SHANGHAI, Oct 29 (SMM) - This is a roundup of China's metals weekly inventory as of October 29.

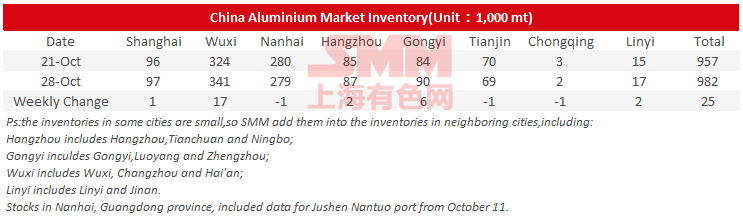

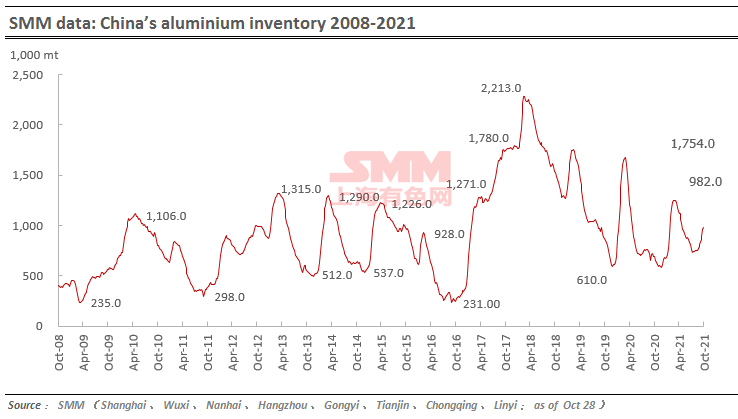

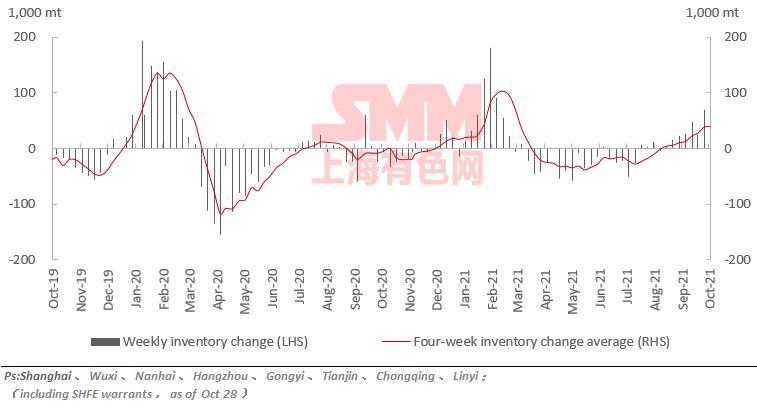

Aluminium Social Inventories Rose 25,000 mt on Week

SMM data showed that China's social inventories of aluminium across eight consumption areas rose 25,000 mt on the week to 982,000 mt as of October 28, mainly because more arrivals in Wuxi, Shanghai and Gongyi have led to rising local inventories. While the inventory in Nanhai fell slightly on the week amid warming consumption market.

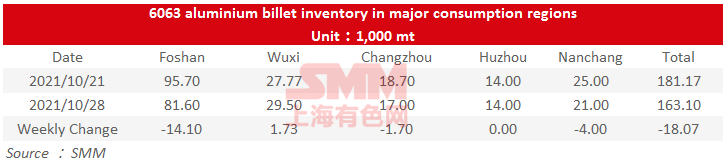

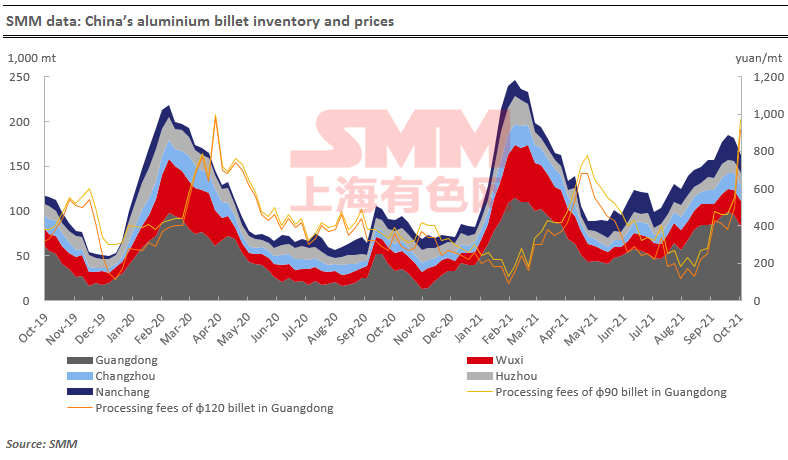

Aluminium Billet Inventories Down 18,100 mt on Week

The stocks of aluminium billet in five major consumption areas dropped 18,100 mt to 163,100 mt on October 28 from a week ago, a decrease of 9.97%.

Among them, majority of the declines were still contributed by Foshan (down 14,100 mt or 14.73%) and Nanchang (down 4,000 mt or 9.97%). While the inventory in Wuxi rose by 1,700 mt or 6.25% week on week as the power rationing keeps affecting local demand for raw materials. As far as SMM understands, there were less arrivals of aluminium billet in Foshan this week, and the shipments also picked up amid warming downstream purchase on slumping aluminium prices and more demand from conversion plants after the power rationing eased in Guangdong.

Looking forward, the orders at aluminium extruders have been moderate according to SMM. But some aluminium billet producers have reduced their output amid rising production costs, resulting in less arrivals of aluminium billet in south China. Therefore, the aluminium billet inventory next week is likely to fall again.

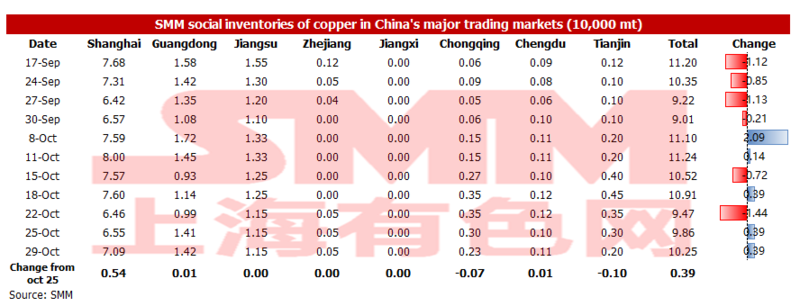

Copper Inventory in Major Chinese Markets Rose 3,900 mt

The copper inventory across major Chinese markets increased 3,900 mt from Monday October 25 to 102,500 mt as of Friday October 29.

The inventory in Chongqing and Tianjin decreased slightly by 700 mt and 1,000 mt respectively. And the stock accumulation was seen in Shanghai and Guangdong. The inventories in Shanghai increased 5,400 mt to 70,900 mt, and the inventory in Guangdong increased100 mt to 14,200 mt. The slight increase in customs clearance for imported copper, coupled with the weak consumption at the month-end, accounted for the inventory growth in Shanghai and Guangdong.

Due to the low local spot premium in Tianjin, smelters in the north shifted to deliver the goods to east China, which lowered the inventory in Tianjin. The volume of imported copper will not be large next week. And domestic smelters reportedly cut output. As such, the supply will decrease. But downstream consumption will pick up amid eased power rationing. Domestic inventories will decrease slightly next week.

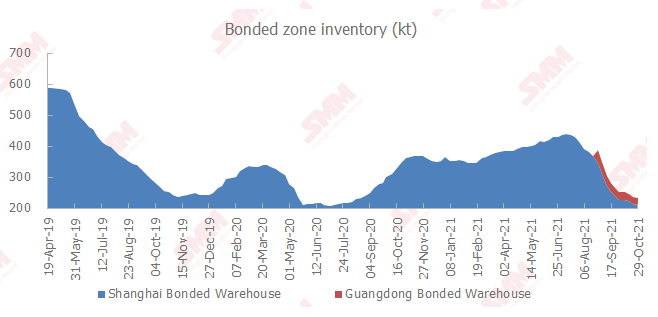

Copper Inventory in China Bonded Zone Declined 3,900 mt on Week

The copper inventories in domestic bonded zones decreased 3,900 mt from October 22 to 233,300 mt as of October 29, falling for three consecutive weeks, according to SMM survey.

The inventory in the Shanghai bonded zone decreased 3,400 mt to 209,800 mt, and the inventory in the Guangdong bonded zone fell 500 mt to 23,500 mt.

During the week, the spot premiums in Shanghai remained high. Some traders continued to move the bonded zone inventories into the domestic market. This, combined with the stable shipments, drove continued declines and the bonded zone inventories.

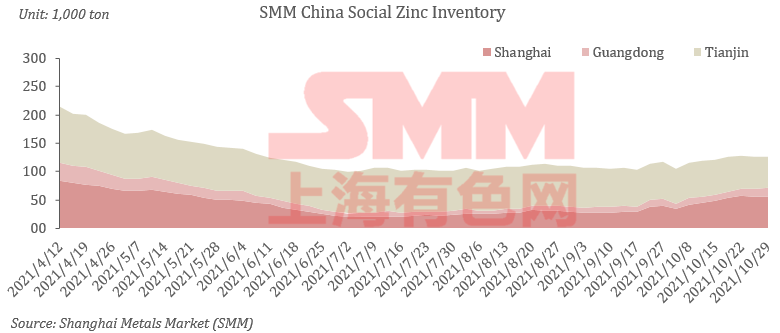

Zinc Social Inventories Down 3,700 mt on Week

Total zinc inventories across seven Chinese markets stood at 143,600 mt as of October 29, down 2,200 mt from October 25 and 3,700 mt from October 22.

The inventory in Shanghai declined as the arrivals of imported zinc increased and downstream producers bought goods on dips. Guangdong saw a sharp increase in the stocks as power rationing in Guangxi loosened and the arrivals of goods on the market rose. The stocks in Tianjin fell sharply amid transportation restrictions and the stranding of goods in the station. Inventories in Shanghai, Guangdong and Tianjin fell 1,900 mt, and inventories across seven Chinese markets decreased 3,700 mt.

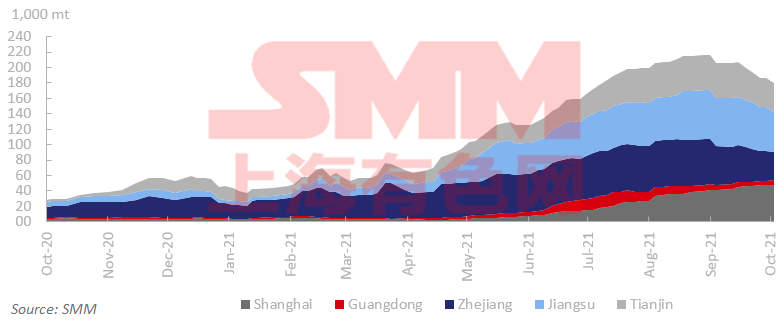

Lead Ingot Social Inventory Down 6,300 mt on Week

The social inventory of lead ingots across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin decreased by 6,300 mt from October 22 and fell 6,100 mt from October 25 to 180,600 mt as of October 29, hitting a new low since August 6, 2021.

The smelters of the major primary lead deliverable brands were under maintenance this week, and the smelters cut the production by 20-40% under the power rationing. The supply declined significantly. Anhui cut off the power for the line change, restricting the production of some secondary lead smelters, which reduced the lead ingot supply to Jiangsu, Zhejiang, and other consumption areas. The downstream users turned to purchase from the social warehouses, and the total social inventory of lead ingots dropped.

The restored profits of secondary lead have boosted the production, but the power rationing and the air pollution control will still affect the production in November. The deliverable brands of primary lead may increase the maintenance. The social inventory of lead ingots is expected to fall slightly.

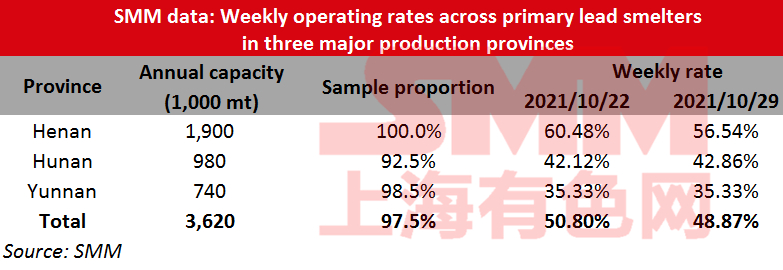

Operating Rate of Primary Lead Smelters Down 1.92% on Week

The average operating rate across primary lead smelters in Henan, Hunan and Yunnan provinces dropped 1.92 percentage points from the previous week to 48.87% in the week ended October 29, an SMM survey showed.

In Henan, the output of Jinli and Wanyang reduced on the week due to the power rationing, Yuguang slightly increased the production after the work resumption on Wednesday, and Yongning Gold and Lead resumed the production after the maintenance. Wanyang will resume a small amount of the output this Sunday, and it may conduct the routine maintenance after November. Guiyang Yinxing in Hunan slightly increased the production after the power rationing. Jiangxi Jinde conducted the maintenance as planned, and Jiangxi Copper has not completed the maintenance yet.

Nickel Ore Inventories at Chinese Ports Rose 540,000 wmt

The nickel ore inventory at Chinese ports grew 540,000 wmt from a week earlier to 8.987 million wmt as of October 29. The total Ni content stood at 70,600 mt.

The total inventory at seven major ports stood at around 4.69 million wmt, a growth of 260,000 wmt from a week earlier.

The nickel ore inventories accumulated significantly this week as the demand remained poor. Based on the current inventory accumulation, the port inventory can meet domestic demand for about three months. And the supply tightness of nickel ore will improve significantly.

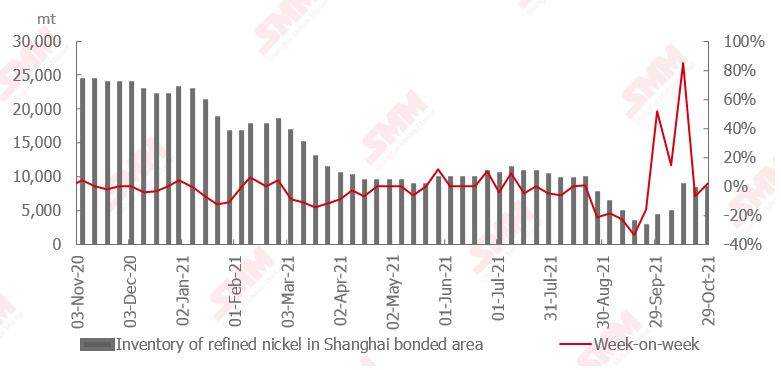

Import Window Closed amid Slower Decline in Nickel Plate Inventory

The SHFE/LME nickel price ratio continued to fall this week amid the slower decline in domestic nickel plate inventory and large inflows of imported goods, according to SMM data.

Some goods went to the bonded zone after the import window closed. The bonded zone inventory is likely to decrease if the import window opens.

Over 500 mt of nickel briquette is expected to arrive next week. And the shipments arrivals of nickel plate are expected to exceed 800 mt which will still have an impact on the domestic inventories.

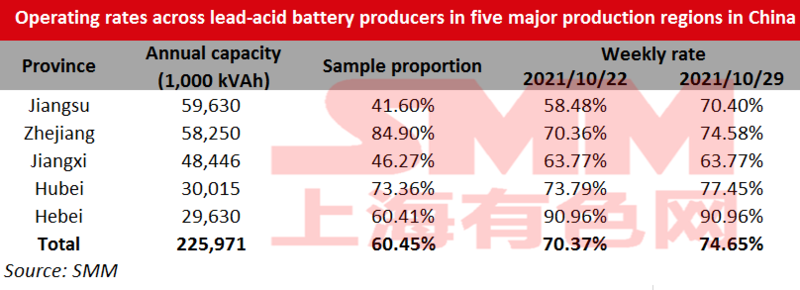

Operating Rate of Lead-Acid Battery Plants Rose 4.28% on Week

The average operating rates across lead-acid battery producers in Jiangsu, Zhejiang, Jiangxi, Hubei and Hebei provinces increased 4.28 percentage points from October 22 to 74.56% as of Friday October 29.

The distributors were more active in purchase amid the eased power rationing in Jiangsu and the rising lead prices. The orders of the lead-acid batteries for electric bicycle and electric car increased, and some producers raised the operating rates due to the shortage of the finished products.

The power rationing in Zhejiang and Anhui has not been fully lifted yet, which may continue to affect the production of the lead-acid battery companies.