SHANGHAI, Apr 24 (SMM) – An increase in the inflow of seaborne steel billet to China will unlikely cause significant impact on domestic steel prices, SMM expects, while concerns about steel prices intensified following recent market talk that suggested an influx of more than 3 million mt of steel billet to China between April and July.

Data from the National Bureau of Statistics (NBS) indicated that China produced 996 million mt of crude steel in 2019, dwarfing the anticipated 3.12 million mt of steel billet imports in April-July. Also, the amounts of potential imports account for only 3.95% of China’s crude steel output in March.

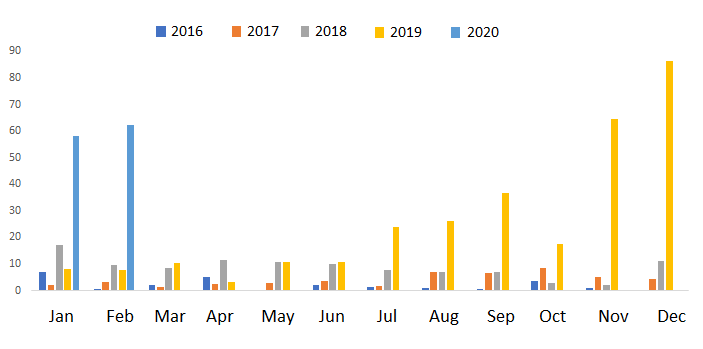

China’s monthly steel billet imports in April and the upcoming three months may unlikely surpass the record 864,000 mt in December 2019, showed SMM data.

China’s imports of steel billet (unit: 10,000 mt, source: China customs)

Finished steel products produced from imported billet usually make up the low-end resources in the Chinese market due to their lower standards. As compared with steel scrap, imported billet also has less cost advantage in steel production at blast furnace and EAF steelmakers. These suggest that any impact from the expected seaborne billet inflow on the mainstream steel market would be limited.

Overseas demand for steel has slumped as measures to contain the fast-spreading coronavirus slowed business activity outside China, while the virus’ spread stalled domestically. This resulted in significantly wider price spreads between foreign and Chinese steel billet and bolstered the inflow to China.

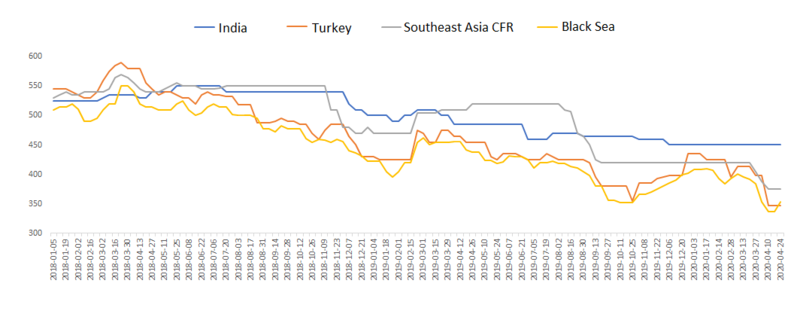

Prices of Southeast Asian billet have slipped to the weakest since 2016, at $347/mt, creating a discount of $90/mt as compared with China’s square billet price on a fob basis, SMM assessed.

FOB prices of steel billet in overseas markets (unit: $/mt)