SHANGHAI, Jul 8 (SMM) – Chinese electric arc furnace (EAF) steelmakers operating rates came off from highs as of early July, as their in-plant inventories piled up as the wet season deterred the release of end-users demand.

Elevated costs of feedstock steel scrap and weaker-than-expected rebar prices have driven more than half of EAF steel mills into losses. This also accounted for the slower operation at EAF steel plants.

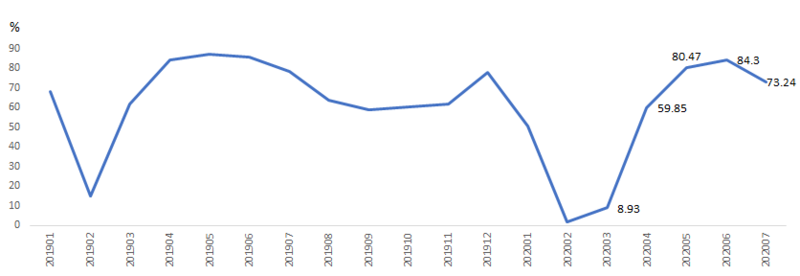

As of July 7, operating rates across independent EAF steel mills in China stood at 73.24%, down 4.49 percentage points from a week ago and down 11.52 percentage points from a month earlier, according to an SMM survey.

Operating rates across EAF steel mills in China (Source: SMM)

The operating rates will unlikely recover much in the near term as prices of steel scrap will highly likely stay firm on tight supplies and continued heavy rainfall expected in east, south-west and central China, where most of Chinese EAF capacity is located in, will keep demand subdued.

End-users consumption will diverge among different regions. While shipments at sellers have improved on the eased impact of rainy weather in some areas, this failed to significantly reduce steel inventories at social warehouses and at EAF steelmakers.

In east China, the average operating rates at EAF steel mills have slipped to 78%, from 84% in early June. Most plants reported marginal losses and have curtailed their production time.

A representative steelmaker in east China said it currently operates at a rate of 60% with production losses of below 100 yuan/mt, as compared with a rate of 80% at the start of July.

The operating rates across EAF steel mills in central China have declined steeply to 35%, from 67% a month ago, primarily weighed by weakness in demand. Maintenance and overhauls are commonly seen in Henan.

A major producer in central China faced significant inventory pressure amid poor sales, with mounting stocks of all specifications. It halted production for one-week maintenance on July 5, but it could be compelled to extend the maintenance if demand remains sluggish.

In south China, the average operating rates dipped from 88% to 83% over the past month. However, the rates have shown signs of picking up on recovering demand as the rainy season draws close to an end.

According to an SMM survey, a representative steel mill in south China was on the verge of losses. It has ramped up to full capacity on expectations of demand recovery, following after it cut the operating rates to 80% on slow shipments in mid-June.

The EAF operating rates in south-west China dropped from 100% to 91% over the past month, mainly pressured by elevated inventory at plants. Currently, most local EAF mills are able to break even.

A representative steel plant in south-west China has concluded maintenance and reached full operation, but it still faces heavy pressure from in-plant stocks, which are nearly threefold of the normal levels.