At the SMM LME LONDON EVENT held during LME WEEK, Wu Ming, head of metals and commodities at PRC Macro, expressed her views on the impact of Chinese real estate on global metal demand.

China’s real estate slowdown: knowns and unknowns

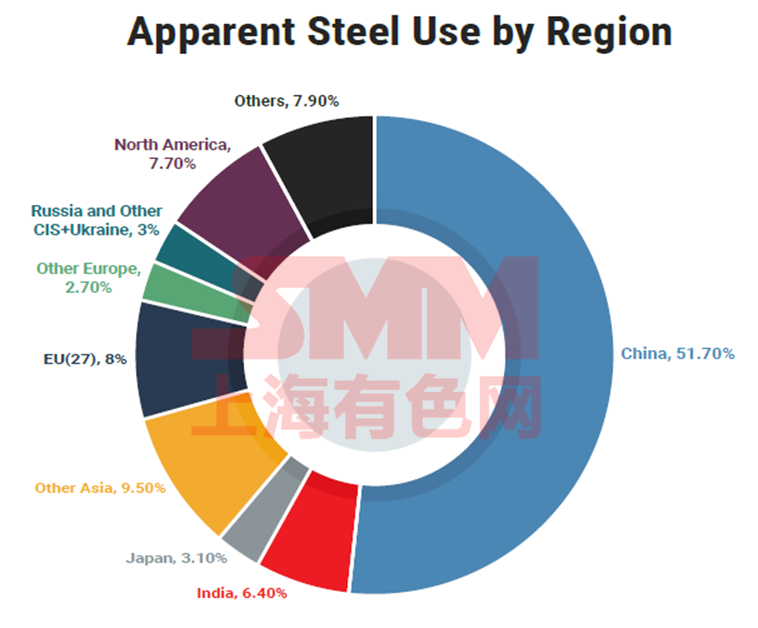

A slowdown in China's property market has weakened global metals demand as the industry accounts for about 20% of global steel demand, about 18% of aluminium demand and about 6% of copper demand. This is expected to lead to overcapacity and oversupply.

The Mystery of Steel

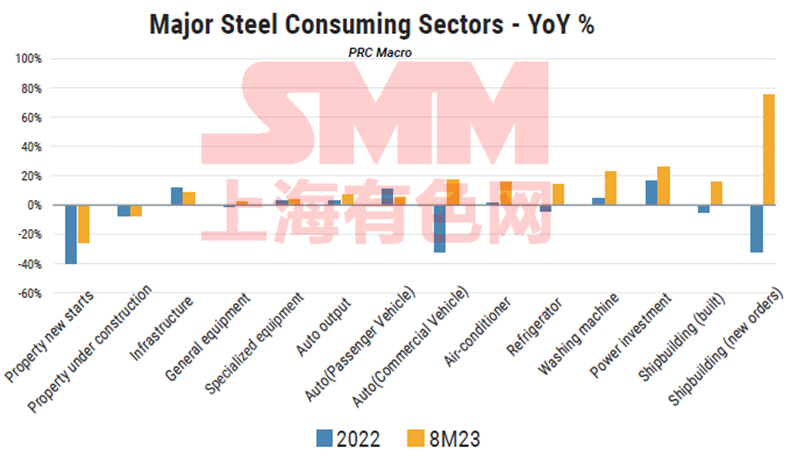

In theory, steel and iron ore demand should collapse as housing starts and construction weaken, but actual demand for steel this year has exceeded market expectations.

New driving forces: energy transformation, manufacturing upgrade

Chinese manufacturers hold a leading position in the global value chain and are capable of providing more high value-added products. China's energy transition not only boosts infrastructure and domestic consumption, but also enhances the competitiveness of Chinese manufacturers.

ODI boosts steel demand thanks to Belt and Road initiative

Strong exports consumed about 8% of steel production , largely counteracting the impact of the real estate slowdown.

The surge in exports to the Middle East was driven by a strong rebound in policy-supported RMB overseas direct investment (ODI).

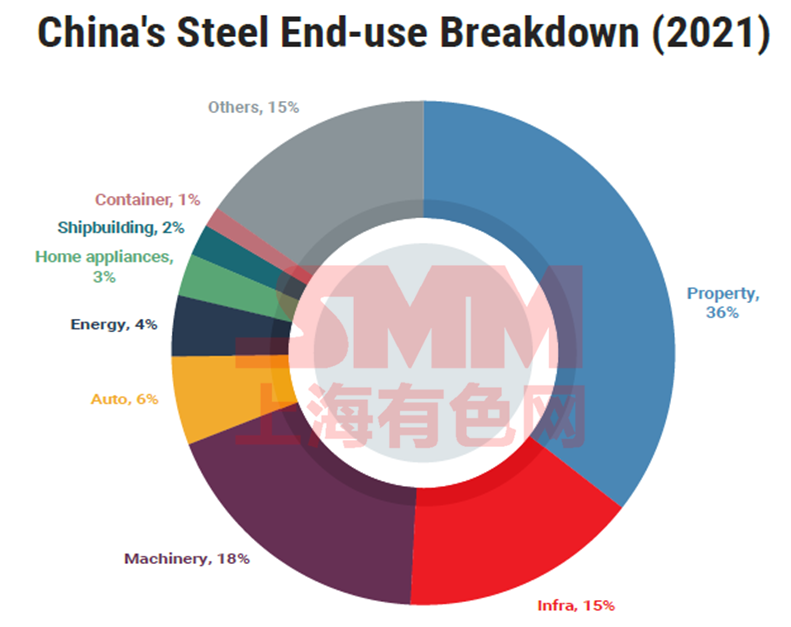

Structural changes in China’s steel market

Manufacturing upgrades, energy transformation and overseas demand have led to changes in the structure of China's steel market, with flat steel gaining more share.

Chinese steel mills are working to reduce risks posed by the property market, and industry policy guidance will reinforce this trend.

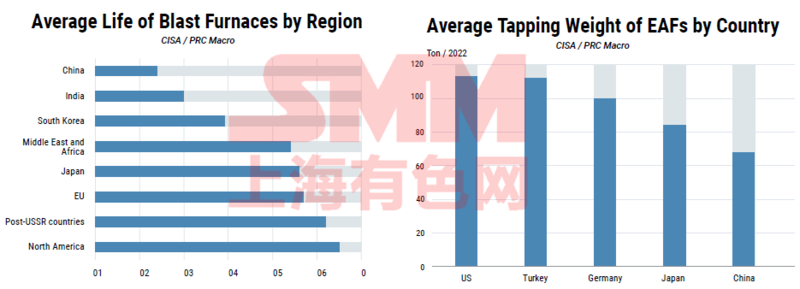

Chinese steel mills

The average service life of BF-BOF assets in China is only about 14 years, compared with more than 40 years elsewhere, making it difficult for Chinese steel mills to scrap them in a short period of time. At the same time, the current capacity of electric arc furnaces is too small to produce flat steel.

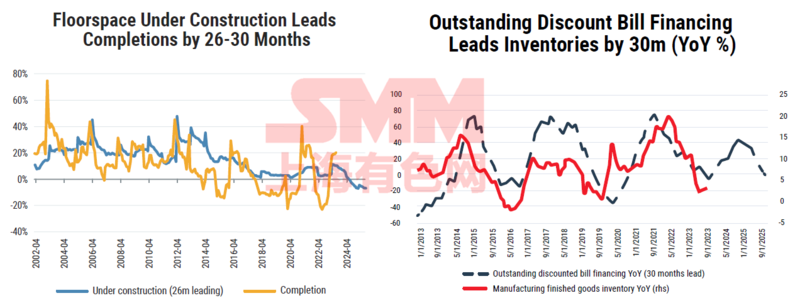

Copper and aluminium: Still have support in the near term

Completion of real estate will maintain growth until at least the second quarter of 2024.

Manufacturing stockpiling may begin in the fourth quarter of 2023, driven by energy investment, manufacturing upgrades and real estate completions.

Conclusion

•Global metal producers and metal demand are reducing the risk of China's real estate crisis. China's energy transformation, manufacturing upgrades, and strong exports driven by ODI in the Belt and Road initiative countries are becoming new driving forces for metal consumption.

•These new drivers have led to structural changes in China's steel market, with the share of flat steel rising steadily.

•This structural change on the demand side, coupled with China's supply structure, makes iron ore demand more resilient.

•China's property completion and restocking cycle will continue to support aluminium and copper demand in the short term.