SHANGHAI, Apr 13 (SMM) – SMM surveyed 41 major aluminium processors in 12 provinces and found that their average operating rate dipped 0.6 percentage point on a weekly basis to 74.4% last week. Backlog orders allowed overall operating rates to remain largely stable. Construction related processors performed the best due to robust domestic demand and little impact on exports. Export orders for May are expected to fall sharply, which will affect aluminium plate/sheet, strip and foil producers the most as export account for a significant proportion of their business. Fewer export orders are likely to weigh on overall operating rates slightly this week.

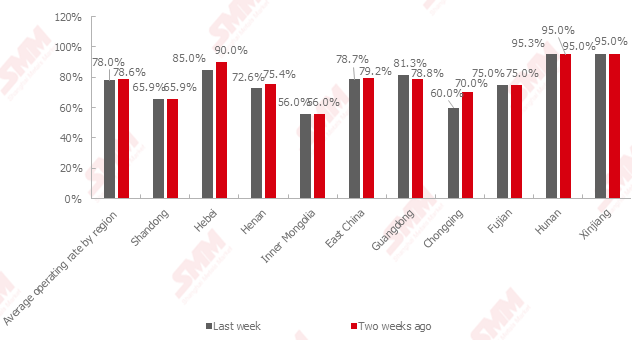

Operating rates at major aluminium processors by region (updated on April 10)

Source: SMM

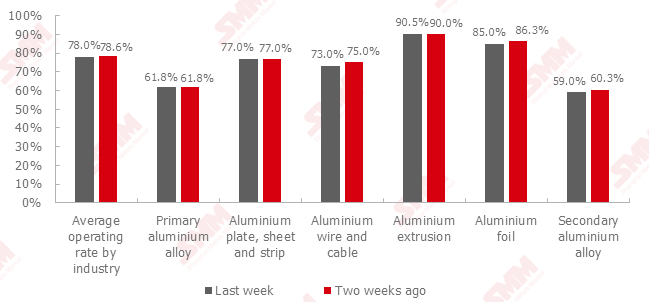

Operating rates at major aluminium processors by industry (updated on April 10)

Source: SMM

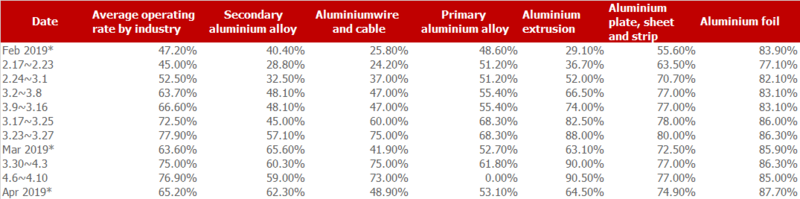

Weekly operating rates at major aluminium processors by industry

Source: SMM

Note: * refers to monthly operating rates.

Aluminium extrusion: Operating rates at aluminium extrusion producers changed little. Strong domestic demand partly made up for declines in export orders at construction extrusion producers. Current orders at some of the construction extrusion producers could sustain production for at least a month. Industrial extrusion producers reported fewer export orders and some of them remained pessimistic. Rising aluminium billet processing fees pushed up costs for extrusion producers. To avoid accumulation of finished products, extrusion producers had stricter cargoes pick-up requirements on clients. Operating rates at construction extrusion producers are expected to remain largely stable in the short term, but may decline at industrial extrusion producers.

Aluminium plate/sheet and strip: Operating rates at large aluminium plate/sheet and strip producers were largely flat from a week ago. New orders declined sharply in early April, but backlog orders could allow producers to basically maintain full production this month. Producers are concerned about orders for May and June amid global COVID-19, which will affect output as well. Inventories of finished products remained higher than normal levels as clients, especially overseas buyers, continued to pick up goods slowly. Weak orders and cash flow issues kept plate/sheet and strip producers cautious about purchasing raw materials.

Aluminium foil: Operating rates at aluminium foil producers declined as COVID-19 hampered exports, with foreign clients cancelling or delaying orders. Output of air-conditioner foil increased from March following arrival of the high season, but was lower than a year ago as orders from export-oriented air-conditioner manufacturers declined. Production of light-gauge and medium-gauge foil decreased due to the negative impact on exports. Sluggish global automobile industry forced producers of soldering and brazing foil to slash output significantly. Production of electronics foil could sustain till May due to recovering domestic demand. April used to be the peak season of orders for aluminium foil, but the peak may be delayed or absent this year.

Aluminium wire and cable: Operating rates at large aluminium wire and cable producers dropped slightly. Current production is mostly based on orders received before the Chinese New Year. Production schedules for April are full at some producers, while others reported lower operating rates as some clients in Southeast Asia and South America cancelled orders. State Grid is expected issue tenders for ultra-high voltage and power distribution projects mostly in the second half of the year. Aluminium rod producers reported stable orders from wire and cable producers.

Secondary aluminium alloy: Operating rates at large secondary aluminium alloy producers dropped 1.3 percentage points. Tighter aluminium scrap supply forced some small producers in Jiangxi, Zhejiang and Shandong provinces to shut down. Some small and medium-sized producers have shown no intention to resume production amid tight raw material supply and weak orders. As aluminium scrap supply will probably remain tight this month, an increasing number of small and medium-sized producers are facing risks of shutdowns this week. Some producers will continue to seek primary aluminium as a substitute to aluminium scrap.

Primary aluminium alloy: Operating rates at the top five primary aluminium alloy producers remained unchanged at 61.8%. Wheel plants reduced raw material purchases due to falling domestic and export orders, forcing A356.2 aluminium alloy producers to cut output in early April. Alloy producers will focus on depleting inventories in the short term as operating rates at wheel plants are unlikely to recover significantly until automobile sales improve.

![Secondary Aluminum Operating Rate Plunged in February March Recovery Was Set to Rebound Significantly [SMM Analysis]](https://imgqn.smm.cn/production/admin/votes/imageskkgTu20240508153005.png)