SMM News: affected by the epidemic and other factors, the output of new energy vehicles in China was affected in the first half of 2020, and the installed capacity of power batteries decreased. In the first half of the year, China produced 102000 new energy vehicles, down 36.5 percent from the same period last year, and the installed capacity of power batteries was 17.5 GWH, down 41.8 percent from the same period last year.

According to data from the Power Battery Industry Innovation Alliance, in the first half of 2020, the total loading of ternary batteries totaled 12615MWH, accounting for 72.2% of the total, down 40.9% from the same period last year; and lithium iron phosphate batteries totaled 4743.2MWH, accounting for 27.1% of the total, down 39.6% from the same period last year.

With the increase in subsidized energy density requirements, it can be seen from the chart that ternary batteries are still the main force of power batteries, with a market share of 72.18%, an increase of about 9 percentage points from 63.37% in the first half of 2019. The market share of lithium iron phosphate batteries was 27.14%, up two percentage points from 25.52% in the first half of 2019.

With the launch of Biadihan, which is loaded with blade batteries, and Latesla's plan to launch lithium iron phosphate battery electric vehicles in China, the market share of lithium iron phosphate may increase to a certain extent in the second half of 2020.

From the enterprise point of view, in the first half of the year, a total of 59 power battery enterprises in China's new energy vehicle market were equipped with supporting vehicles, 5 fewer than the same period last year, and the top 3, top 5 and top 10 power battery enterprises installed 12.6GWh, 14.5GWh and 16.4GWH respectively, accounting for 71.9%, 82.9% and 93.8% of the total installed capacity, respectively.

Among the top 10 battery companies with installed capacity in the first half of 2020, Ningde Times still ranks first, with 8.44GW installed capacity, with a market share of about 48.31%; BYD ranks second with 2.45GWh installed capacity, with a market share of 14.01%, down 10 percentage points from last year; LG Chemical ranks third, with 1.67GWhh installed capacity and a market share of 9.53%. Thanks to the number of models such as Guangzhou Automotive New Energy Aion S, AVIC Lithium installed rose to fifth place from the top 10 in the first half of 2019, with a market share of 4.35 per cent.

According to the collation of the Gaishi Automotive Research Institute, the supporting customers of Ningde era in the first half of the year include Lailai Automobile, Guangzhou Automobile New Energy, Yutong bus, Xiaopeng Automobile, ideal Automobile and other car companies, which have become the darling of the new car-building forces, and their installed capacity in the passenger car market is 5.65GWh. accounting for 65.9% of its total installed capacity. BYD's supporting customers in the first half of the year, in addition to their own, but also include Tengli Automobile, Zoomlion heavy Technology, Beijing Hualin Special equipment and other car companies. AVIC Lithium Power supporting customers are Guangzhou Automobile New Energy, Changan, Dongfeng well-off, Geely, Jiangling and other car enterprises.

In the first half of 2020, the market share of Ningde era accounted for nearly half, and the proportion of foreign battery enterprises increased compared with the past. From July, Ningde era began to supply Tesla, and its market share will increase to a certain extent in the second half of the year, which will also have a certain impact on the market share of LG Chemical and Panasonic.

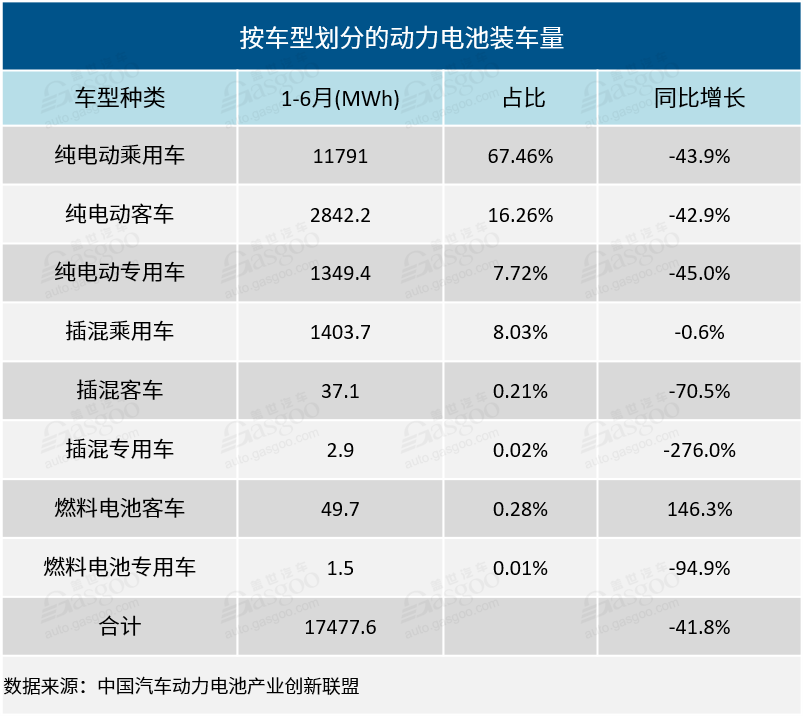

In terms of vehicle types, in the first half of 2020, the installed capacity of power batteries of new energy passenger vehicles was 13194.7 MWh, accounting for 75.49%; the installed capacity of power batteries of new energy buses was 2929 MWh, accounting for 16.76%; and the installed capacity of power batteries of new energy special vehicles was 1353.8 MWh, accounting for 7.75%.

The installed capacity of power batteries is mainly pure electric vehicles, accounting for 91.45% of the total installed capacity of 15982.6 MWh, in the first half of the year, of which pure electric passenger vehicles account for 67.46%. Hybrid electric vehicle power battery installed 1443.7 MWh, accounted for 8.26%, fuel cell vehicle power battery installed 51.2 MWh, accounted for only 0.01%.

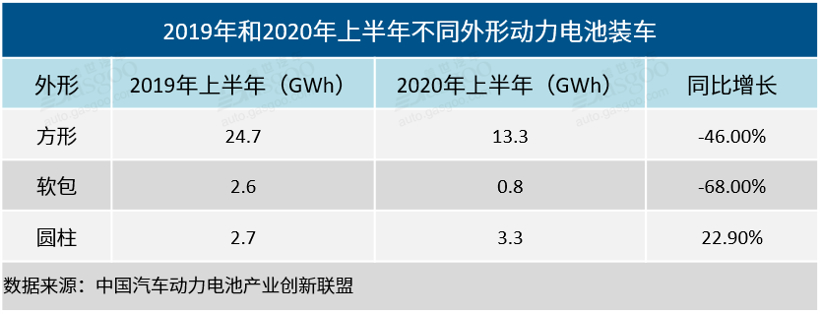

In terms of the shape of power batteries, in the first half of 2020, the domestic new energy vehicle market was still dominated by square batteries, with a total of 13.3GWhs, accounting for 76.4 percent, which was 6 percentage points lower than that in the first half of 2019; driven by the output of Tesla Model 3 models, cylindrical batteries loaded 3.3GWhs, accounting for 18.9 percent, an increase of 10 percentage points over the same period last year. The installed capacity of soft package batteries in the first half of the year was 0.8GWhh, accounting for 4.8%.

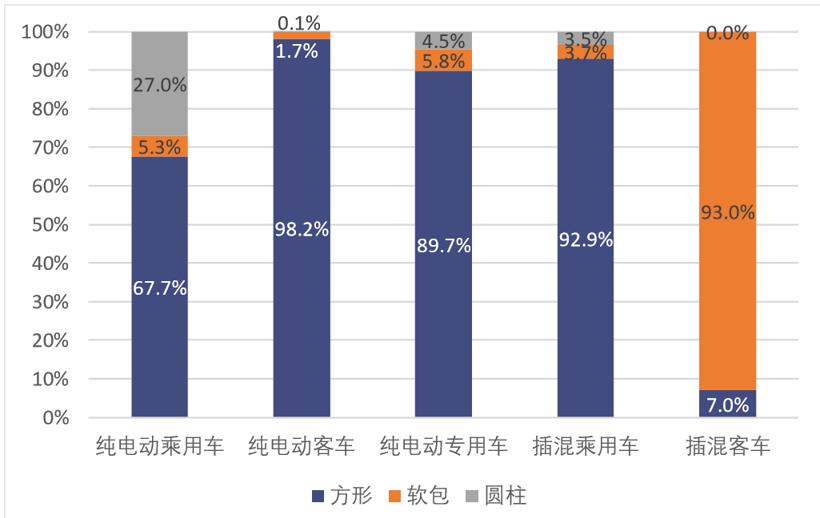

Distribution of power batteries with different shapes in various models in the first half of 2020

Photo Source: China Automotive Power Battery Industry Innovation Alliance

As shown in the picture above, except for plug-in hybrid buses with flexible batteries, other new energy models are mainly square batteries, and the Tesla effect increases the proportion of cylindrical power batteries used in pure electric passenger cars.

From the perspective of popular and best-selling models, the top 10 pure electric passenger cars sold in 2020 are Tesla Model3, Chuanqi AION.S, Xilai ES6, BYD Qin, Weima EX5, Euler R1, Mercedes-Benz E-Star, Chery eQ1, BAIC EU5 and BYD e2.

Of the 10 cars, only the Chery eQ1 uses lithium iron phosphate and ternary power batteries, while the remaining nine models all use ternary batteries. Model3 uses LG Chemical and Panasonic, while other models use domestic batteries. The supply companies are mainly Ningde era, BYD, AVIC Lithium, etc., among them, Ningde era is used in five models, BYD and AVIC Lithium are used in two popular models respectively.

With the exception of the Chery eQ1, all the other nine models have a range of more than 300km; with the exception of the ES6, the energy density of the battery system is above 140Wh/kg.

In terms of domestic installed capacity of foreign power batteries, in the first half of 2019, there were 5 foreign power battery enterprises supporting domestic new energy vehicles, with a total of 57000 new energy vehicles; the total installed capacity of power batteries was 2887.8 MWH, an increase of 2479.5% over the same period last year, accounting for 16.5% of the total installed power batteries, and all the products were ternary batteries.

Driven by the mass production and delivery of Tesla Model 3, LG Chemical and Panasonic entered the top 10 domestic power battery installed enterprises in the first half of 2020, with a market share of 16.24%. LG chemical installed capacity is 1665.1MWH, accounting for 57.7% of the domestic installed capacity of foreign-funded battery enterprises, Panasonic installed capacity of 1173 MWh, accounts for 40.6%, the proportion of the two enterprises is 98.3%. It can be seen that foreign-funded enterprises have begun to infiltrate the domestic market, and the competition pattern of China's power battery market has changed, and it is no longer just domestic power batteries that play a leading role.

Scan the code and apply to join the SMM metal exchange group.