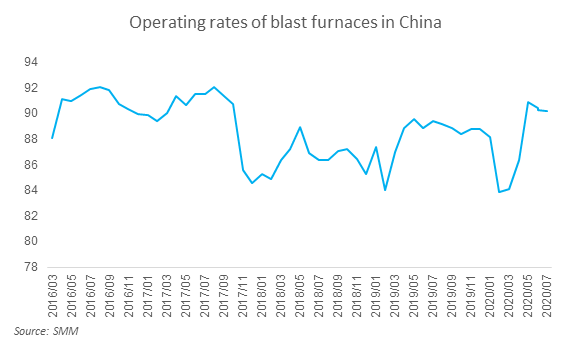

SHANGHAI, Jul 3 (SMM) – Operating rates of blast furnaces at Chinese steelmakers fell for a third straight week this week, as some mills in north and central China conducted maintenance after higher costs and lower steel prices squeezed profits.

An SMM survey showed that the BF operating rates averaged 90.16% for the week ended July 1, down 0.13 percentage point from the previous week. The rate is expected to hold stable next week.

For the same week, mills producing steel products via the BF based route were estimated to see profits of 125 yuan/mt on average, sharply down 60 yuan/mt from the prior week.

Inventories of steel products in China rebounded after the Dragon Boat Festival which fell on June 25, as the re-imposition of strict lockdown restrictions in the capital city—Beijing—on the back of a resurgence of COVID-19 infections, together with spiking cases outside China and floods in some Chinese regions, sparked caution across the market.

Electric arc furnace mills are also scaling back operations. A separate SMM survey showed that the average operating rate of 34 Chinese EAF steel mills slipped 4.24 percentage points from a week earlier to 77.73% as of June 30.

Easing supply pressure paves the way for another rally in steel prices as demand will recover after the wet season and the outbreak in Beijing has come under control.

Here are the details of the SMM survey.

Shougang in north China plans to put its one 4,000-m3 BF under maintenance this month, and its rolling lines will undergo maintenance in turn for nearly a month.

East China’s Magang will also put its rolling lines under maintenance later this month, with its margins on rebar currently standing at 200-300 yuan/mt.

A sharp decline in rebar profits, on the other hand, prompted Hunan Valin LY Steel in central China, to switch from rebar to hot-rolled coil. The company now sees profits of more than 200 yuan/mt on HRC, compared with about 100 yuan/mt on rebar.

South China’s Wangang and Weigang in the southwest expressed pessimism about the market outlook, as inventories increased on weak demand.