SHANGHAI, Dec 17 (SMM) - This is a roundup of China's metals weekly inventory as of December 17.

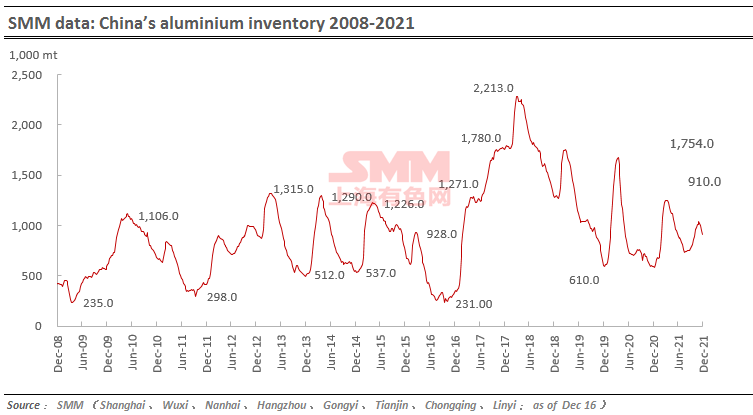

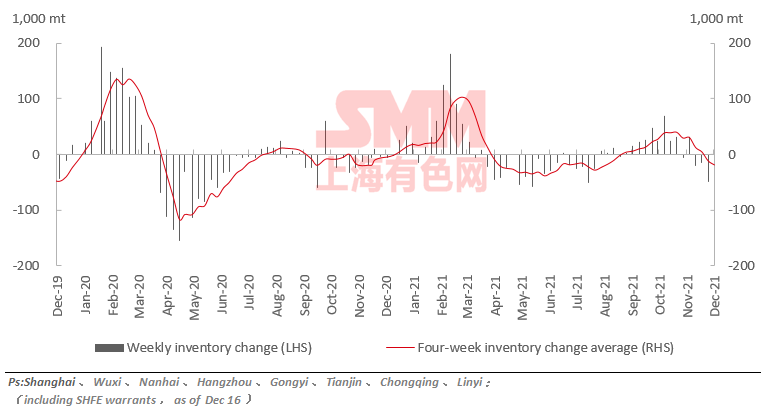

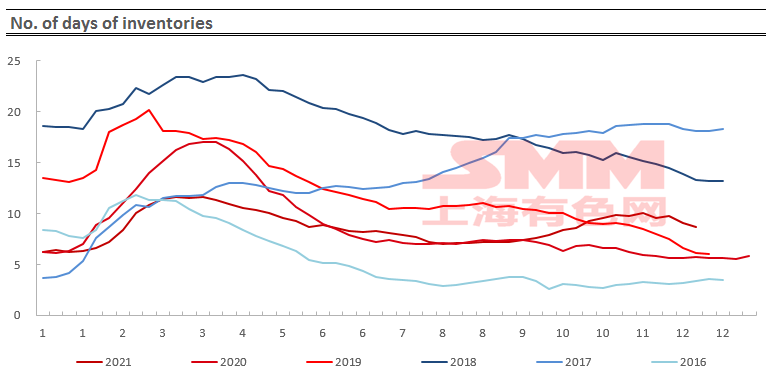

Aluminium Social Inventories Dropped 42,000 mt on Week

SMM data showed that China's social inventories of aluminium across eight consumption areas dropped 42,000 mt on the week to 910,000 mt as of December 16, mainly contributed by Wuxi, Nanhai and Shanghai. The inventory in Gongyi flat on the week. The reading today dropped 5,000 from Monday September 13, indicating slower decline this week.

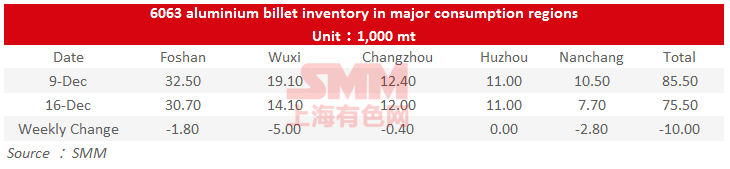

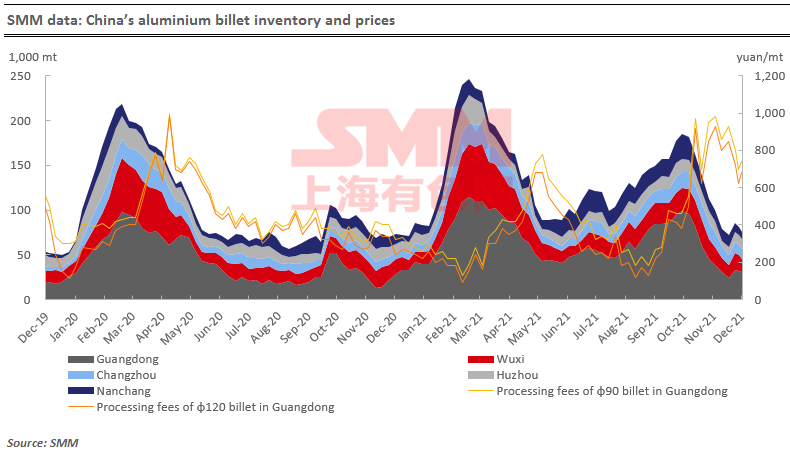

Aluminium Billet Inventories Down 10,000 mt on Week

The stocks of aluminium billet in five major consumption areas dropped 10,000 mt to 75,500 mt on December 16 from a week ago, a decrease of 11.7%.

Except for Huzhou where the inventory was flat on the week, all the other four markets saw declines in local social inventory to varying degrees. Wuxi and Nanchang contributed most of the declines, and the inventory in these two regions dropped 5,000 mt and 2,800 mt respectively, a decrease of 26.18% and 26.67% week on week. According to the feedback from the warehouses, the arrivals of aluminium billet was low, especially Wuxi and Nanchang, as the aluminium billet manufacturers were less willing to make shipments when the conversion margins have been low recently.

Looking into the next week, the downstream sectors of aluminum billet are sluggish in demand, while the arrivals of aluminium billet are also expected to be according to market feedback. Hence the likelihood is that the social inventory of aluminium billet next week will be largely unchanged.

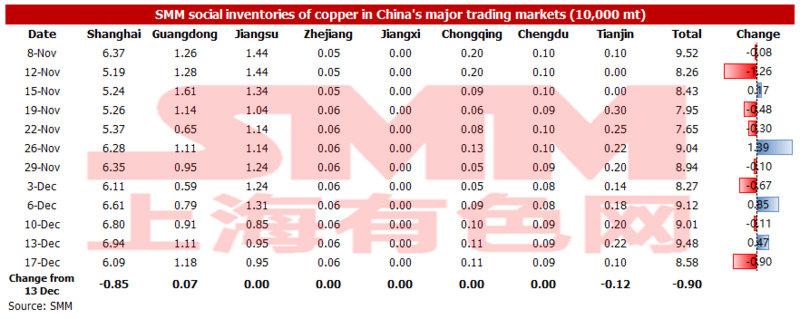

Copper Inventory in Major Chinese Markets Dipped 9,000 mt on Week

As of Friday Dec 17, the copper inventory across major Chinese markets fell 9,000 mt from Monday to 85,800 mt. The inventory in Guangdong only increased slightly by 700 mt, while the inventory in Shanghai and Tianjin decreased. And there was little change in the inventories in other regions.

The inventories in Shanghai decreased 8,500 mt from Monday to 60,900 mt; and the inventories in Tianjin were down 1,200 mt from Monday to 1,000 mt.

The copper prices declined and then rose this week. After the copper price fell sharply in the middle of the week, the buying on the dip drove the inventory decline. The lower customs clearance volume also drove the sharp inventory decline in Shanghai.

The volume of customs clearance and arriving shipments of domestic cargoes will increase next week. If copper prices do not fall sharply, the consumption will be weaker than this week. Therefore, SMM expects that the inventory will increase slightly next week.

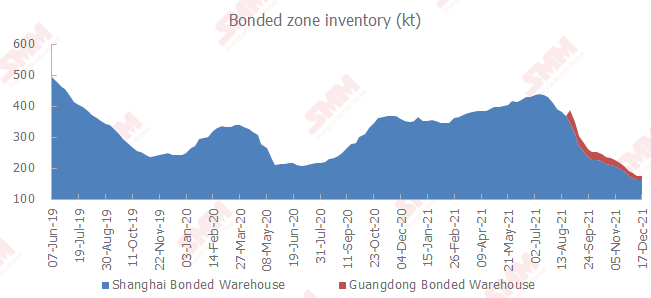

Copper Inventory in Domestic Bonded Zone Declined 1,300 mt on Week

The copper inventories in domestic bonded zones decreased 1,300 mt from December 10 to 173,900 mt as of Friday December 17, falling for ten consecutive weeks, according to SMM survey.

The inventory decline has narrowed noticeably. The inventory in the Shanghai bonded zone decreased 1,300 mt to 160,500 mt, and the inventory in the Guangdong bonded zone remained unchanged at 13,400 mt.

The trading in the domestic and import market has weakened at the year-end. The SHFE/LME copper price ratio dipped this week. And there have been import losses since the middle of the week. The import demand was subdued. As such, the decline in the bonded zone inventories has slowed down.

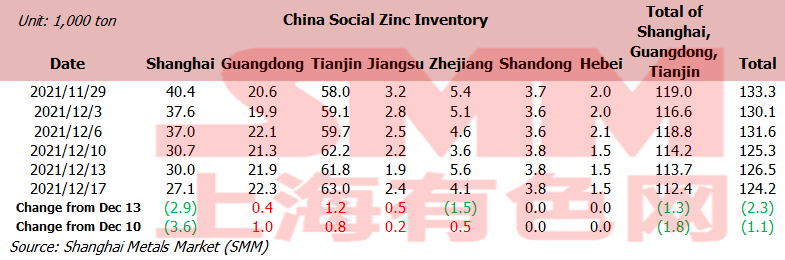

Zinc Social Inventories Down 1,100 mt on Week

Total zinc inventories across seven Chinese markets stood at 124,200 mt as of December 17, down 2,300 mt from December 13 and 1,100 mt from December 10.

The inventory in Shanghai fell sharply as some major plants implemented maintenance, and market demand for goods in Shanghai increased due to delivery hindering out of Covid-19 pandemic in Ningbo. Guangdong saw an increase in the overall inventory amid growing arrivals of goods in the spot market and muted demand from downstream producers. The stocks in Tianjin continued to increase as demand from downstream producers remained weak and some plants mainly digested raw material inventory. Inventories in Shanghai, Guangdong and Tianjin fell 1,800 mt, and inventories across seven Chinese markets decreased 1,100 mt.

Nickel Ore Inventories at Chinese Ports Fell 241,000 wmt

The nickel ore inventory at Chinese ports dipped 241,000 wmt from a week earlier to 8.77 million wmt as of December 17. Total Ni content stood at 68,900 mt. The total inventory at seven major ports stood at around 4.07 million wmt, a drop of 201,000 wmt from a week earlier.

The shipments arrivals of nickel ore have decreased. Although the NPI output has not returned to normal completely, the growth in demand exceeded that in the supply. It is expected that the nickel ore inventories will continue to decline next week.

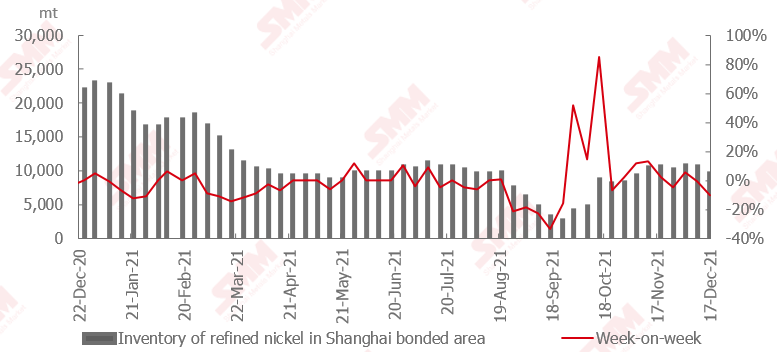

Higher SHFE/LME Nickel Price Ratio Drove Rapid Declines in China Bonded Zone Inventories

According to an SMM survey, the SHFE/LME nickel price ratio rallied this week on the significant shortages of domestic cargoes. The import window for spot nickel reopened on Thursday, prompting the traders to transfer the nickel plate inventory in the bonded zones into the domestic market.

The imports of nickel briquette were limited.

The lower nickel prices have incentivised the downstream buyers to purchase, especially the electroplating and alloy plants. This drove the domestic nickel plate inventory to fall sharply. The premiums of nickel plate have hit a high for the year.

Despite some planned shipments arrivals of nickel plate next week, some of the cargoes have been presold. The market thus will not see a large inflow of imported nickel plate. Nonetheless, the available delivered cargoes are likely to alleviate the supply tightness of nickel plate.

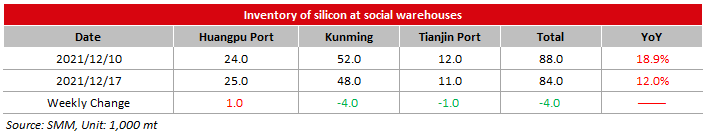

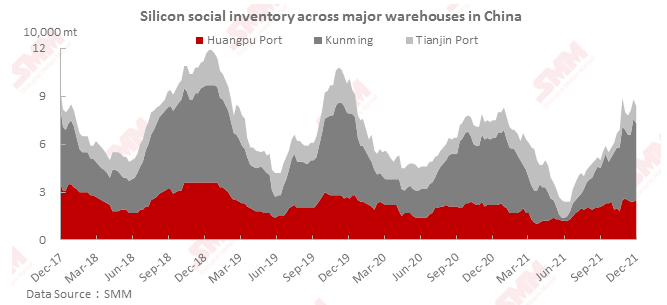

Silicon Metal Social Inventory Dropped 4,000 mt on Week

The social inventory of silicon metal across Huangpu port, Kunming city and Tianjin port decreased 4,000 mt from the previous week to 84,000 mt as of Friday December 17.

The inventory at Tianjin port declined due to the high shipments, while the inventories at Huangpu port increased due to the high arrivals from Kunming and other places.

The inventory in Kunming dropped significantly, mainly due to the large volume of shipments and the lower arrivals on the week.

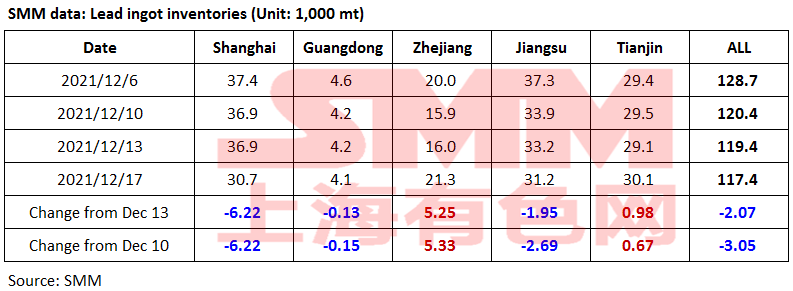

Lead Ingot Social Inventory Dropped 2,100 mt on Week

The social inventory of lead ingots across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin decreased 3,000 mt from December 10 and 2,100 mt from December 13 to 117,400 mt as of December 17.

The domestic supply of lead ingots gradually increased, but the supply in some regions remained tight. As the lead prices rose strongly during the week, the discounts of secondary refined lead expanded to 500 yuan/mt over the average price of SMM 1# lead (ex-factory). The downstream users reduced their purchases, and tended to purchase from smelters. As such, the social inventory of lead ingots declined more slowly.

The enterprises from the lead industry chain will continue to collect funds in late December, and the downstream purchases may be suspended next week. The social inventory of lead ingots is expected to fall more slowly next week.