In October, the sodium-ion battery industry chain entered a phase of adjustment, presenting a complex picture of "weakening material segment MoM and steady progress in the battery cell segment." Cathode materials faced short-term pressure due to inventory digestion and system compatibility issues, declining significantly MoM. While hard carbon anodes maintained strong YoY growth, they were constrained by three major bottlenecks: cost, performance, and scalability. The electrolyte market remained relatively stable, with minor fluctuations not altering the long-term collaborative trend. Meanwhile, downstream battery cells continued to scale up in segments such as ESS and start-stop applications, driving both YoY and MoM growth in production. Despite the short-term pullback in the material segment, sodium-ion batteries, as a complementary technology to lithium batteries, are still undergoing validation. Enterprises are actively optimizing systems and promoting cost reductions to accumulate strength for the next phase of mass production.

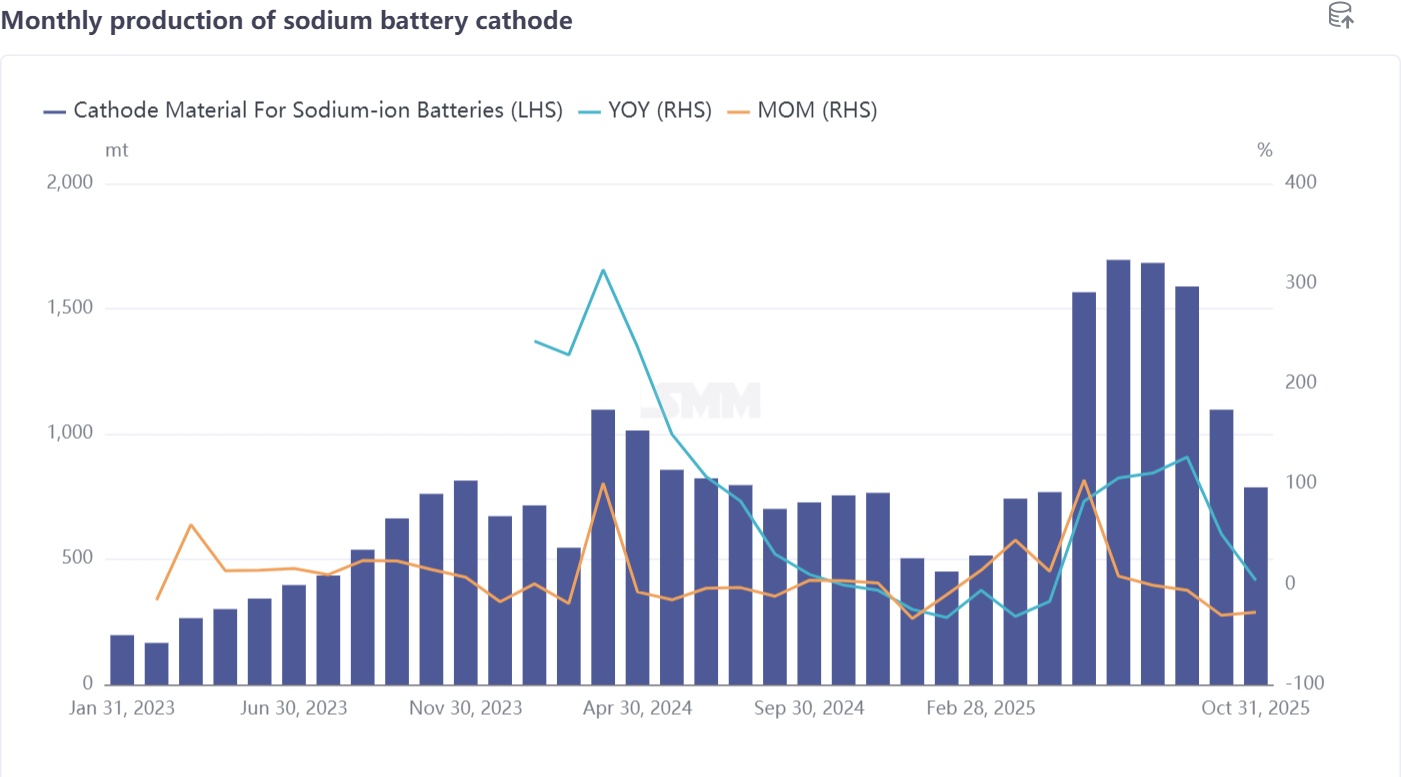

Cathode Materials: Orders Declined Significantly, Battery Cell Manufacturers Digest Inventories

In October, sodium-ion battery cathode material production fell sharply by 28% MoM, with only a slight increase of 4% YoY. Among them, polyanion-type NFPP materials accounted for 72% of total production. Although this share rose by 2 percentage points MoM, actual production decreased by over 100 mt. Some enterprises saw shipments drop by nearly 50% from the peak period, mainly because downstream battery cell manufacturers had stockpiled heavily earlier and are now slowing their procurement pace to digest inventories. Additionally, as battery cell manufacturers advance mass production, they face system compatibility issues, necessitating adjustments in production pace for technical optimization, which further reduced demand for NFPP materials. Shipments of layered oxide O3 materials remained low, as their application in large projects such as heavy trucks still requires approval at the battery cell, battery pack, and vehicle levels, with the timeline for mass production yet to be clarified. If system compatibility issues are effectively resolved in November, NFPP production is expected to rebound slightly. Total sodium-ion battery cathode material production in November is projected to increase by 6% MoM and 10% YoY.

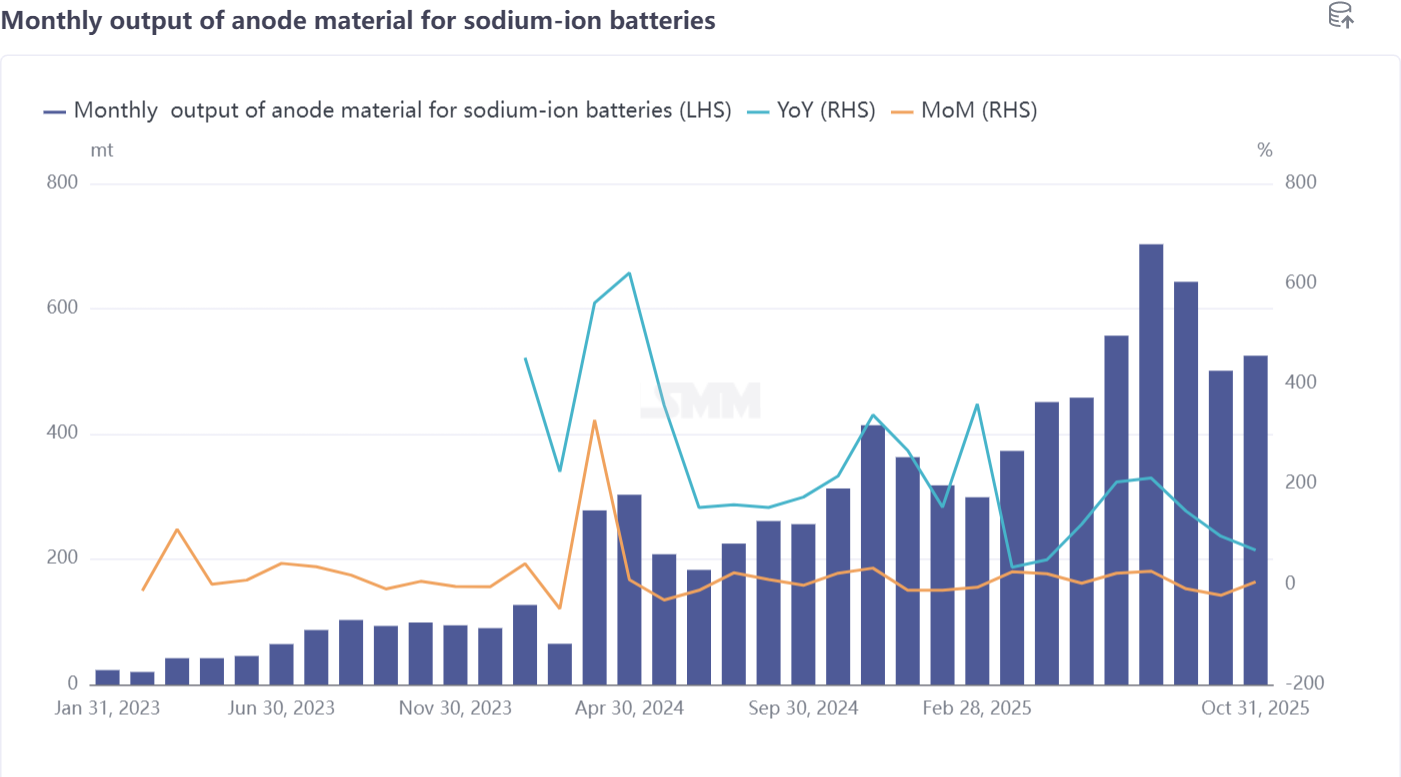

Hard Carbon Anode Materials: Industry Bottlenecks, Cost and Performance Breakthroughs Needed

In October, sodium-ion battery anode material production increased by 5% MoM and surged by 68% YoY. However, the development of hard carbon anodes still faces three major challenges. First is the cost issue: the market expects its price to drop to 60% of that of graphite anodes, or about 18,000 yuan/mt, but current raw material and processing costs make this target difficult to achieve. Second is the trade-off between technology and performance: using lower-cost coal-based routes results in inferior product capacity, C-rate performance, and cycle life, while biomass routes offer better performance but come with higher raw material and acid-washing costs, also making it hard to reach the ideal cost. Third is the scalability challenge: biomass routes face undersupply of raw materials, such as coconut shells, whose annual supply falls far short of industry demand. Moreover, the transition of agricultural and forestry raw materials like straw and bamboo to industrial production faces obstacles, including difficult environmental protection approvals, making small-scale production insufficient to meet market demand. The hard carbon industry continues to explore ways forward. Production in November is expected to decrease by 9% MoM but still maintain 15% growth YoY.

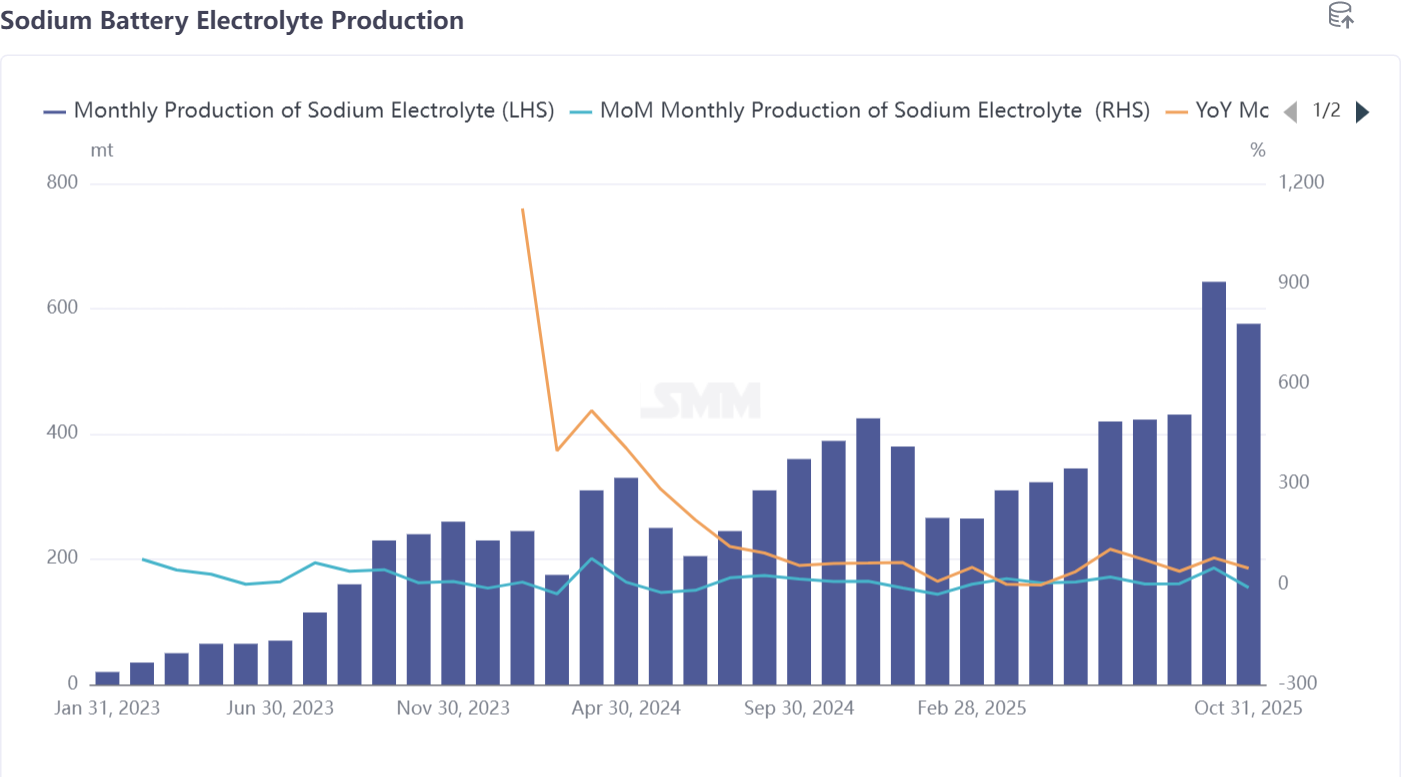

Sodium-Ion Battery Electrolyte: Prices Edged Up, Market Remains Order-Driven

In October, sodium-ion battery electrolyte production fell 10% MoM but rose 48% YoY. Additive prices for electrolytes increased slightly this month, causing some cost fluctuations, yet the overall impact on prices was limited. Currently, sodium-ion battery electrolyte production primarily relies on existing lithium battery electrolyte enterprises. Close collaboration between battery cell manufacturers and electrolyte plants facilitates the development of specialized formulations tailored to the performance requirements of sodium-ion battery cells. The electrolyte market continued to be order-driven, with production in November projected to increase by 2% MoM and 38% YoY.

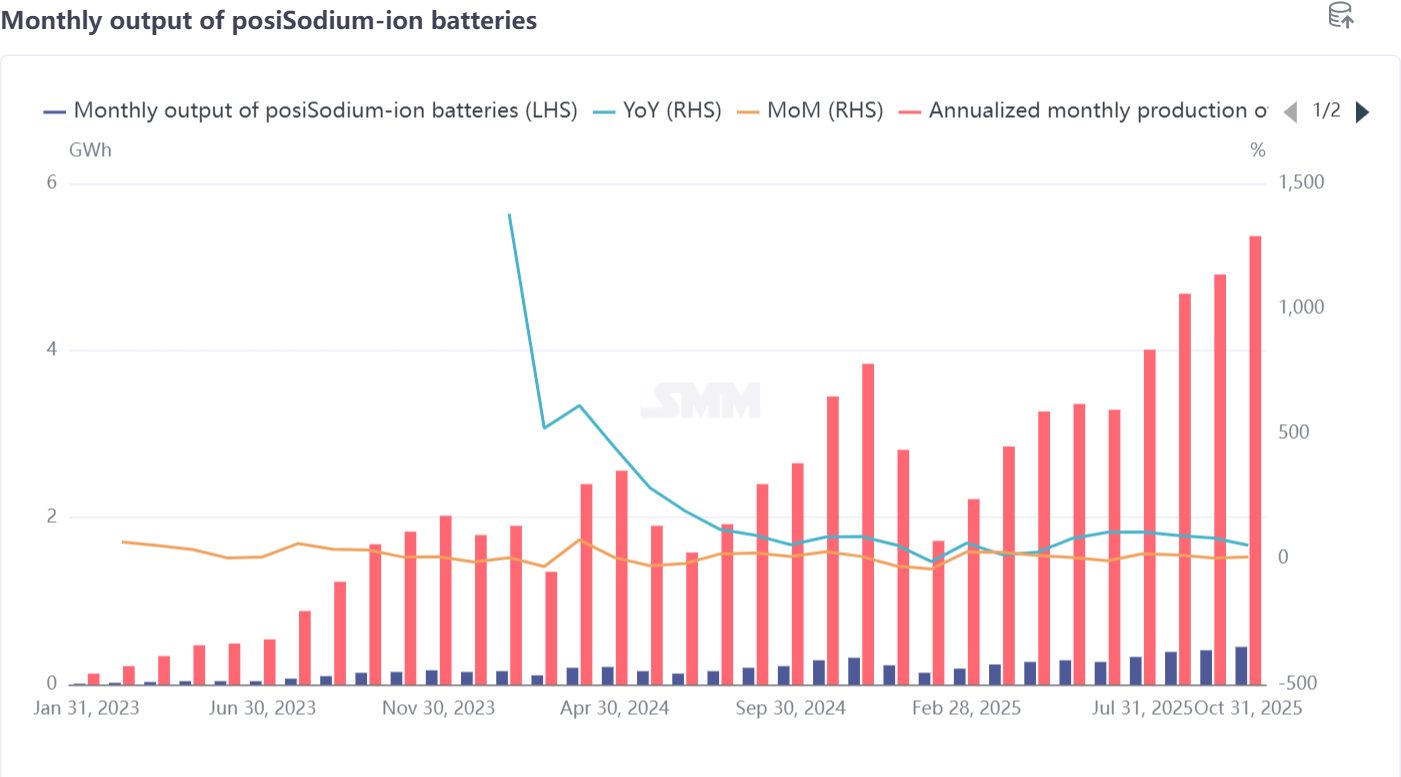

Battery Cells and End-Users: Seeking the Optimal Balance Between Performance and Cost

In October, sodium-ion battery cell production grew 9% MoM and 56% YoY. According to the SMM survey, operating rates were relatively high for production lines in the ESS and start-stop power supply sectors. Mass production for start-stop power supplies progressed relatively smoothly, while ESS cells still require a better balance between cost and energy density to secure a place in the energy storage market. In the electric two-wheeler sector, the impact of the new national standard implementation on existing solutions was limited. The sodium-ion battery industry is still in its early development stage, competition across various segments is not yet intense, and there is limited room for cost reduction. The industry urgently needs to enhance product performance and build market reputation to further penetrate application markets such as two-wheelers. Sodium-ion battery cell production in November is expected to increase by 10% MoM and 68% YoY.

Summary

In October, the sodium-ion battery industry chain continued to explore commercialization paths amidst dynamic adjustments. Cathode materials faced short-term pressure due to inventory and technical compatibility issues; hard carbon anode remains a key bottleneck constraining industry development; the electrolyte market is stabilizing; and downstream battery cells are making gradual progress in application segments. Although growth in the materials segment has slowed currently, the industry as a whole remains in a critical phase of technological improvement and system optimization. If breakthroughs are achieved in hard carbon costs and the compatibility of cell performance, sodium-ion batteries are expected to see more certain growth in markets such as energy storage and two-wheelers.