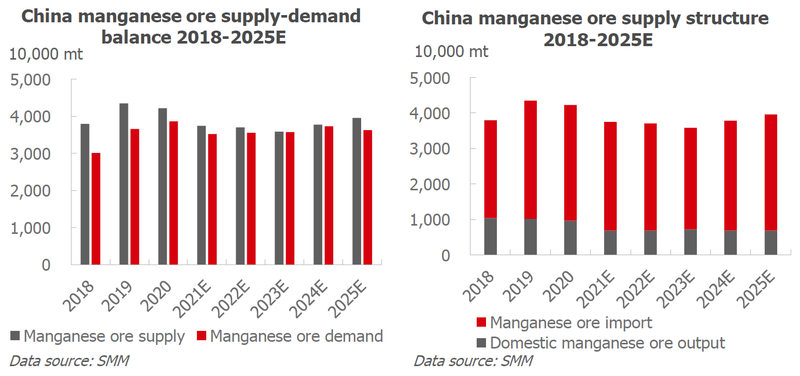

SHANGHAI Feb 10 (SMM) - Domestic manganese ore supply grew by 15% in 2018 due to significant inflows of imported resources, even as domestic production shrank further amid environmental pressures. Imports between January and October 2018 stood at 22.08 million mt, well above 21.26 million mt in 2017.

Domestic manganese ore prices began to fall in 2019, dragged on by the profits at manganese alloy producers in the second half of the year and inflows of manganese ore from Cote d'Ivoire, Ghana and Zambia. The manganese ore inventories at ports continued to hit record highs in H2 2019 amid continued increase in imports, with inventories at Tianjin port rising 90% from 2018. The high inventories and cash flow issues forced the domestic traders to sell despite losses. Many independent mines reduced or halted shipments to China against overly low prices in Q4 2019.

The manganese ore exporting countries implemented different levels of restrictions on population mobility, import and export in the first half of 2020, in order to curb the spread of COVID-19. China's effective COVID-19 prevention and control measures enabled various industries in the country to recover rapidly. During March to June 2020, China saw the largest increase of about 85% in prices of imported manganese ore, driven by the record high single-day output of steel. The robust demand from the Chinese market and decent profits bolstered mainstream manganese ore exporters across the world to ship as many manganese ore as possible to China under the premise of complying with their COVID-induced restrictions. For the first ten months of 2020, China imported 25.46 million mt of manganese ore, a year-on-year decrease of 7.9%. The decline was mainly caused by the sharp decline in imported manganese carbonate ore, according to customs data. (Due to shortages of storage capacity at Tianjin Port, large amounts of manganese ore could not be unloaded, and thus the import data for January-to-October was smaller than the actual value).

The demand for manganese ore failed to boom in 2021 due to the frequent power rationing in the manganese alloy market under environmental protection requirements. According to SMM statistics, the annual import volume of manganese ore in 2021 increased slightly compared with the previous year, and the port inventory was high throughout the year. According to the ore traders, the manganese ore prices stood lower than expected in the year, and the profits were thin. The quotations by overseas mines kept rising, but the domestic manganese ore prices lacked upward momentum on the weak demand, and the importers basically suffered losses last year. China imported 25.64 million mt of manganese ore from January to November 2021, a year-on-year increase of 0.69%.

SMM expects that the domestic demand for manganese will stay weak at first and then strengthen in 2022-2025. The demand of manganese alloy is likely to be suppressed by the environmental protection policies as well as the weakening consumption of crude steel in the gloomy real estate market, so the demand for manganese ore may fall further when compared with 2021 at first. After that, the end enterprises may increase the exports amid weak domestic demand, which is likely to boost the upstream production, when the manganese ore prices may rebound.

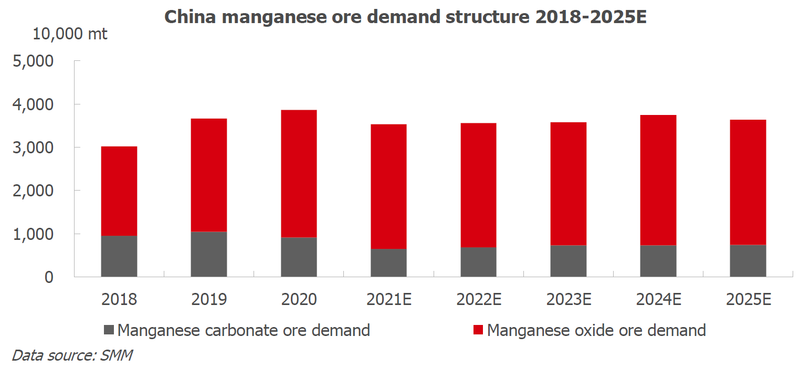

China manganese ore demand 2018-2025E

China’s demand for manganese ore continued to improve in 2018. In terms of manganese carbonate ore, the large EMM smelter in north China stepped up exploitation at its mine in Ghana to ensure normal production of brownfield projects. The high profits and productivity across steel mills and new standards for rebar that took effect in November, significantly grew the demand for manganese oxide ore (including metallurgy-grade semi-carbonate manganese ore) as silicomanganese alloy producers maintained high operating rates.

The demand for silicomanganese alloy was higher than expected in 2019, and the output rose by 14.24% to a record high of 1.06 million mt. The manganese ore varieties used by alloy producers diversified in order to pursue higher profits on the ground of technical improvement and varied raw material structures. The EMM output produced with manganese carbonate ore increased by 9.29% on the year, which drove up the demand for domestic and imported manganese carbonate ore.

China’s crude steel output reached a record high in May 2020. The demand for manganese alloy and ore increased significantly in the second half of 2020 as steel makers recovered from the impact of the COVID-19 pandemic. China's total demand for manganese ore is estimated to stand at about 38.62 million mt in 2020, of which 96.1% is imported manganese ore.

China’s manganese ore demand stood relatively stable in H1 2021 as expected despite the occasional short power supply for downstream enterprises. The downstream demand for manganese ore then declined amid sharp production cuts under stricter environmental protection control in H2 2021. The transactions of imported ore were sluggish throughout Q3, and the prices kept falling. Although the overseas quotations remained high, the domestic prices stagnated. The overall manganese ore market in 2021 was poorer than the previous year.

SMM believes that in 2022-2025, the demand for manganese ore in China will be weak first and then grow stronger. The stricter environmental protection control will give rise to lower output of end enterprises. The real estate market will stagnate in recent years, which will suppress the output of crude steel, and the further weigh on the demand of manganese ore. However, the traders may increase their exports amid lacklustre domestic market, and the demand may be boosted by then.

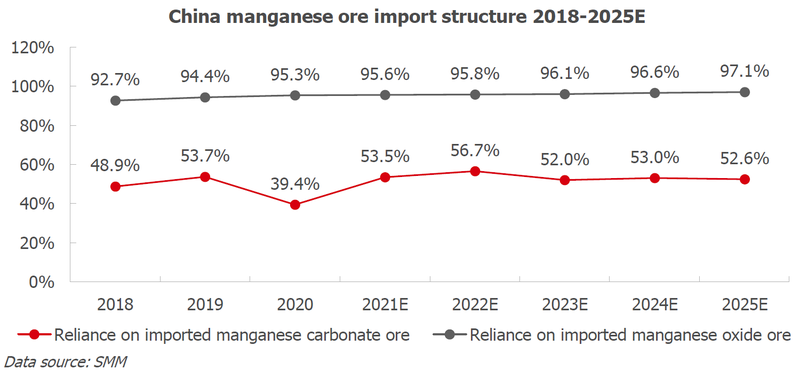

China’s reliance on imported manganese ore 2018-2025E

Manganese carbonate ore

China’s reliance on imports increased significantly in 2018. After Ningxia Tianyuan Manganese Industry Group (“NTM”), a giant EMM manufacturer, exhausted its stocks, the giant expanded the mining capacity of its controlling mine in Ghana to ensure raw material supplies (the Ghana manganese mine that it holds 90% equity). Sufficient imports also attracted some smelters to purchase. The reliance on imports is less significant when seen from the demand side.

The utilisation of imported manganese carbonate ore by domestic producers was stable in 2019 compared to 2018, without output cuts or expansions at NTM. Only several EMM plants in Guangxi as well as Xiushan county of Chongqing, Huayuan county of Hunan and Songtao county of Guizhou, which is known as “the manganese triangle”, used a small volume of imported ore.

The utilisation of imported manganese carbonate ore by large-scale manganese plants in Ningxia fell sharply in 2020, as shipments of manganese ore from Ghana were completely halted during February-May amid the COVID-19 pandemic. However, the demand for imported ore in H2 rose amid higher operating rates.

NTM cut its EMM production and reduced its consumption of manganese ore in 2021 mainly due to the environmental production control and power rationing. SMM believes the demand for imported manganese carbonate ore will remain high in the future after the above impact is alleviated. Judging from the production cut plans of the member EMM enterprises from the National Manganese Industry Technical Committee, the production suspension period in 2022 will be two months longer than in 2021, hence the EMM output of NTM is likely to drop further, of which the demand for ores will decline. But almost all the raw materials it needs are imported manganese carbonate ore.

SMM expects the enterprises will shorten the production suspension in 2023-2025E, as the demand from end users at home and abroad may grow steadily in the next 2-3 years, and the demand for EMM will rise simultaneously. However, the production will not be ramped up sharply because the plants will need to stabilise the prices. The Committee’s demand and reliance on the imported manganese carbonate ore will remain high.

Manganese oxide ore

The reliance on imports rose markedly in 2018. With significant environmental pressures, most domestic manganese oxide ore mines failed to maintain normal operations. Manganese alloy producers relied significantly on imports, and manganese-rich slag and manganese chemical producers used imported ore as main raw materials.

The demand for high-grade manganese ore picked up in 2019 as alloy output increased remarkably and the demand for deliverable high-quality alloys improved as a result of the active silicomanganese alloy futures market, which drove up the demand of imported manganese oxide ore.

The reliance on imports registered an all-time high at 95.2% in 2020. Falling prices of imported manganese ore and rising imports of high-grade manganese ore have made imported manganese ore more economical for downstream users. Improved demand for high-quality silicomanganese alloy from special steel and stainless steel mills prompted silicomanganese producers to ramp up the production, thus their demand for high-grade manganese ore increased. Nonetheless, there is almost no high-grade manganese ore output in China.

The reliance grew further to 95.6% in 2021. The silicomanganese alloy producers all used the high-grade manganese oxide ore to increase their output under the power rationing throughout the year, especially in the third quarter. The reliance on the imported manganese oxide ore increased further since the domestic supply was limited under the environmental protection policies.

China’s reliance on imports is likely to rise further in 2022-2025E. The strong demand from smelting and chemicals, a lack of domestic manganese oxide ore reserves and tough environmental requirements would increase imports.

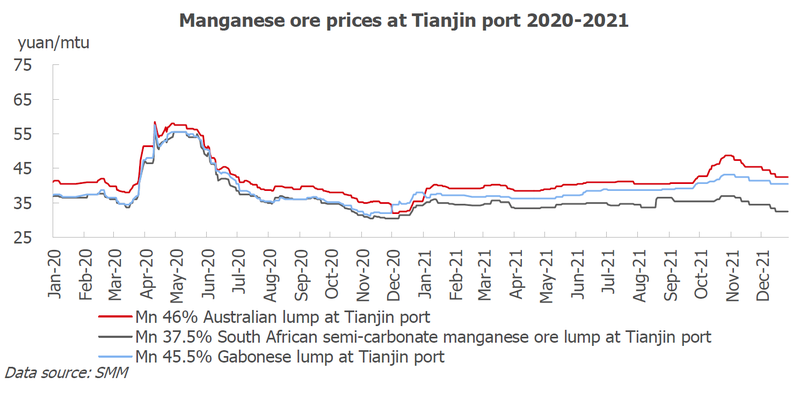

Mainstream imported manganese ore prices and port inventories 2021-2025E

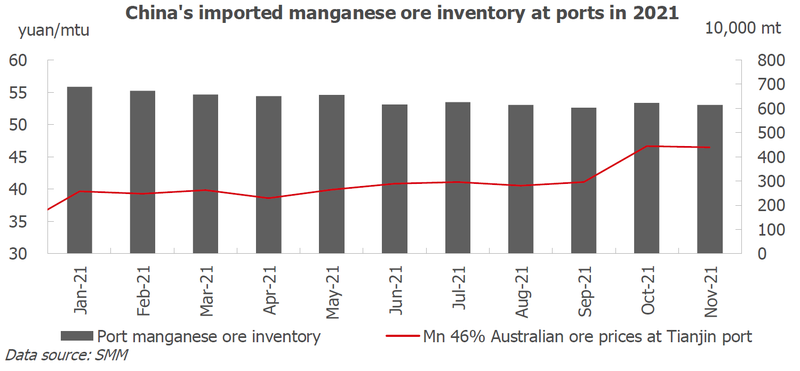

The spot prices of imported manganese ore kept rising in 2021 before peaking in October, and then pulled back rapidly. SMM takes the prices of Australia lump (Mn 45.5%) at Tianjin Port as an example to break down the market.

The price trend of imported manganese ore in 2021 was accordant with the prices of silicomanganese alloy.

The output of silocomanganese alloy kept rising in the first half of the year, and the crude steel output stood high as well, which stabilised the demand for manganese ore. The ore prices also stood stable amid high inventory and normal profits of manganese alloy.

In the second half of the year, especially in September, the power rationing severely restricted the alloy production, and the production cuts were more extensive than the production suspension in the crude steel industry which was under the stricter environmental protection inspections. Hence the manganese alloy prices reached new highs, and the profits once surged to 3,000-4,000 yuan/mt. In this context, the ore traders raised their quotations, and the alloy plants accepted well amid considerable profits. Besides, the alloy plants tended to purchase more imported manganese oxide ore with higher grades to ensure their output during the power rationing, which provided support for the quotations of ore. In this scenario, the prices of spot Australia lump (Mn 45%) increased over 20.75% from September 1 to the end of October, up from 40.5 yuan/mtu to 48.75 yuan/mtu. However, the manganese alloy plants started to resume the production in Q4 and maintained normal production until November. While the crude steel production was still under strict restrictions. The supply then exceeded the demand, weighing on the alloy prices rapidly and forcing down the prices of manganese ore. As of mid-December, the spot prices of Australia lump (Mn 45%) fell by over 10.77% from 48.75 yuan/mtu to 43.5 yuan/mtu.

The prices of imported manganese ore surged in October 2021, boosted by the rising profits of downstream alloy plants. However, the transactions of imported ore did not increase significantly at that time as the alloy plants had cut the production sharply, and the demand for manganese ore declined. Hence the port inventory of imported manganese ore accumulated markedly in the fourth quarter. However, the port inventory was still lower than that in the same period in 2020. As of late November 2021, the manganese ore inventory at Chinese ports totalled 6.14 million mt, falling 7.36 million mt or 16.55% year on year.

Healthy profits are expected to drive more legitimate miners, mainly in Africa and South America, to engage in the industry. More varieties available in the market and technology innovation at downstream users will weaken the capability of mainstream manganese mines to control the prices. Manganese mines and traders will face more fierce competition. The era of relatively low profits for overseas mines has arrived.

To access full SMM China Manganese Industry Chain Annual Report 2021-2025, please contact Michael Jiang at michaeljiang@smm.cn or T: +86-21-51666812 |M:+86-1522-1415-920.