SHANGHAI, Apr 29 (SMM) - This is a roundup of China's metals weekly inventory as of April 29.

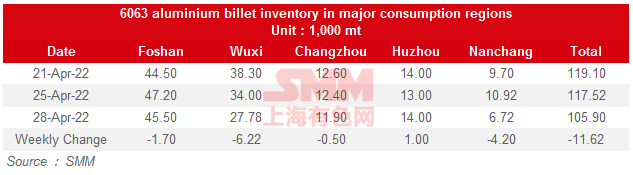

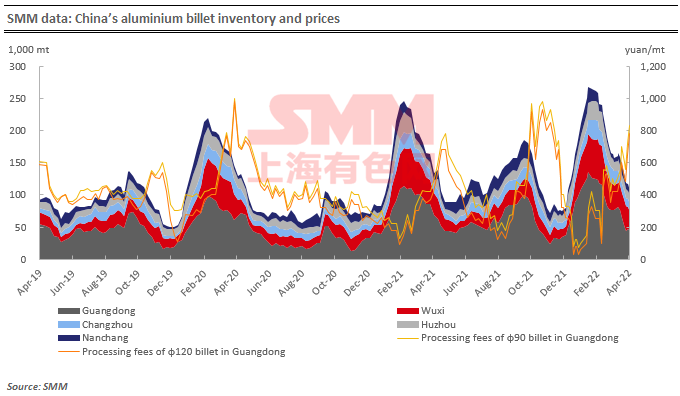

Aluminium Billet Inventory Declined 11,600 mt on Week

The domestic aluminium billet inventory stood at 105,900 mt as of April 28, a drop of 9.88% from a week ago. The inventory changes across each of the five major regions were as follows: Nanchang (-4,200 mt or 38.46%); Changzhou (-500 mt or 4.03%); Foshan (-1,700 mt or 3.6%); Wuxi (-6,200 mt or 18.28%); Huzhou (+1,000 mt or 7.69%).

Transportation efficiency in Wuxi picked up slightly, and local downstream producers restocked as needed ahead of the upcoming Labour Day holiday. Downstream consumption was sluggish in Foshan, causing the local inventory to fall at a slower pace.

Transportation and downstream purchases in east China were still hindered by the pandemic. Overall, the social inventories are expected to decline further after the holiday due to downstream restocking.

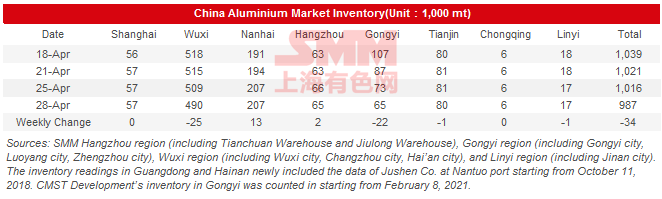

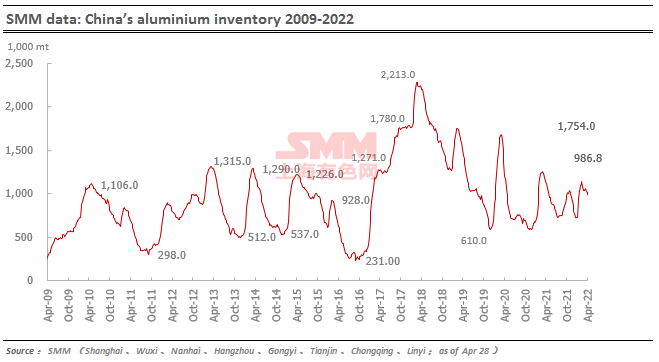

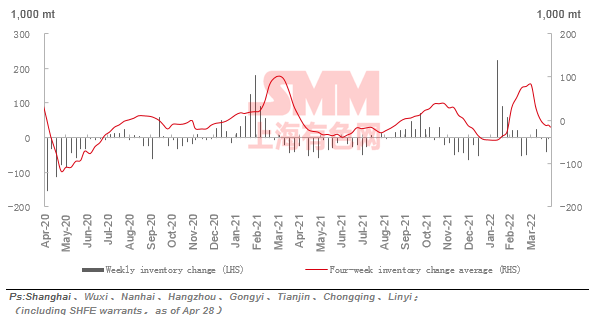

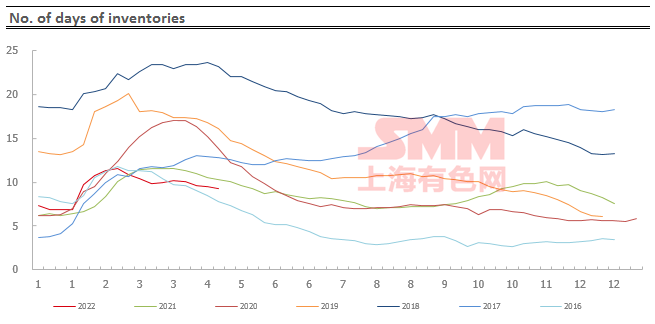

Inventory of Aluminium Fell by 34,000 mt on Week

According to SMM statistics, social inventory of aluminium across China stood at 987,000 mt, a decrease by 34,000 mt from April 21, down 11% or 128,000 mt from a year ago. Inventory of aluminium hovered at a low level and continued to decline. By regions, the delivery from Wuxi gradually recovered with a decrease by 25,000 mt in weekly stocks. The shipments from Wuxi were mainly delivered to the surrounding areas. Some goods were transferred to Gongyi with low volume due to tight truck transportation capacity and restricted cross-province transport. While the shipments from Gongyi were smooth, but the arrivals reduced because of transport restrictions, leading to a continuous decline in inventory, with inventory dropping by 22,000 mt to 65,000 mt compared with April 21. In Nanhai, inventory increased by 13,000 mt from April 21 due to the increase in arrivals and the low demand in downstream. Inventory remained flat in Hangzhou and Tianjin.

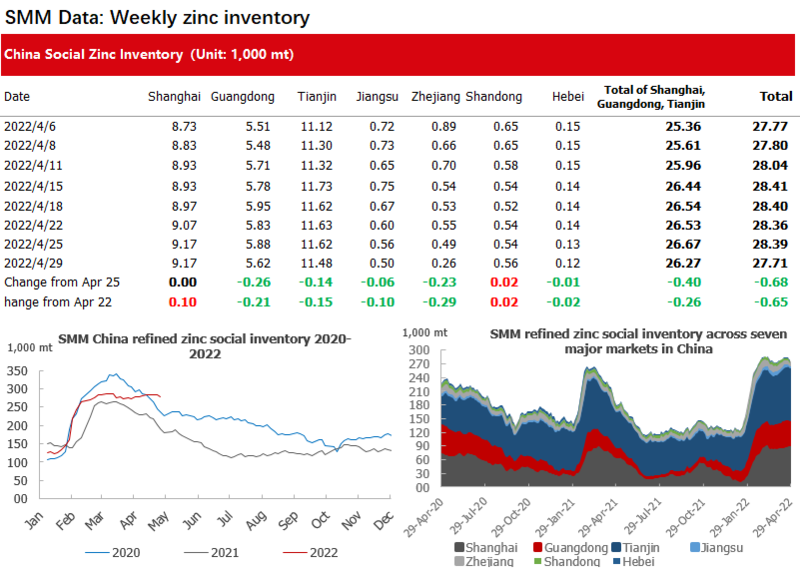

Inventory of Zinc Ingots Fell by 6,500 mt on Week

Total zinc ingots inventories across seven major markets in China stood at 277,100 mt as of Friday April 29, down 6,500 mt from April 22, down 6,800 mt from April 25.

Domestic inventory of zinc decreased sharply this week. In Shanghai, the lockdown has not been lifted. Although goods could be picked up with permit, no delivery has been seen and inventory in Shanghai continued to increase. In Tianjin, the arrivals increased and it has been heard that there were about 50,000 mt of zinc ingots to be exported at Tianjin port. Therefore, the inventory in Tianjin decreased sharply this week due to the rising export demand and the restocking demand of downstream before the Labour Day holiday. In Guangdong, the arrivals decreased compared to last week. The inventory in Guangdong decreased because of the rising exports and the restocking of downstream for the Labour Day holiday, while some traders received zinc ingots for export. In Zhejiang, the decrease in inventory was mostly contributed by the downstream demand for the Labour Day holiday. Inventories in Shanghai, Guangdong and Tianjin dropped 2,600 mt, and inventories across seven markets decreased 6,500 mt.

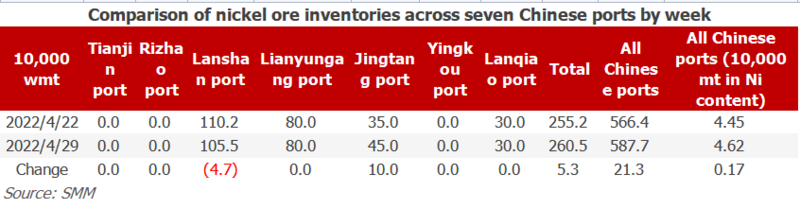

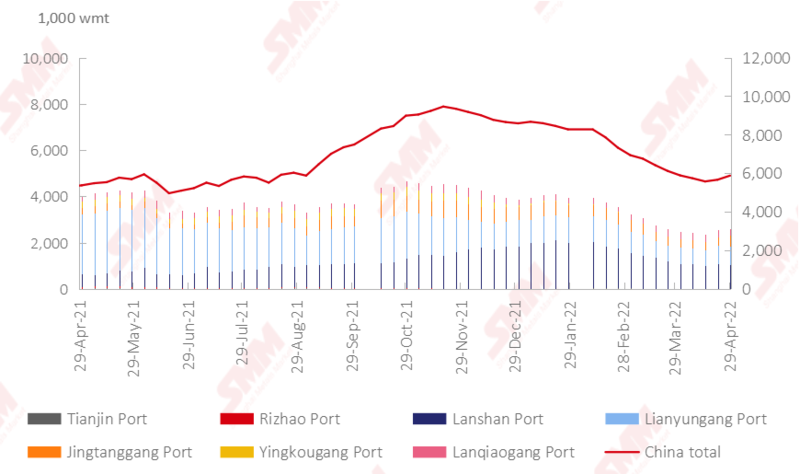

Nickel Ore Inventories at Chinese Ports up 213,000 wmt on Week

As of April 29, the nickel ore inventory at Chinese ports increased 213,000 wmt from last week to 5.877 million wmt. Total Ni content stood at 46,200 mt. The total inventory at seven major ports across China stood at 2.605 million wmt, 53,000 wmt higher than the previous week. Port inventory of nickel ore increased gradually. Shipment from major mining areas of the Philippines rose sharply as the rainy season passed. Accordingly, the supply will be sufficient. It is expected that the shipment will return to the peak season level after May. NPI plants’ demand for nickel ore was dragged down by the uncertainty of the later trend of the NPI market In addition, the transportation problem aroused by the pandemic slowed down the consumption of port inventory of nickel ore. In the short term, it is expected that the port inventory of nickel ore and the increase in inventory will gradually increase.

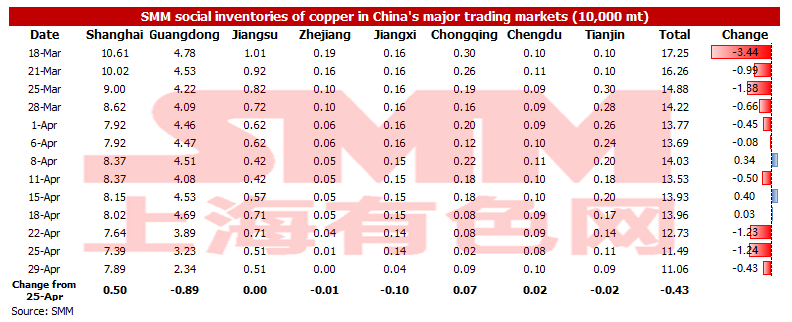

Copper Inventory in Major Chinese Markets Fell 4,300 mt on Week

As of April 29, copper inventory across major Chinese markets dropped 4,300 mt from Monday to 110,600 mt, a decrease of 16,700 mt from last Friday. The total inventory was lower than the same period last year. The inventories in Shanghai, Chongqing and Chengdu increased, while the inventories in Guangdong, Zhejiang, Jiangxi and Tianjin dropped. Among them, the inventory in Shanghai increased the most. According to SMM research, most smelters are reluctant to ship goods to warehouses in Shanghai, instead, they send their goods to Changzhou, Wuxi, or directly to factories. The increase in Shanghai inventory was contributed by the sharp increase in arrivals of imported copper and the hindered transportation. The sharp decrease in Guangdong inventory was caused by the huge spread between east China and south China which attracted many traders and plants to ship goods from Guangdong inventory to Zhejiang, Jiangsu, and Jiangxi. In detail, the inventories in Shanghai increased 5,000 mt to 78,900 mt, the inventories in Guangdong dropped 8,900 mt to 23,400 mt, the inventory in Chongqing rose 700 mt to 900 mt, and the inventory in Tianjin dipped 200 mt to 1,100 mt.

Looking forward, according to SMM research, most downstream manufacturers in east China and south China will have a longer May Day holiday. Therefore, the inventory on the first day before the holiday is expected to increase significantly and be higher than that in the same period last year. However, due to the resumption of downstream production and the low in-plant inventory, it is expected that the downstream will restock and then the inventory will drop again.

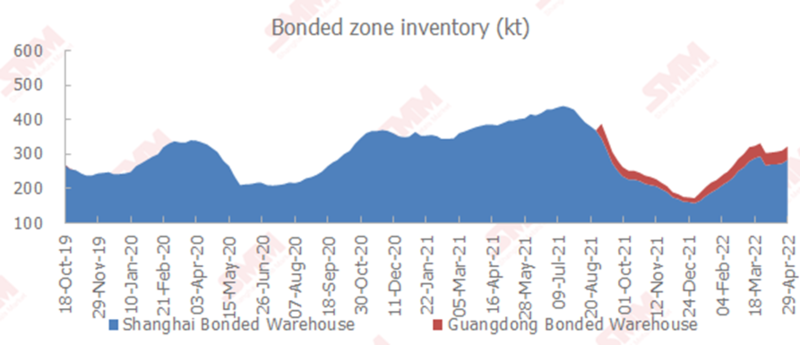

Copper Inventories in Domestic Bonded Zone up 6,300 mt on Week

According to SMM research, copper inventories in the domestic bonded zone increased 6,300 mt from April 22 to 328,700 mt on April 29. Inventory in the Shanghai bonded zone increased 6,000 mt to 289,300 mt, and inventory in the Guangdong bonded zone rose 300 mt to 39,400 mt. This week, the price ratio continued to improve WoW. However, due to the restrictions on documents and logistics, the actual flow of goods remained inefficient. Goods piled up at ports slowly flowed into the bonded warehouses, slightly pushing up the bonded zone inventory.

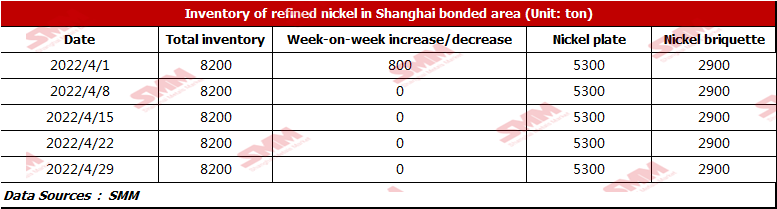

Nickel Inventory in Shanghai Bonded Zone Remained almost Unchanged this Week

This week, LME nickel remained volatile. Due to the macro factors, SHFE nickel prices remained rangebound at high levels this week, and the price ratio was not improved. Nickel inventory in Shanghai bonded zone stood at 8,200 mt this week. The inventory of nickel briquettes and nickel plates was 2,900 mt and 5,300 mt respectively, flat from last week. Due to the COVID-19 outbreak, the operation in Shanghai bonded zone stagnated. At present, LME nickel has not regained its liquidity, but SHFE nickel prices are high due to the shortage of supply in China. If SHFE nickel prices are kept at the current level, the imports will gain profits.

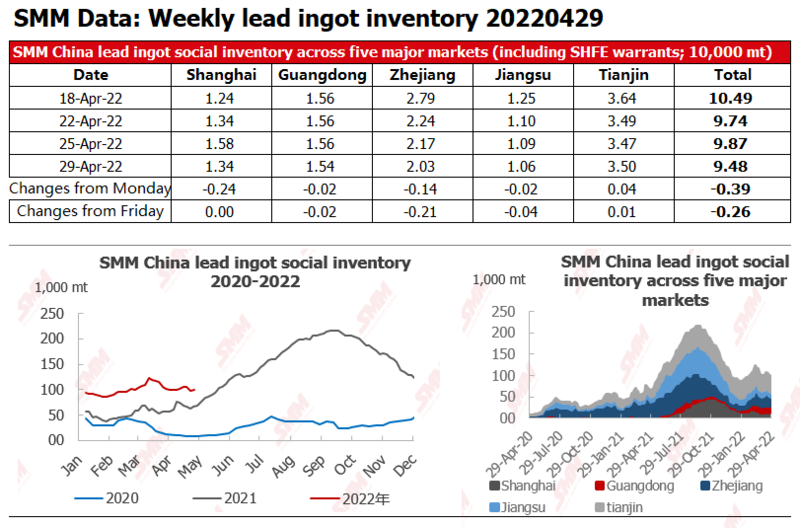

SMM China Lead Ingot Inventory Dropped 2,600 mt on Week

SMM China lead ingot inventory across five major markets in China stood at 94,800 mt as of April 29, down 2,600 mt from last Friday April 22 and down 3,900 mt from Monday April 25.

According to research, lead ingot supply improved as a whole from last week. However, more deliverable brands carried out maintenance, while the downstream restocked on demand as the Labour Day holiday is approaching. Downstream players mostly purchased from surrounding markets, including Zhejiang and Jiangsu where local lead ingot inventory dropped.

On the other hand, most downstream companies will be closed for Labour Day holiday, which might lead to accumulation in social inventory.