SMM July 11 News:

In H1 2025, the phosphorus chemical industry experienced significant price fluctuations and capacity adjustments, primarily influenced by global economic conditions, raw material supply, and growing new energy demand. Demand side, phosphorus resource consumption in the new energy sector continued to increase. The application of phosphoric acid and industrial-grade MAP in the LFP cathode material industry, as well as yellow phosphorus in LiPF6 (the main electrolyte raw material), saw substantially higher usage volumes compared to the same period last year.

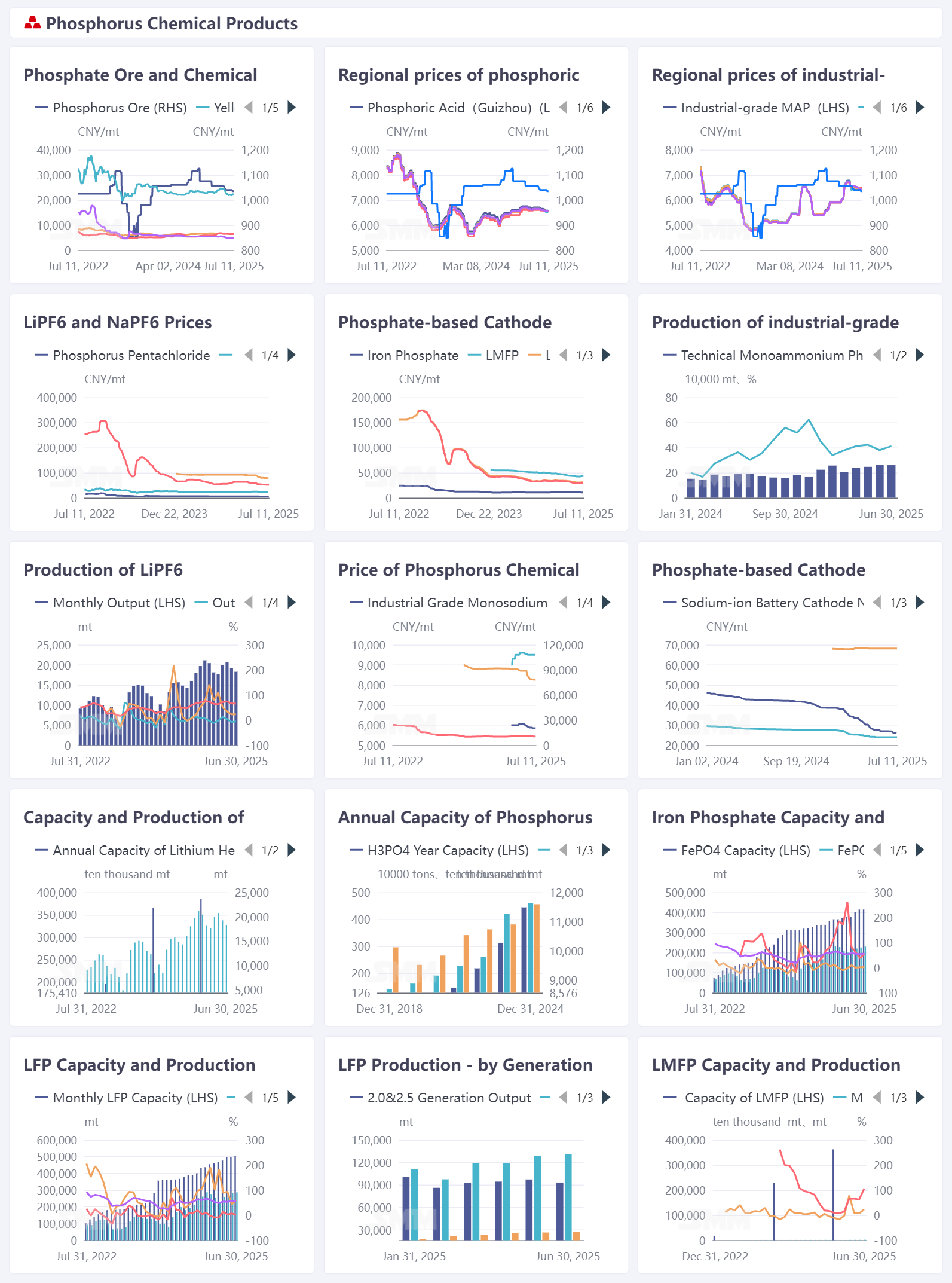

I. Price Review of Phosphorus Chemical Products

In H1 2025, phosphorus chemical product prices showed divergent trends. Phosphate ore and phosphoric acid prices fluctuated across regions, reflecting regional supply-demand disparities. Industrial-grade MAP price movements were affected by downstream demand and costs, exhibiting some volatility. Prices of products like LiPF6 adjusted with market supply-demand patterns, generally seeking balance within the industry cycle, demonstrating the transmission effects of the new energy industry chain.

Phosphate ore: Prices initially rose then declined. Early-year prices were high due to tight supply but later pulled back as demand weakened. Phosphate ore prices are expected to remain elevated throughout the year, with miners enjoying robust profits.

Phosphoric acid: Regional price differences were pronounced, with overall prices stabilizing with a slight downward trend in H1. Industrial-grade MAP prices exhibited seasonal fluctuations influenced by the agricultural flush fertilizer sector, peaking in March-April and stabilizing with a downward trend in May-June.

II. Capacity Under Supply-Demand Dynamics

Capacity side, annual phosphorus resource capacity and segment-specific capacities like LFP continued expanding, with companies actively deploying production facilities, gradually realizing industry scale effects. Production data showed phased variations in output for products like LiPF6 and LFP, closely linked to downstream new energy demand (e.g., power batteries, ESS), with output rising during peak demand seasons while also being affected by raw material supply and production scheduling.

The phosphorus chemical industry is deeply integrated with the lithium battery industry chain, supporting lithium battery material systems from phosphorus-based cathode materials to electrolytes like LiPF6. Shifts in the consumption share of products like industrial-grade MAP in the new energy sector reflect the growing boost from the new energy industry to phosphorus chemicals, while fluctuations in phosphorus chemical raw material prices inversely impact lithium battery material costs and market competition patterns. III. Outlook for the Second Half of 2025

In the first half of 2025, the market for phosphorus chemical products experienced price fluctuations and changes in demand, but maintained an overall growth trend.

In the short term, attention should be paid to the boost in demand for phosphorus chemical products in the second half of 2025 (H2) driven by the peak season for downstream new energy applications (such as the peak season for NEV production and sales, and the concentrated construction of energy storage projects), as well as the price and profit changes brought about by intensified market competition following capacity release.

In the long term, with the continuous development of the new energy industry, the demand for high-energy-density and high-safety phosphorus-based lithium battery materials is expected to grow. Phosphorus chemical enterprises need to focus on technological R&D (such as optimizing the performance of phosphorus-based cathode materials) and industry chain collaboration (stabilizing upstream and downstream supplies) to adapt to the upgrading of the new energy industry. At the same time, they also need to address challenges such as overcapacity and stricter environmental protection requirements to achieve sustainable development.