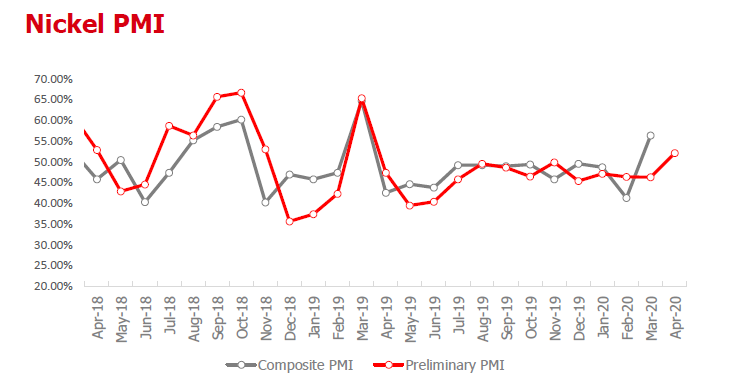

SHANGHAI, Apr 1 (SMM) – Manufacturing activities across nickel downstream sectors in China expanded in March after contracting for eleven consecutive months, as factories get back to business amid the easing of movement restrictions from COVID-19.

SMM data showed that the purchasing managers index (PMI) for downstream nickel industries, including stainless steel, electroplating, alloy and battery, stood at 56.31 in March, up 15.07 points from February. A reading above 50 indicates expansion.

Production sub-index rose significantly

The composite sub-index for production in March rose a significant 25.45 percentage points from February to 62.87, on the back of ramped-up operations at stainless steel mills after output cut in February as trades improved and raw materials prices weakened. The sub-index for production in the stainless steel sector advanced 24.67 percentage points on the month to 63.14. Profits margins for stainless steel remained limited, but were not as low as to trigger large-scale output curtailment. Gradual resumption of logistics also facilitated the recovery of stainless steel production. The sub-index for production in the electroplating sector performed better than expected, standing at 58.95 in March, as electroplating factories returned from February’s holidays to fulfil orders received before the Chinese New Year. Some large-scale electroplating plants resumed 80% of their capacity.

New orders sub-index rebounded in March

According to SMM data, the overall sub-index for new orders across downstream nickel sectors rallied 26.42 percentage points from February, to 61.15 in March. The recovery of logistics services revived trades of stainless steel and lifted orders at stainless steel producers, which led to an increase of 27.9 percentage points in the new orders sub-index of the sector to 62.19 for March. The new orders sub-index for the alloy sector stood at 62.18, beating expectations, as alloy casting plants maintained stable operations with most of them running at full capacity. Orders for military and nuclear power use as well as orders from civil-use products for domestic sales were sable last month. The delay of some export orders caused limited impact on the alloy sector. In the battery sector, new orders sub-index continued to recover to 60.91 in March. However, the rapid widespread of COVID-19 overseas raised some concerns about a decline in export orders.

Raw materials inventory sub-index remained in contraction

The overall sub-index for raw materials inventories extended its decline in March, falling 3.25 percentage points from February to 42.82, as ample supply of nickel pig iron (NPI) and pessimistic outlook for its prices kept stainless steel producers from drastically stockpiling the raw material. Producers in other downstream sectors resumed restocking, with the raw materials inventory sub-index for the alloy sector at 63.19 for March. Most factories arranged restocking last month as prices of base metals retreated.

Finished goods inventory sub-index edged higher, failed to surpass 50

The overall sub-index for finished products stocks failed to enter the expansion territory as it climbed 4.65 percentage points from February to 45.85, indicating that sluggish consumption continued to drove up inventories, which is especially the case in the stainless steel sector. Less flexibility to cut production saw stainless steel mills relinquishing profits to destock amid weaker-than-expected consumption. The situation could sustain in the months ahead.