SMM Analysis: Since H2 2025, price trends in the recycling market have shown significant divergence. Cobalt sulphate prices rose rapidly from early September, with an overall increase of over 60%; meanwhile, LFP-based black mass prices fluctuated within a limited range between June and October. The underlying trend changes reflect that the recycling sector in H2 was increasingly influenced by material structure and divergent downstream demand.

I. Price Trend Changes of Mainstream Salts

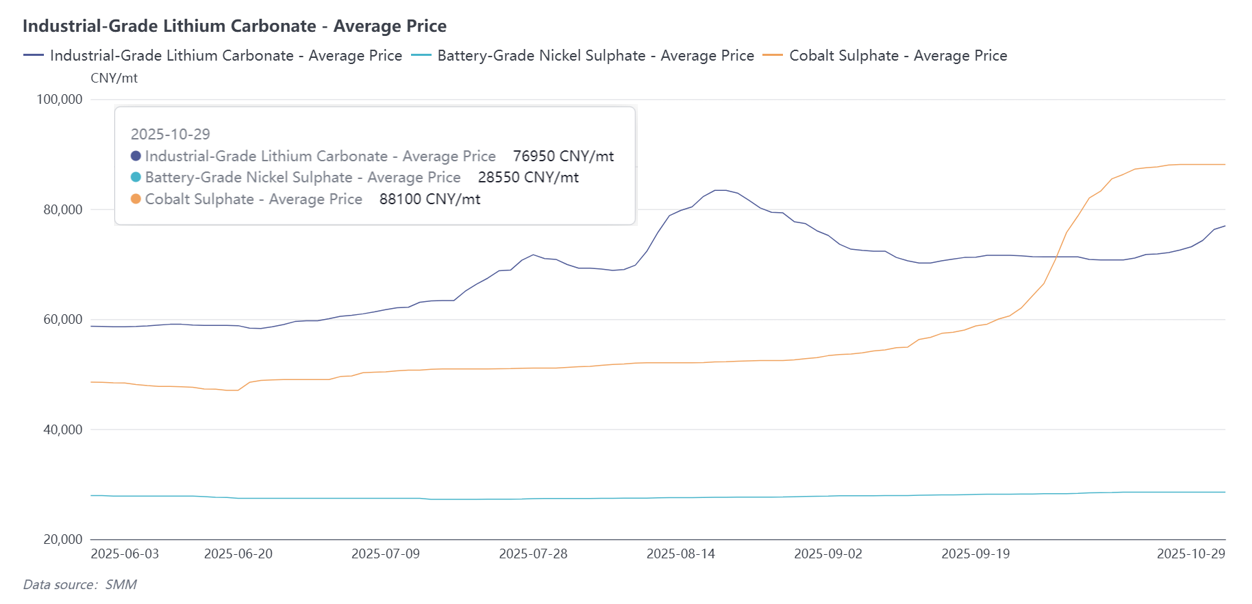

Image 1: Price Trends of Major Salts

From the price trends shown in Chart-1, cobalt sulphate was the most notable individual performer in H2. It began to rise rapidly in early September, accelerated noticeably from mid-to-late September through October, and reached a significantly high level by month-end (Chart-1 shows 88,100 yuan/mt). It exhibited the strongest increase and momentum among the three types of salts. Its ascent on the chart shows a steep climb, indicating a concentrated surge within a short period.

Industrial-grade lithium carbonate followed a pace of "rising first, then pulling back, followed by a mild rebound." An upward trend was visible from early July to mid-August, followed by a period of pullback and consolidation. After mid-September, it gradually stabilized and experienced a mild rebound, reaching approximately 76,950 yuan/mt by the end of October. Overall, lithium carbonate's fluctuations during this cycle were relatively mild, having moved from the middle of the fluctuation range back to the tail end of a relatively upward trend.

Battery-grade nickel sulphate remained relatively stable, showing the smallest curve fluctuations throughout the period. Its price stayed within a narrow range, with no sudden significant volatility on the chart, standing at approximately 28,550 yuan/mt on October 29.

In summary, Chart-1 clearly illustrates the divergent patterns among the three major salts in H2: cobalt prices rose rapidly in the short term, lithium carbonate returned to a mild rebound after experiencing fluctuations, and nickel sulphate remained flat.

II. Analysis of Drivers Behind Price Divergence

In H2 2025, mainstream chemical product prices showed significant divergence: cobalt salt led the gains, lithium chemicals rebounded mildly, and nickel sulphate remained relatively stable.

First, the rapid rise in cobalt sulphate prices was driven by both the recovery in downstream ternary cathode precursor production and tightening overseas supply. From August to September, orders from leading domestic precursor manufacturers recovered noticeably, particularly with rebounding demand for high-nickel cathode materials, leading to a concentrated release of cobalt salt demand. Meanwhile, exports from some mines in Congo were affected by maintenance and customs clearance cycles, slowing the pace of intermediate raw material arrivals at ports and causing tight raw material inventories at domestic refineries. The supply-demand mismatch drove consecutive increases in spot quotations, forming an accelerated phase from early September to mid-October.

In contrast, the trend of industrial-grade lithium carbonate was more reflective of cost-side recovery. From June to August, lithium prices traded flat at low levels, mainly due to high lithium carbonate inventories and conservative production schedules at downstream battery cell manufacturers. However, after entering September, operating rates at downstream LFP production lines gradually increased, some power battery manufacturers began stockpiling in advance, and salt lake production declined slightly due to seasonal factors, leading to improved market sentiment. After a prolonged period of bottoming out, lithium prices showed signs of a mild rebound, but the lack of sustained volume support limited the overall increase.

Battery-grade nickel sulphate prices remained relatively stable, reflecting the coexistence of surplus and digestion in the midstream nickel-based precursor sector. Although high-nickel ternary cathode materials saw a marginal recovery, NEV manufacturers continued to prioritize cost reduction, and precursor producers maintained a rigid demand-based procurement pace. On the other hand, the continued commissioning of high-grade nickel matte projects in Indonesia ensured ample nickel sulphate supply, buffering cost-side pressure. Relative supply-demand balance kept nickel sulphate prices trading within a narrow range, without the concentrated upward movement seen in cobalt salt.

In summary, H2 price trends for mainstream chemicals were mainly characterized by cobalt sulphate strengthening due to tight upstream resources and concentrated demand release, lithium carbonate experiencing a mild recovery after inventory digestion, and nickel sulphate remaining stable amid ample supply.

III. Market Analysis of Scrap Lithium Battery Black Mass

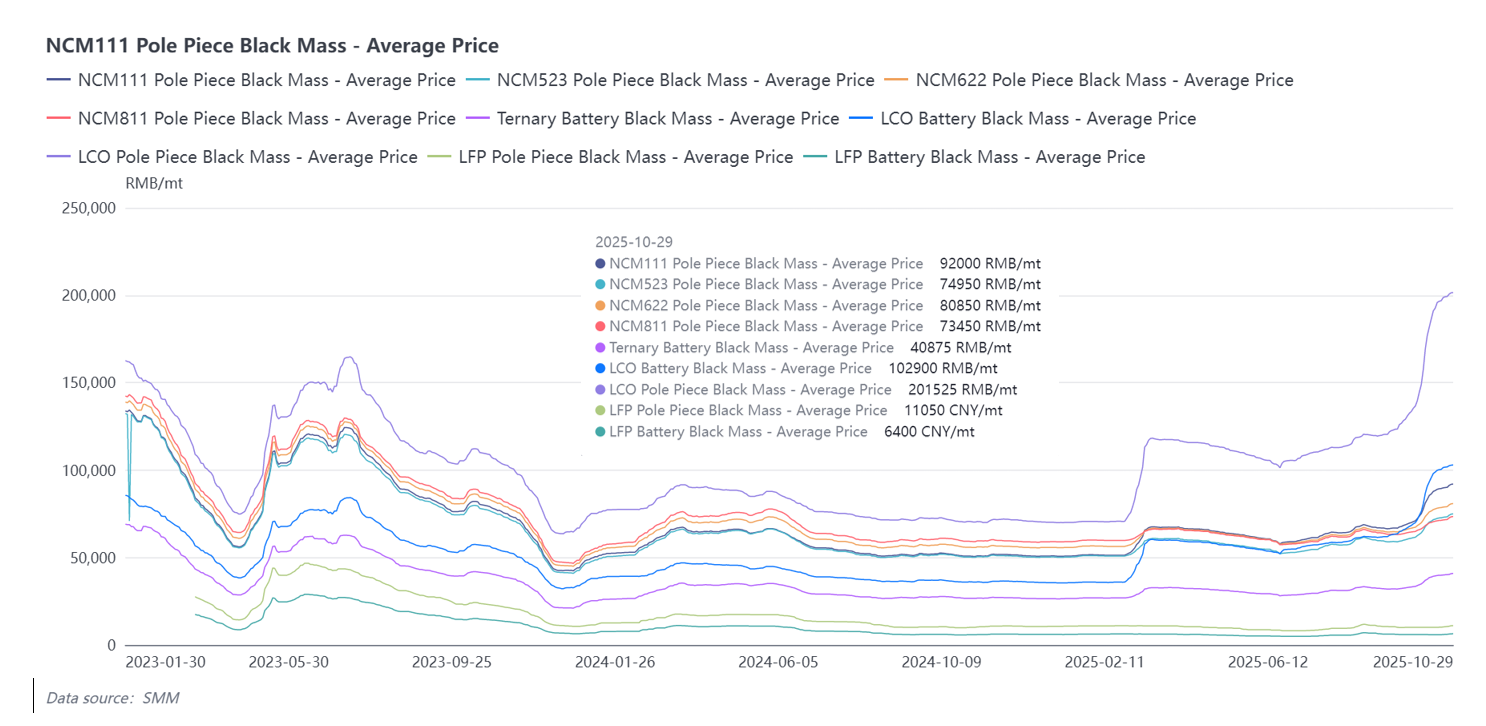

Image 2: Black Mass Price Trend

In H2 2025, the scrap lithium battery black mass market exhibited clear structural divergence. Influenced by supply-demand adjustments across the industrial chain and fluctuations in metal prices, black mass of different chemistries showed distinct trends: cobalt-based led the gains, ternary remained stable with a positive bias, and LFP moved sideways.

From the price trends in Image 2, ternary pole piece black mass of various models generally followed a mild upward trajectory in H2 2025. Among them, 111-type pole piece black mass performed relatively firmly, with prices gradually rising since August. This trend was mainly driven by tight supply of medium- and low-nickel scrap and restocking demand from downstream material plants. Some recycling enterprises reported that due to mature recycling processes and high smelting recovery rates for medium- and low-nickel systems, purchasing enthusiasm remained stable, supporting prices at relatively high levels. In contrast, 811-type pole piece black mass prices moved sideways, staying at the lower end of the ternary range. Since high-nickel scrap mainly comes from new-type batteries with shorter renewal cycles, market recycling volume is limited. Additionally, some smelters remain cautious about fluorine content and processing costs for high-nickel black mass, making it difficult for prices to gain additional support in the short term. Ternary battery black mass remained at the bottom of the full range due to low metal content in battery dismantling materials.

LCO battery black mass and pole piece black mass continued to climb since August, posting the highest gains among all systems. By month-end October, battery black mass approached 100,000 yuan/mt, while pole piece black mass exceeded the 200,000 yuan/mt mark. Although the upward momentum slowed in October, as of October 23, prices still rose about 4,000 yuan/mt WoW. The price strength was driven by both raw material costs and demand. Refined cobalt prices rose significantly at the end of Q3, supporting the recycled materials market; meanwhile, lithium carbonate prices increased from 350,000 yuan to 390,000 yuan, adding cost-side pressure. Demand side, mobile phone production rose 22% MoM in September, and the recovery in the consumer electronics market boosted LCO cathode demand. Due to long recycling cycles and high dismantling costs for used 3C batteries, limited black mass availability tightened supply-demand conditions, further sustaining the upward fluctuation in prices. LFP black mass remained generally stable in H2 2025. The two lower lines in Figure 2 represent LFP battery and pole piece black mass, both showing relatively small fluctuations. According to recent industry data, LFP pole piece black mass was quoted at approximately 2,600–2,800 yuan per point on October 16; by October 28, the average price rebounded to around 2,900 yuan per point, while battery black mass was quoted at about 2,600–2,700 yuan per point, remaining within a mild range overall. The primary reasons for price stability were ample scrap supply and a slowdown in demand. With the continued growth in retired power batteries, LFP scrap sources remained abundant, forming a stable recycling flow. The LFP system has a lower metal value content, primarily lithium, and limited sensitivity to fluctuations in upstream salt prices; even as lithium carbonate prices rose, LFP black mass prices remained stable.

Conclusion

Overall, price fluctuations in mainstream battery raw material salts have a significant transmission effect on black mass market trends. Currently, LCO black mass performs most prominently, supported by the recovery in refined cobalt and the consumer electronics market, with continued upside room for prices. Ternary black mass remains relatively stable and is expected to enter a phase of slowdown. In contrast, LFP, affected by the rapid growth in retired power batteries, is gradually facing supply-side pressure and may encounter oversupply in the future.