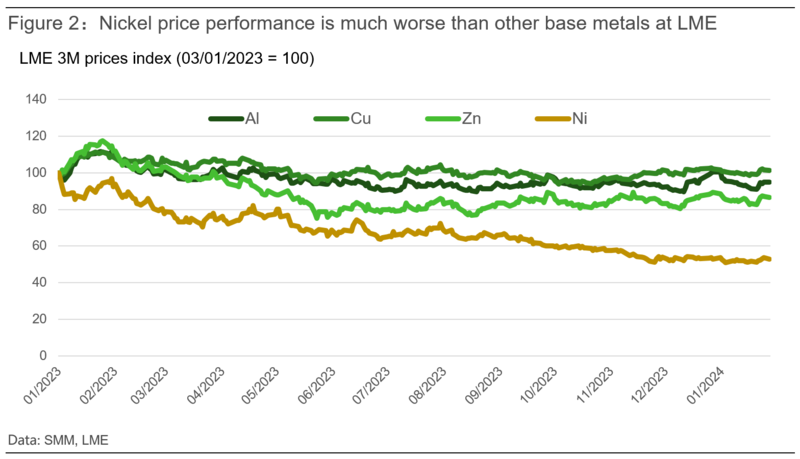

As the nickel price at LME market has significantly decreased by nearly half over the last 13 months, global nickel producers are facing huge challenges now. Most recently, Wyloo Metals and BHP in Australia announced to shut down some capacity due to the falling prices, respectively. Although weak demand is one of problems, many market participants believe the booming of Indonesian nickel industry is the key driver for oversupply.

Advantages of Indonesian nickel industry

Since 1 January 2020, the government of Indonesia has officially implemented a policy to ban the export of nickel ore. With policies carried on with consistent supervision, Indonesia's nickel ore exports have fallen drastically. In 2019, nickel ore exports from Indonesia were 32.4 million tonnes, however, in 2020 there were only 1,405 tonnes. At that time, Indonesian nickel mines were pressed to find overseas investors with funds and technologies to build nickel processing plants. Compared to the cautious western investors, only Chinese companies would like to invest huge capital to support Indonesia develop nickel industry. At the same time, the Indonesian government also issued policies to support new projects, for example a tax holiday of 15 years from the start of commercial production. Under many supportive policies, seeing the strong nickel demand prospective from the lithium-ion battery industry and the success of the first nickel processing project from Tsingshan, many other Chinese investors rush into this nickel-rich country.

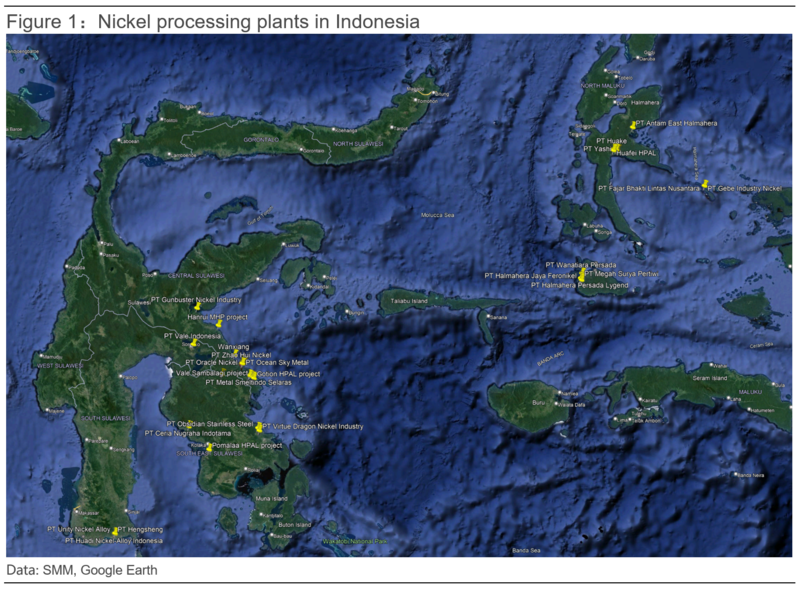

Hugh nickel reserve is the other advantage of Indonesian nickel industry. As Meidy Katrin from Indonesian Nickel Miners Association (APNI) pointed out during her presentation at SMM 2023 Lithium-ion Battery Europe conference in Hungary, the nickel reserves and resources in Indonesia was 55.1 million Ni metal tonnes and 174.2 million Ni metal tonnes respectively in 2022. Abundant nickel reserves supply a solid foundation for developing the nickel downstream. As the main reserves are in Sulawesi Island, Halmahera Island, and Obi Island, the main nickel processing plants or projects are located in these three islands, as shown in the figure 1.

In order to efficiently process limonite and saprolite from the nearby nickel mines, the Chinese investors have further developed or implemented different technologies, like High Pressure Acid Leach (HPAL), Rotary Kiln Electric Furnace (RKEF) and Oxygen-Enriched Side-Blown Furnace (OESBF). Many companies that have different process routes are able to adopt the most efficient way to produce MHP, NPI, nickel matte according to the different nickel ores and market dynamics, which can improve their cost efficiency. The secured nickel ore supply also allows investors to build plants with bigger capacity to gain the scale advantage, compared to other producers in the world.

As local governments in Southeast Asia are keen to develop lithium-ion battery and EV industries, Nickel companies in Indonesia could supply nickel sulphate, cobalt sulphate, even battery precursor and lithium-ion battery in the future. The advantage of integrated production chain, including investors’ facilities in China, fortifies their ability to withstand the fluctuation in nickel prices.

Consequences of the booming Indonesian nickel industry

Since 2023, the nickel price has significantly fallen at LME market, as shown in the figure 2. Although all base metals prices are under weaker demand pressure, unlike other metals, nickel also suffers from strong increase in the supply side, mainly from Indonesia, which is a main driver for decreasing prices at LME market.

As a consequence of falling nickel prices, the Australian mining company, Wyloo Metals announced it will place the Cassini, Long and Durkin nickel mines under care and maintenance from June this year. After that, BHP announced that it will pause part of its Kambalda processing operations in Western Australia, as Wyloo is a major supplier to BHP’s nickel concentrator in Kambalda. Currently the French authorities are seeking an agreement to save New Caledonia's nickel processing plants partly owned by Eramet, Glencore and Trafigura, which could cost 1.6 billion USD. Compared to NPI producers in China, Indonesian NPI producers have cost advantages, which has forced NPI producers to shut down some capacity in recent years. SMM estimates that China produced 388.9kt NPI (Ni metal) in 2023, down by 5.2% y/y. At the same period, Indonesia contributed 1375.8kt NPI (Ni metal), up by 20% y/y.

Due to the geopolitical issue and critical minerals supply policies that many governments have published, the automatic adjustment capability to cope with oversupply in the global nickel market doesn’t work well as before. The changes in nickel processing routes allow producers to easily shift from one nickel product to another, which make emerging nickel companies with whole value chain are more adaptable to different market condition. In 2023, three refined nickel producers with total 79.1kt capacity applied for LME brand registration, which is the one measure for these producers to complete their nickel product mix. Until now, two brands have been approved, the other two brands are expected to be approved in 2024. If the market cannot see enough output curtailments, the nickel price could remain under pressure for longer time than expected.

Another consequence of increasing nickel supply from Indonesia is weak cobalt prices in the global market. Currently total 265kt HPAL capacity (Ni metal) is under operation in Indonesia. SMM estimates that these HPAL plants produced around 20kt cobalt in form of mixed hydroxide precipitate (MHP) in 2023. There are 17 HPAL projects with 1.09 million tonnes capacity (Ni metal) in the pipeline in Indonesia. Although some of them may not be built on time under the current market situation, we still see substantial cobalt output as by-product from these HPAL projects in the next few years.

As general elections in Indonesia are scheduled to be held on 14 February 2024 to elect the President, Vice President and People's Consultative Assembly (MPR). SMM doesn’t expect the next government will significantly change the current policies on the nickel industry. Some new policies might be issued to further develop the nickel value chain, reduce the low value-added product exports, and improve the ESG performance of the local nickel industry. As the country holding the largest nickel resources in the world, Indonesia will continue to play a key role in the global market, especially during the energy transition.