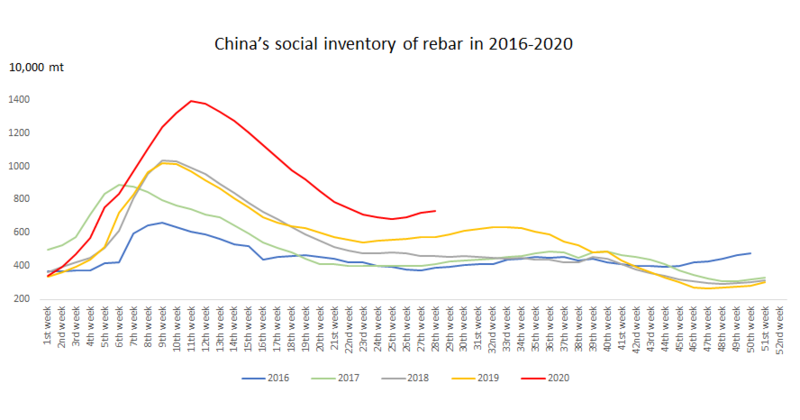

SHANGHAI, Jul 13 (SMM) – Inventories of steel rebar across Chinese steelmakers and social warehouses continued to build this week, but the increase significantly slowed from a week ago on the back of lower supply, eased impact on demand from the wet season in the south and coronavirus crisis in the north, and bullish prospects for near-term consumption.

Revival of end-users demand in some regions led to a slowdown in the buildup of social inventories this week. Reduced cash flow burden at construction sites as they head into the second half of the year also facilitated procurement.

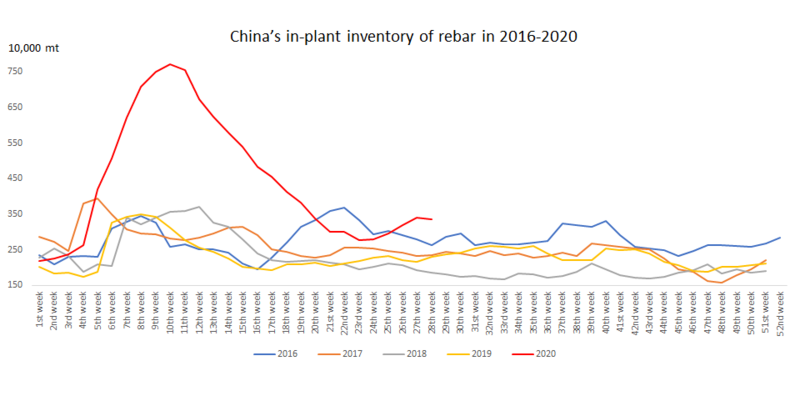

Inventory at steelmakers swung to decline this week, following after four consecutive weeks of increase. The drop was primarily driven by a scaling back of production at electric arc furnace (EAF) and blast furnace steel mills, improvement in orders at steel plants and stepped-up purchases by traders.

An SMM survey showed that the operating rates of blast furnaces at Chinese steelmakers have declined for the fourth straight week, falling 0.06 percentage point from a week ago to an average 90.1% as of July 8. The operating rates across independent EAF steel mills in China stood at 73.24% as of July 7, down 4.49 percentage points from a week ago and down 11.52 percentage points from a month earlier.

Market prospects for demand recovery after the rainy season increased. This, coupled with the recent rally in the stock market amid optimism around global economic reopening, gave the market a boost and prompted traders to restock.

SMM expects the movement of near-term rebar prices to diverge by region, following a broad price rally recently. Rebar prices in areas that saw a fading impact of the rainy weather will likely sustain increases, while the demand outlook in the middle and lower reaches of the Yangtze River and in south-west China will remain clouded by the wet season.

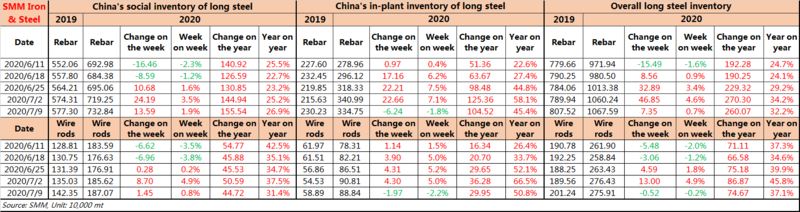

According to SMM data, rebar inventories across social warehouses stood at 7.33 million mt as of July 9. This was up 1.9%, or 135,900 mt, from July 2, slowing from a rise of 241,900 mt, or 3.5% last week.

Inventories at Chinese steelmakers edged down 1.8% on the week and stood at 3.35 million mt, after the stocks rising 7.1% in the previous week.

Overall inventories of rebar, including stocks across steelmakers and social warehouses, grew 0.7% and posted 10.68 million mt as of July 9, after a build of 4.6% in the prior week.

On a yearly basis, overall inventories were 32.2% higher as of July 9. The stocks were 34.2% higher year on year last week.