SHANGHAI, Apr 26 (SMM) – Copper scrap supply in China is estimated to have shrunk nearly 200,000 mt in the first three months of 2020, as escalated virus-control measures disrupted global trade flows and as Chinese suppliers held back on sales following a slump in copper prices.

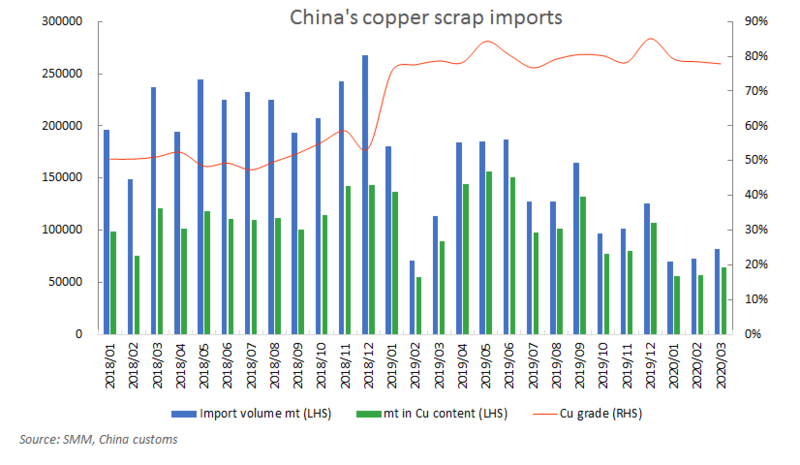

A total of 225,083 mt of copper scrap was imported to China in January-to-March, down close to 140,000 mt, or more than 38% from the same period last year, according to data from China customs. SMM estimates that those copper scrap imports, with average Cu content of 78.49%, contained 176,676 mt of copper, down more than 37% from the quarter ended March 2019.

Global supply chain disruption caused by the COVID-19 pandemic, the late timing of Chinese importers receiving the initial batch of import quotes for this year, and a high statistical base contributed to the sharp decline in copper scrap imports in Q1.

Disruptions to copper scrap exports from Malaysia, the biggest copper scrap supplier to China and accounting for 16.54% of China’s copper scrap imports, began to take hold in late March, SMM learned from Chinese copper scrap importers who have plants in Malaysia, as the Southeast Asian country entered a nationwide lockdown starting March 18.

A slump in copper prices, risk concerns amid the global outbreak and port congestion, meanwhile, prompted copper scrap suppliers from Southeast Asia, Europe and the US to scale back shipments to China.

China’s environmental authorities did not issue the first batch of copper scrap import allowances for 2020 until late December, which delayed imports in the new year as importers began their Lunar New Year break in late January.

A high statistical base also led to the sharp year-over-year decline in copper scrap imports in Q1, as importers rushed to import high-quality copper scrap before the quota-system on Category 6 imports came into force in the second half of 2019.

Imported copper scrap accounts for about 60% of copper scrap consumption in China. SMM learned that Chinese firms have almost used up copper scrap import quotas for Q1. For Q2, 224,200 mt of copper scrap import allowances have been issued in two batches, which accounts for less than half of realised imports in the same quarter last year but is expected to be sufficient as seaborne trades remain under the pressure from the pandemic.

The Chinese firm who has a recycling plant in Malaysia said that their recent copper scrap shipments from Malaysia will not be able to arrive at China until mid-May due to port congestion. The firm now has high inventories of copper scrap at its plant in Malaysia and cash flow woes have emerged since shipments were disrupted since late March.

Woes such as low efficiency and lack of containers at ports, meanwhile, are also affecting copper scrap shipments from Europe and the US to China. China’s imports of copper scrap and remelt ingot are expected to remain subdued in April-to-May.

Scrap shortages bolstered consumption of copper cathode

Supply shortages, coupled with narrow copper scrap discounts, prompted copper users in China to switch to the alternative feed—copper cathode.

SMM data showed that the average operating rate across Chinese copper rod producers who use scrap as feedstock sank nearly 53 percentage points to 18.68% in March from a year earlier. Orders received by producers who use copper cathode as feedstock, meanwhile, were healthy, and the processing fees for copper rod across east, south and north China have risen sharply for two consecutive weeks.

Compared to the sharp decline in imports of copper scrap, China’s imports of unwrought copper and copper products expanded 9.1% year on year in Q1 to 1.29 million mt, according to data from China customs.

![The Most-Traded BC Copper Contract Closed Down 1.47%, a Stronger US Dollar Index Put Copper Prices Under Pressure [SMM BC Copper Commentary]](https://imgqn.smm.cn/usercenter/Fxolk20251217171712.jpg)