sales has also become an important engine for LG chemical installation. Since the start of delivery at Tesla's Shanghai factory in January this year, Tesla's Model 3 sales have been on the rise. For the whole of the first half of this year, Tesla Model 3 sold 45800 vehicles in China, ranking first in China's new energy vehicle sales.

Hwang Kyu-Won, a local securities analyst in South Korea, believes that Tesla has become a leader in the field of electric vehicles, and that the ability of LG Chemistry to obtain orders from Tesla is the key to its sales growth. Of course, even if other automakers catch up with Tesla in the future, this is also good news for LG Chemistry, because the market for LG Chemistry will be broader.

In 2019, LG Chemical sales reached $24.5 billion (about 167.2 billion yuan), of which the Battery Division sold $7.2 billion (about 49 billion yuan). In the first half of 2020, even under the influence of the epidemic, the battery business of LG Chemical still exceeded 16.6 billion yuan, of which the car battery business set an all-time high. "the company is expected to have revenue of 13 trillion won (about US $11 billion) this year and 30 trillion won by 2025," said Xin Xuezhe (Hak Cheol Shin), chief executive of LG Chemical.

With the decline of domestic demand, Ningde era lost the top selling position in the world.

If the rise of the European new energy market has played a decisive role in promoting the counterattack of LG Chemistry, then the decline in the demand of China's new energy market is one of the important reasons why Ningde lost the top spot in the world in the Ningde era.

In 2020, due to the continuous influence of the epidemic and the changeable international situation, the whole automobile industry has entered a severe survival period, in which the power battery industry relying on the development of new energy vehicles has not been spared. From January to July this year, sales of new energy vehicles in China fell 32.8% to 486000 units compared with the same period last year, and the installed capacity of power batteries also decreased by 35.3% to 22.5GWh from the same period last year.

According to a report by Matthias Schmidt, an independent automotive analyst in Berlin, about 500000 electric vehicles were registered in Europe in the first seven months of this year (including about 269000 pure electric vehicles and about 231000 plug-in hybrid vehicles), surpassing sales of about 14000 electric vehicles in China.

In addition, statistics from (ACEA), the European Automobile Industry Association, show that the average penetration rate of new energy vehicles in seven European countries, including Germany, France, the United Kingdom, Portugal, Sweden and Italy, was 9 per cent in June this year. The penetration rate of new energy vehicles in China is less than 5%. From this data, the European new energy market has completed the anti-surpassing of China.

According to other public data, the revenue of the Ningde era in 2019 was 45.546 billion yuan, while the battery export volume of the Ningde era was only 2.56 billion yuan, accounting for about 5.6 per cent of its revenue. This shows that, as the largest power battery supplier in China, 95% of the battery production capacity of Ningde era is for domestic users. This leads to a decline in the domestic new energy vehicle market, and the installed capacity and market share in the Ningde era will decline accordingly.

The amount of installed capacity has a direct impact on the increase or decrease of enterprise revenue. Data show that in the first half of this year, of Ningde's operating income of about 18.829 billion yuan, the sales revenue of power battery system was about 13.478 billion yuan, down 20.21% from the same period last year.

The battle for the championship of the annual installed capacity is still in suspense.

In fact, the Ningde era was overtaken by LG chemistry in the first quarter of 2020, and the Ningde era has not regained the championship seat until July this year. After losing the top position of power battery installation in the world for 3 years, is there still a chance to surpass LG chemistry in Ningde era? Let's take a look at the order quantity and capacity planning of both.

First of all, in terms of order sources, both LG Chemistry and Ningde era have a huge circle of friends.

Different from the Ningde era, which mainly focuses on the domestic market, LG Chemical has customers all over the world, including Hyundai and Kia in the Korean market, GM, Ford and Chrysler in the American market, Tesla and SAIC GM in the Chinese market, and Volvo, Renault and Audi in the European market. Not long ago, LG Chemical announced that it had received $125 billion (875.4 billion yuan) in orders, enough to keep LG Chemical's plant busy for the next five years.

The number of orders in the Ningde era is not to be underestimated. At least 20 car companies have established partnerships with the Ningde era, including BMW, Volkswagen and Volvo. As early as 2018, Ningde Times received an order of about 164.7 billion yuan from Volkswagen Group. In 2019, Ningde Times announced that it had signed an order of about 60.1 billion yuan with BMW and recently signed an order of 100 million yuan with Volvo.

It is also worth mentioning that in February this year, Ningde Times signed a procurement agreement with Tesla, which means that Ningde Times will also take a share of Tesla's power battery supply in the Chinese market. It is reported that Ningde era will be equipped with 40% Tesla Model3, according to Tesla Model3 production of 49800 vehicles in the first half of the year, the total battery set is 2634.42MWh, only Tesla Model3 will bring the battery installation increment of 2634.42MWh*40%=1053.77MWh for Ningde era. It can be said that Tesla will become the key role for both of them to compete for the hegemony of global power battery installation.

Second, judging from the capacity layout of the two companies, the two sides are engaged in an arms race. According to the respective plans of both sides, the new capacity of both will be around 100GWh in 2020.

At present, LG Chemical has four production bases around the world, including Wukang in South Korea, Nanjing in China, Holland in the United States and Wroclaw in Poland, with a total production capacity of 70GWH, but none of them can meet the current needs of car companies. LG Chemical plans to increase its annual production capacity to 110GWh by 2020.

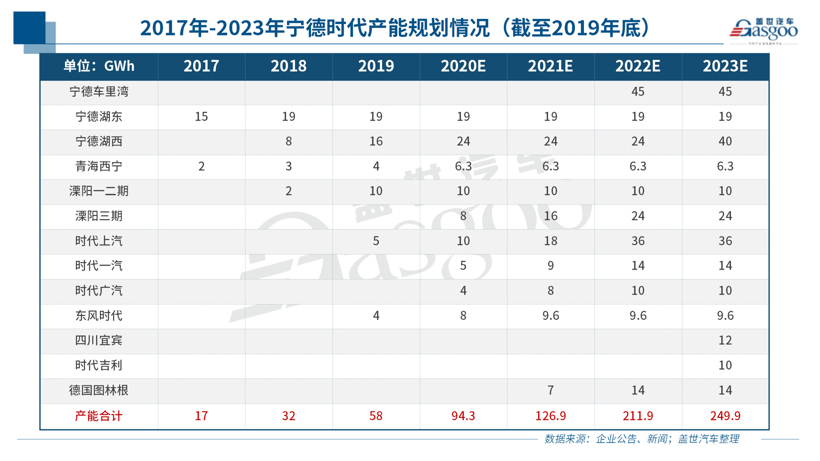

Ningde era, by the end of 2019, Ningde era has been put into production capacity of 58GWH, in order to further expand the market, Ningde era is also planning to expand capacity. According to the plan, it may release the production capacity of near 40GWh on the basis of 58GWh this year, and the production capacity of Ningde era or near 250GWh by 2023.

In addition, with the rise of new energy in Europe and Tesla's crazy expansion in the global market, Ningde era is also actively promoting its overseas business. It is reported that in order to enhance its influence in overseas markets, Ningde Times is building a new plant with an annual capacity of 14GWh in Germany, which is already under construction and is scheduled to start production in 2022.

Obviously, for these two enterprises, whoever builds the factory first and puts into production will occupy more market share. However, as far as the current situation is concerned, although the installed capacity of Ningde era has been surpassed by LG Chemistry, there is not a big gap between the two sides, and the competition for the championship of global installed capacity in 2020 is still in suspense.

For LG Chemical, the delivery of Volkswagen ID.3 and other models in Europe, as well as the best-selling domestic Tesla, is still an important growth engine. LG Chemical had previously said that battery orders were full in the third quarter and were expected to grow by more than 25 per cent compared with the second quarter. As for Ningde era, as sales of new energy vehicles in China gradually pick up, coupled with the start of delivering batteries to Tesla Model 3, Ningde era still has a chance to catch up.

Click to understand and sign up for the 2020 China Automotive New Materials Application Summit Forum.

Scan the QR code above to view the business cards of the participating companies and sign up online

Scan the QR code and follow the official account of Wechat, a new energy source of SMM, cobalt and lithium.