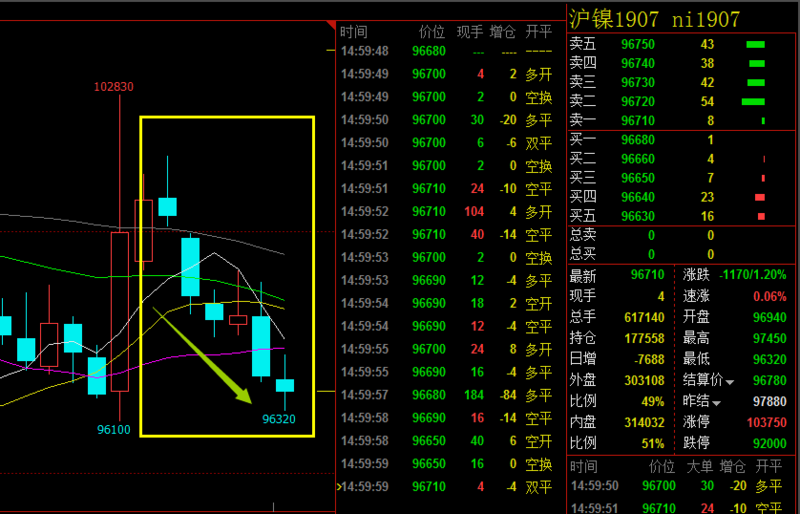

SMM6, 4 June news: today (June 4), nickel prices continued to fall, as of the end of the day, Shanghai nickel main contract 1907 closed at 96710 yuan / ton, down 1.2%. Since May 28, nickel prices have continued to fall after a brief rebound, falling 3630 yuan per ton, or 3.6 per cent, on the 6th.

SMM believes that the recent nickel prices continue to fall, falling to the pre-rally position of 96700 yuan / ton, mainly to long positions. The sharp rise on Friday the 24th scares short sellers, although from the supply and demand side, domestic pure nickel stocks continue to increase, nickel pig iron imports increase, downstream demand has not improved, nickel is still a weak variety. However, due to the small nickel price plate, greater volatility, capital forces play an important role, and considering that there are still no signs of significant production reduction in downstream stainless steel, some of the market bears do not dare to short. At present, the trend of nickel price is still not clear, in the absence of new bad news before the release of nickel prices in a short period of time low or supported, the overall trend to shock.

Market voice

Shandong Securities Futures Jinan Business Department trembling:

"from a technical point of view, the current Shanghai nickel 1908 has fallen below the low of 5.24, belongs to the broken position, the latter trend should still continue to be weak. (Shanghai Ni 1907 has not yet fallen below). From a basic point of view, at present, stainless steel has a high supply and high inventory, and the terminal market is available at random. The price pressure of stainless steel still exists in the seasonal off-season in June. At present, there is an overhaul action in the 200 series of the market. The 300-series market is also expected to need to cut production to end this "vicious circle". In that case, there is still a potential negative effect on nickel prices. The future price trend, the train of thought is still bearish mainly, waits for 300 series to reduce the production to actually transmit to the nickel iron to reduce the production (the nickel iron reduces the production margin to be below 950), this price may be the long-term view. "

Guoxin Futures:

"in terms of nickel, June is the off-season of traditional consumption, and steel mills have been willing to reduce production after the stainless steel inventory has broken through the all-time high. According to SMM research, recently, steel making and hot rolling in a stainless steel plant with an annual production capacity of 470000 tons in Guangxi have ceased production. Liugang Zhongjin, Guangxi Jinhai and Jiugang also have maintenance plans in June, which are expected to affect 65000 tons of stainless steel capacity, while the trend of excess supply of nickel and iron in the second quarter has not changed, and nickel prices are still on the short side in the near future. "

< in the update, please look forward to more points of view! >

"[investment must see] Trade friction news flying all over the metal how to win in chaos?

"Click to enter the registration page

Scan QR code and apply to join SMM metal exchange group, please indicate company + name + main business