Nickel Ore

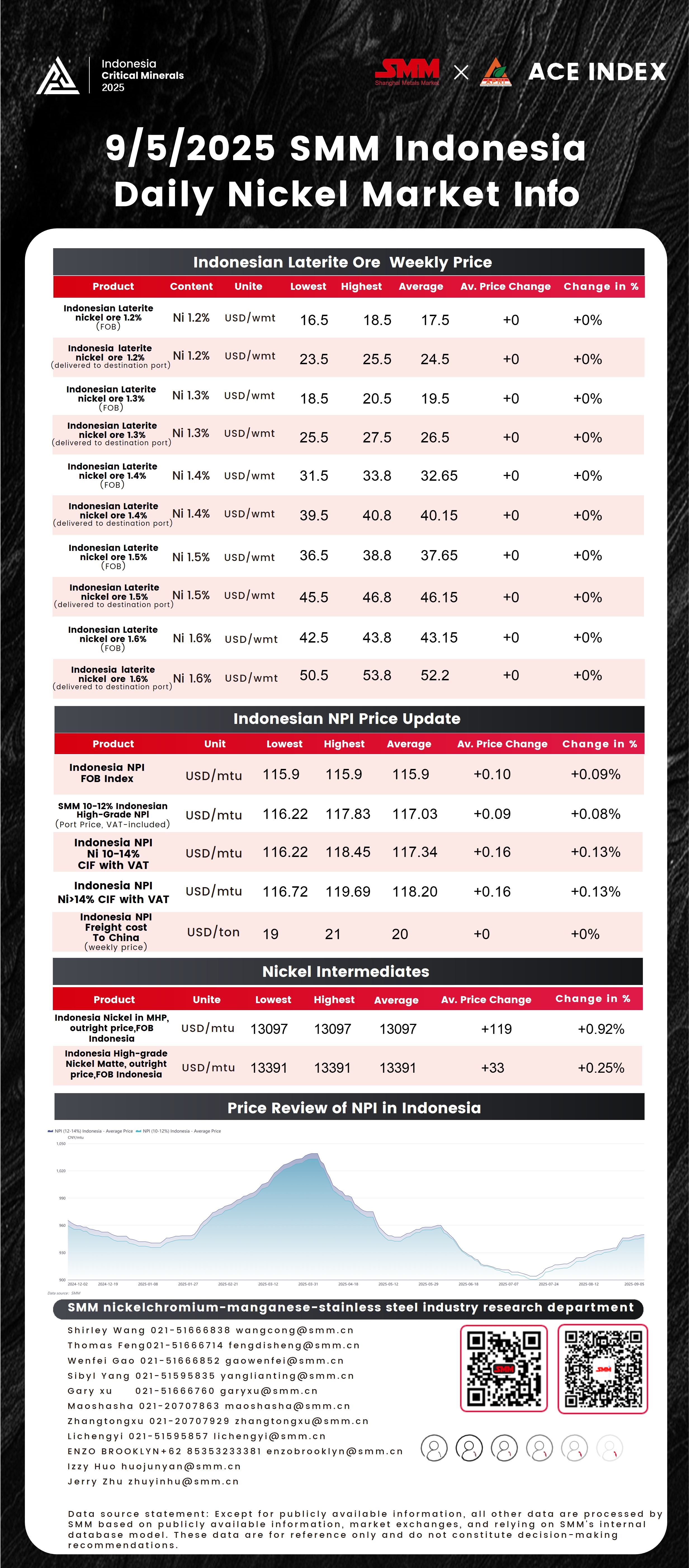

Indonesian nickel ore prices remained stable this week. For the first period of September, domestic benchmark price of Indonesian nickel ore is USD 14,900/dry metric ton. For premiums, according to SMM data on Indonesian domestic laterite nickel ore, 1.4% grade averaged USD 22.2, 1.5% grade averaged USD25.2, and 1.6% grade averaged USD25.7. Variations in premiums are primarily driven by penalties and bonuses applied by some smelters based on ore grade. However, the mainstream ore grades traded in the market are mainly concentrated at 1.5% and 1.6%. This week, SMM domestic laterite nickel ore 1.6% delivered to works price ranged from USD 50.5–53.8/wet ton, unchanged from last week. For lower-grade ores, the SMM domestic laterite nickel ore 1.3% delivered to works price remained stable at USD 25.5–27.5/wet ton, unchanged from last week.

- Pyrometallurgical Ore:

On the supply side, Sulawesi has generally shifted to dry season in the first week of September, with only occasional light rainfall in certain areas. Weather conditions in Halmahera also improved compared with last week. This indicates that the impact of the rainy season across most mining areas has gradually eased, potentially releasing more ore supply into the market. On the quota side, revisions to RKABs for major miners have largely been approved and are close to completion. Overall, Indonesia’s nickel ore supply is expected to increase in the coming weeks. On the demand side, procurement activity in the nickel ore market has shown a slight increase over the past month. Meanwhile, prices of Indonesian NPI have continued to rise, leading to a rebound in production at some smelters this week. In September, the new regulation shortening the RKAB approval period from three years to one year is expected to be released. This may lead smelters to anticipate potential ore scarcity in the future, thereby supporting ore prices at a steady level. Looking ahead to next week, with sufficient RKAB quotas and improving weather conditions in major mining regions, Indonesian saprolite ore prices are likely to face downward pressure. Mainstream premiums are expected to remain stable in the short term.

- Hydrometallurgical Ore:

As weather conditions in key mining regions continue to improve, supply is approaching in an oversupply level. On the demand side, although some HPAL smelters plan to increase production, the increase is expected to be limited and remain insufficient to lift prices. At the same time, the forthcoming RKAB revisions will further boost limonite supply, while some smelters maintain steady procurement due to sufficient raw material stockpiles. Given these circumstances, hydrometallurgical ore prices are highly likely to decline over the coming weeks.

Nickel Pig Iron

“Cost Support and Demand Recovery Drive High-Nickel Pig Iron Prices Higher”

High-Nickel Pig Iron Prices Rise on Cost Support and Demand Recovery The average price of SMM 10–12% high-nickel pig iron (ex-works, tax included) increased by RMB 6.5/Ni unit from last week to RMB 943.6/Ni unit. Meanwhile, the Indonesian NPI FOB index rose by USD 0.88 per nickel unit from last week to USD 115.72/Ni unit. Entering the traditional peak season, combined with market gains driven by expectations of U.S. Federal Reserve interest rate cuts, high-nickel pig iron prices have also moved higher, mainly supported by firm production costs and a seasonal recovery in demand. Although smelters remain under cost pressure with margins still inverted, stronger expectations during the peak season have driven both market offers and transactions upward. On the demand side, downstream stainless steel consumption has improved, with inventories continuing to decline, boosting market confidence. While seasonal demand is expected to keep supporting prices, some downstream buyers show limited acceptance of higher levels, and earlier low-priced cargoes remain in circulation, suggesting a slower upward trend ahead.

Expectations of U.S. Federal Reserve rate cuts continue to provide upward momentum for refined nickel, while NPI is likely to gain at a steadier pace, potentially widening the discount further. Converting NPI into high-grade nickel matte remains incentivized, with current margins for producing nickel sulfate from imported matte proving more attractive. Although smelters’ cash costs remain firm, supported by stable ore and auxiliary input prices, improved NPI grades have slightly eased costs. Looking ahead to next week, auxiliary material prices are expected to remain stable, while Indonesian nickel ore prices may see a slight decline. With expectations of rising high-nickel pig iron prices, smelters’ profit margins are projected to improve marginally.