(Added tables)

SHANGHAI, Mar 3 (SMM) – Steel production curtailments in China are further deepening this week as more mills follow suit, while end-users speed up their resumption of operations, showed the latest SMM survey.

Shrinking supply and recovering demand paint an upbeat picture for spot steel prices, but a sustained price rally is not expected in the short term given the COVID-19 outbreak beyond China, growing steel inventories in China and slow demand recovery.

Steel output to decline further on environmental curbs and maintenance

According to the SMM survey that covers 102 blast furnace steel mills, 50% of them are undertaking maintenance or have trimmed output (excluding mills that reduced output by adjusting rates of equipment utilisation and raw material ratios), up from a ratio of 47.06% last week.

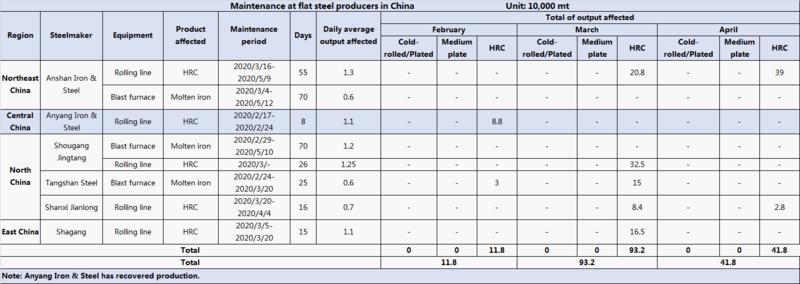

Flat steel accounted for about 11.54% of those production curtailments, while construction steel mills continued their production cuts or maintenance. A small mill with annual pig iron capacity of below 2 million mt, told SMM that it plans to fully suspend production for about 15 days as pressure from inventory and cash flow mounts amid slow demand recovery.

Table 1: Maintenance at flat steel producers in China

Source: SMM

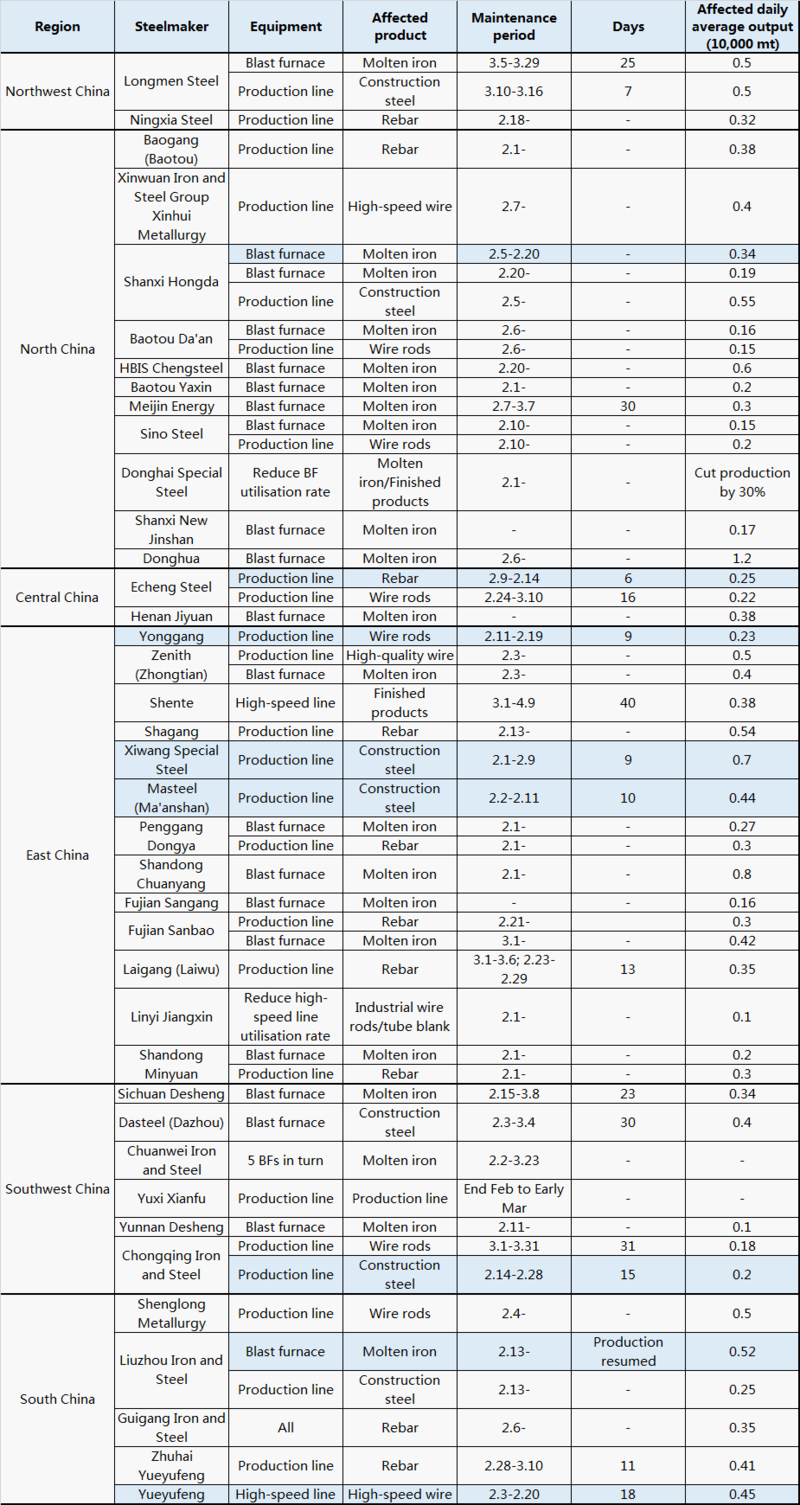

Table 2: Maintenance at long steel producers in China

Source: SMM

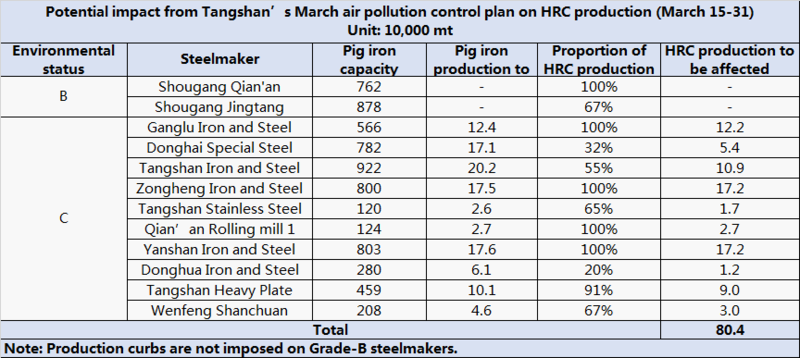

The top steelmaking hub of Tangshan has issued its air pollution control plan for March, which is expected to further lower steel production and ease supply pressure.

Table 3: Impact of Tangshan production curbs on HRC production

Source: SMM

Electric arc furnace (EAF) steel mills, meanwhile, remain closed as losses continue. EAF mills in east China now face hefty losses, which are estimated to be more than 300 yuan/mt, according to SMM calculations. Potential losses on EAF mills in southwest and south China are moderate, but tight supply of steel scrap kept them from reopening. EAF mills in southwest and south China are expected to resume production gradually in the middle of March.

More end-users have reopened, while labour conditions remain tight

Manufacturing: About 80-90% of end-users in Jiangsu, Zhejiang, Anhui, Fujian, Shandong, Hunan, Guangdong and Sichuan have resumed work, while the rates in other regions except for Hubei—epicentre of the COVID-19 outbreak, climbed to 60-70%. Labour issues remain the key factor that subdues production at manufacturers.

Construction: Official data showed that almost all the key projects in Guizhou, Chongqing, Sichuan, Zhejiang, Jiangsu and other regions have resumed work, but SMM research found that actual operations at those restarted projects are subdued amid tough public health measures aimed to prevent the virus.

Locals or people from areas that are not heavily infected returning to regions including Henan, Guangdong and Anhui are not required to isolate themselves as long as they have clean bills of health. This is expected to help spend up operation recovery at construction sites.

East China: Manufacturers saw about 50-70% of workers have returned. The rates are higher in Jiangsu and Zhejiang, but stand at only about 50% in Shanghai. The progress of recovery at construction sites is downbeat, with demand for steel coming in at less than 20% of levels seen before the Lunar New Year holiday.

South China: Manufacturers saw about 50-60% of workers have returned. Required quarantine period for people returning from Hubei and nearby areas is 14 days, but is about 7 days for people returning from other regions. The resumption of major construction projects fared well, and some sites have begun to restock steel.

North, northeast and northwest China: The worker return rates ranged from 30-60%. End-users in Tangshan saw a rate of 60%, while the rates in Tianjin and Beijing stood at only 30-40%. Recovery at construction sites is subdued.

Southwest China: Operations at construction sites have improved substantially from February, but the recovery has yet passed onto demand for steel.

Central China: Hubei remains locked down, and businesses are not to resume work earlier than March 10. Other regions such as Henan and Hubei saw a sharp increase in the resumption of construction sites, and demand for steel is expected to pick up in March.

Warehouses and ports outside central China have recovered to normal

Warehouses and ports in regions beyond central China have largely recovered their operations to normal, showed the SMM survey. Over 90% of warehouses and ports in south, east, north and northeast China have reopened, while the rate is only about 50% in central China as those in Hubei remain suspended.

South China: Warehouses and ports there recovered relatively faster. Almost all warehouses in Guangdong have reopened as of Monday March 2, while ports are in normal operations. It is relatively slow for cargoes to enter warehouses where are running out of storage capacity.

East China: The recovery pace there is second to south China, but has seen a tangible acceleration in recent days. Warehouses in Shanghai and nearby areas have resumed processing business, but the processing time is only about 70% of their normal levels. Operations at about 90% of ports have also recovered to normal.

North China: More than 90% of warehouses and ports in Tangshan, Handan and other regions have recovered, while the rate is only about 70% in Tianjin due to manpower shortages.

Northeast China: More than 90% of warehouses and ports there have reopened as this region felt relatively less impact from the virus. Warehouses have yet fully recovered their processing business.

Transportation has largely recovered, but capacity remains constrained

Logistics across regions beyond Hubei have largely recovered, but capacity has yet returned to normal levels due to a shortage of labour force and protective supplies. Less than 50% of transport capacity has recovered in Tianjin and Beijing, while 70-80% has recovered in Jiangsu, Zhejiang, Guangzhou and Shandong.