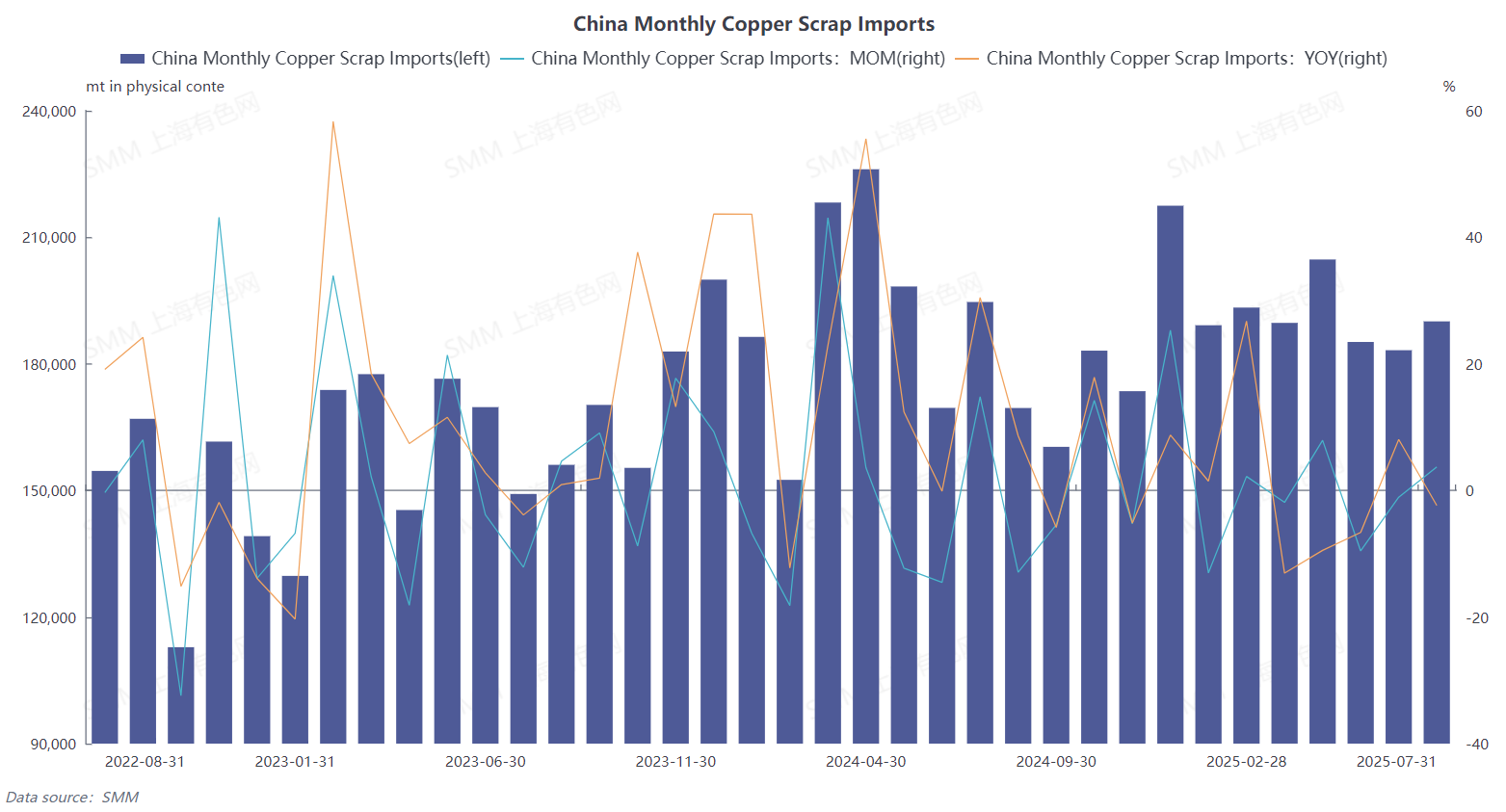

According to the latest data from the General Administration of Customs, China's imports of copper scrap and shredded copper scrap reached 190,100 mt in physical content in July 2025, up 3.73% MoM and down 2.36% YoY. From a cumulative perspective for January-July, imports amounted to 1.3355 million mt, down 0.77% YoY (HS code 74040000). Despite the traditional off-season and the persistent inverted import prices, July imports increased instead of decreasing, once again demonstrating unexpected resilience.

SMM believes that the main reasons for maintaining high import volumes in July are as follows:

1. Strong support from robust rigid demand by domestic smelters: The tight supply situation of domestic copper concentrates has not changed, with spot TCs remaining at low levels. To maintain production, smelters' dependence on recycled copper raw materials, a key supplementary material, remains high, providing a fundamental support for import volumes.

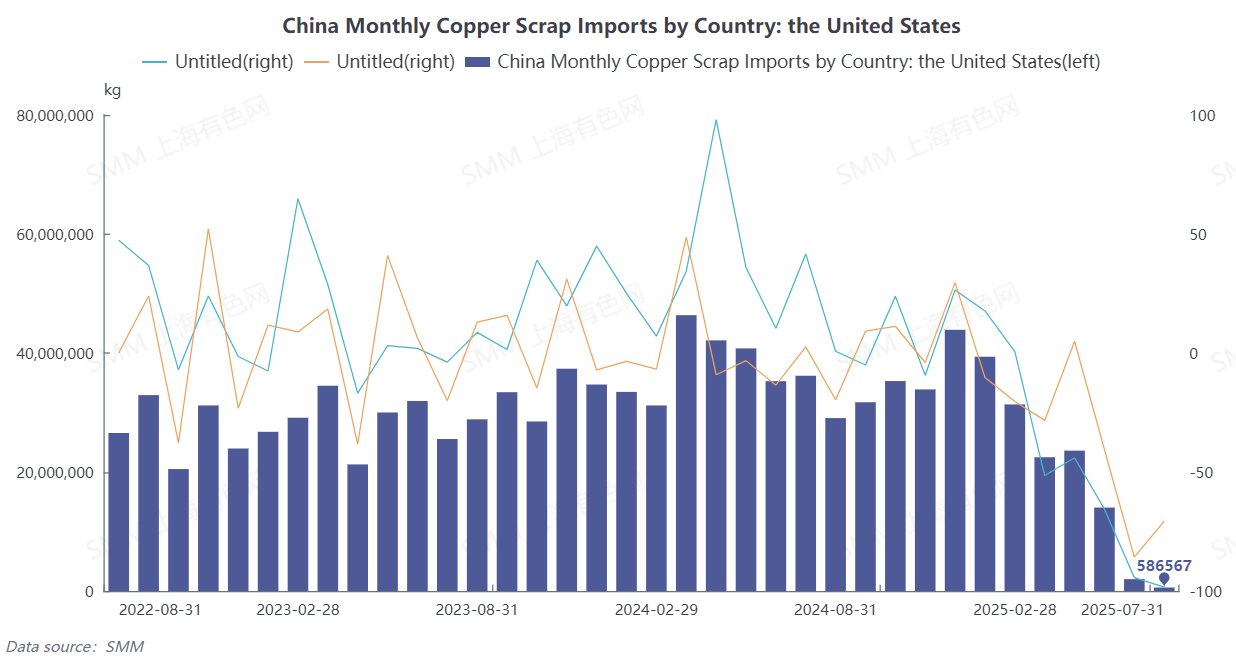

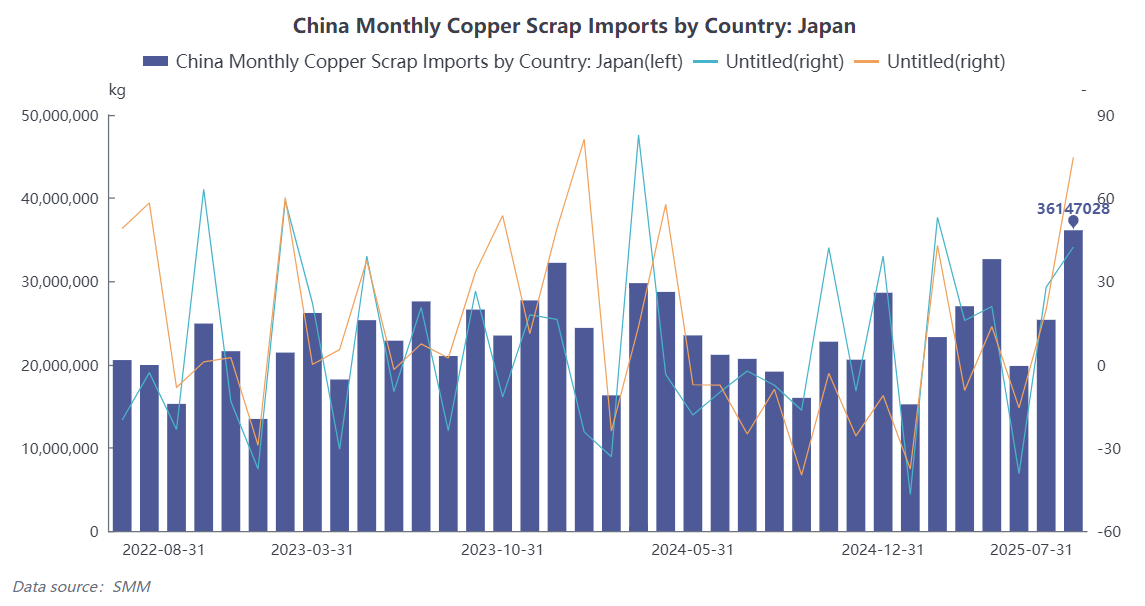

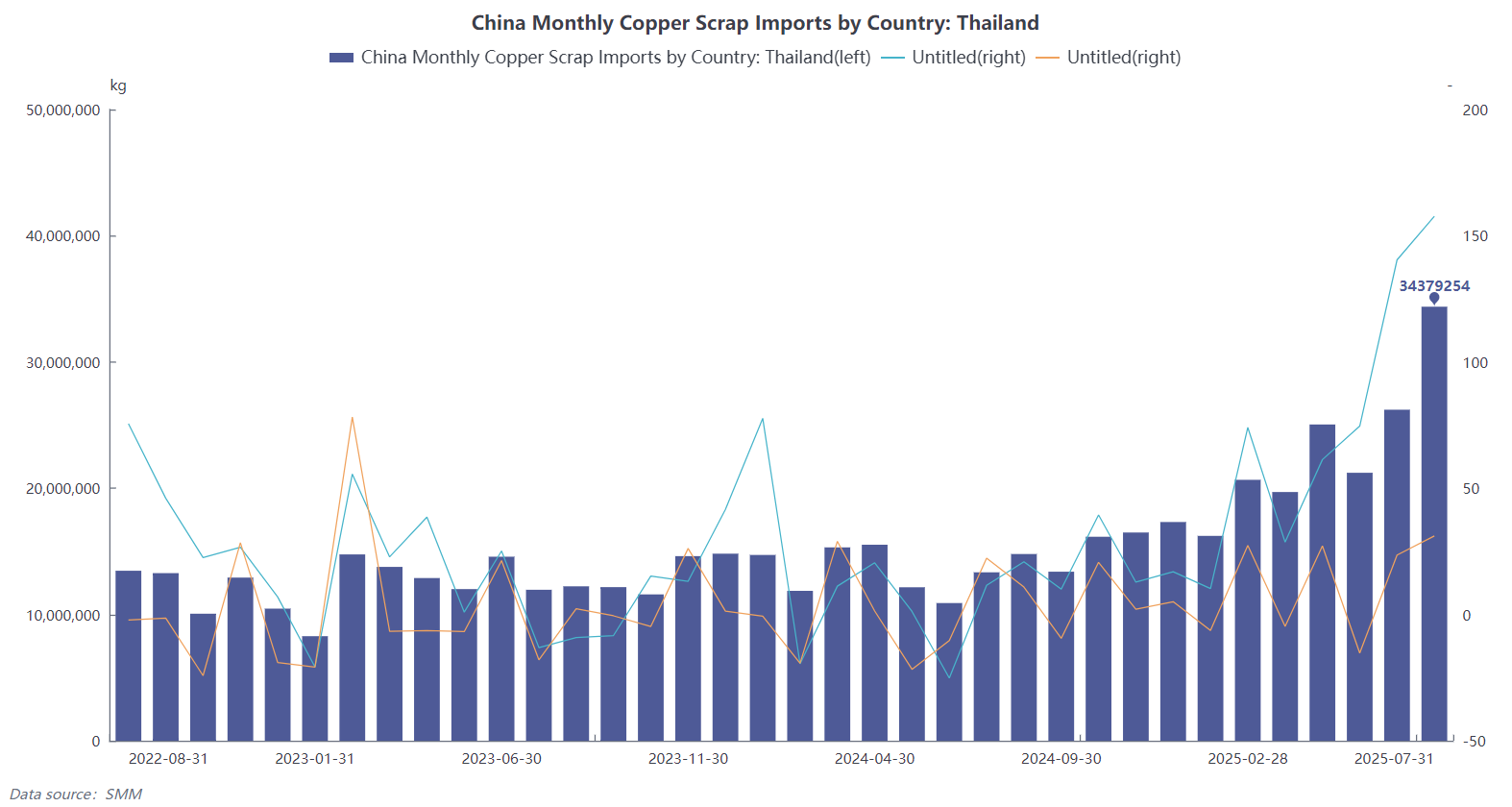

2. Ongoing deepening of diversified import sources: Imports from major alternative sources such as Japan and Thailand remained high and continued to grow, effectively offsetting the near-zero impact of US supplies. The "de-Americanization" restructuring of the global recycled copper supply chain is still ongoing, forming a new pattern with relatively stable total volume but significantly adjusted flows.

3. Concentrated arrival of previous orders: A brief improvement in the SHFE/LME price ratio previously stimulated the generation of some forward orders, which were concentrated in customs clearance in July, supporting the MoM growth in import data.

Specifically, in July 2025, Japan's exports to China maintained strong momentum, ranking among the top import sources. Exports of copper scrap and shredded copper scrap to China reached 36,100 mt, up 42.4% MoM and surging 74.69% YoY, accounting for 19.02% of China's total imports, surpassing Thailand to take the lead. Thailand became the second-largest importer of recycled copper raw materials, with July imports reaching 34,400 mt in physical content, accounting for 18.09%, up 31.11% MoM and soaring 157.72% YoY. Additionally, South Korea, Spain, and Malaysia also ranked among the top import sources, reflecting the increasingly diversified new normal of China's recycled copper raw material supply. Meanwhile, US supplies further faded from the Chinese market, with the import share dropping to an extremely low level of 0.31% in July, and the market gap left by the US continues to be filled by other regions. However, the actual situation of tight supply in the market has not been alleviated by stable import data. According to SMM, the recycled copper raw materials market is still facing severe challenges: US supplies have almost disappeared, and due to the impact of US tariff policies, there are virtually no quotes for US supplies; the domestic spot market has a limited circulation of goods, and suppliers generally choose to refuse to budge on prices under cost support. At the same time, under the expectation of the latest policy adjustments in the domestic recycled copper industry, production enterprises (such as those producing recycled rods) want to lower the price of recycled copper raw materials, which is expected to cause a temporary shortage of domestic supplies.

Looking ahead, SMM believes that in the coming months, the imports of recycled copper raw materials in China will continue to fluctuate at highs with structural optimization.

1. Smelter stockpiling demand: As Q4 approaches, to meet annual production targets, domestic smelters, under the pressure of high copper concentrate prices, are expected to see an increase in their procurement demand for recycled copper raw materials and may start stockpiling in advance.

2. Southeast Asian transit supply gradually taking shape: The chain of US recycled copper being processed in Thailand, Malaysia, and other Southeast Asian countries before being exported to China is gradually forming scale and becoming routine.

3. Rigid demand providing a floor: With the ongoing tightness in copper concentrates, the rigid demand from domestic smelters for recycled copper raw materials will provide a floor for imports. Additionally, under the influence of policy adjustments in the recycled copper industry, it is expected that future domestic producers of recycled copper raw materials will prefer to purchase raw materials with 13% VAT, further providing a floor.

Overall, in July 2025, China's imports of recycled copper raw materials once again showed resilience against the backdrop of the off-season. It is expected that in the short term, there will be no significant growth in imports, but the probability of a cliff-like decline is also low, and imports are expected to hover at highs. In the long run, the restructuring of the global recycled copper supply chain has become a certainty, and the diversification of China's import sources and the importance of the "Southeast Asian transit" model will increasingly stand out. Future attention should be paid to whether the import profit window can open, overseas policy trends, and the actual recovery of downstream consumption in China. However, at present, SMM believes that although the overall imports of recycled copper raw materials are expected to remain high in the coming months, the growth is mainly driven by the demand from smelters. The import structure may diverge: imports of copper wire nodules needed for smelting are expected to continue increasing, while categories such as bare bright copper may decrease, maintaining a dynamic balance in total import volume.

Therefore, with the import scale expected to remain stable, as the off-season gradually ends and downstream demand recovers, coupled with the anticipated adjustment of VAT policies on recycled copper raw materials, which is expected to encourage companies to increase their purchase willingness for raw materials subject to a 13% tax rate, it is expected to lead to an increase in the imports of recycled copper raw materials. Domestic supply increments of recycled copper raw materials will be limited, and the situation of tight spot market supply is expected to persist.