SHANGHAI, Aug 13 (SMM) - This is a roundup of China's metals weekly inventory as of August 13.

Copper Inventories Down 10,500 mt from Monday

SMM data showed that copper inventories across mainstream areas in China fell 10,500 mt from this Monday to 159,500 mt as of Friday August 13.

Among them, inventories in Shanghai decreased 400 mt from this Monday to 95200 mt; Guangdong deceased 11,700 mt to 49400 mt; Jiangsu increased 1000 mt to 8100 mt; Tianjin fell 400 mt to 1800 mt; Zhejiang and Jiangxi were basically flat from this Monday.

Domestic overall inventories fell again after only one week’s rally, and re-stocking was mainly in Guangdong as arrivals shrank greatly on power curtailment across upstream smelters. In addition, copper imports fell from last week, partly contributing to the fall in overall inventories.

Shanghai Bonded Copper Stocks Fell 11,400 mt on Week

SMM data showed that the stocks of copper in Shanghai bonded areas fell 11,400 mt from last Friday August 6 to 380,700 mt as of August 13, falling for five consecutive weeks, while de-stocking slowed from last week.

Domestic social inventories fell again as output at smelters in China was still disrupted and refined copper was replacing copper scrap. The price ratio recently was generally favourable, and godown warrants were flowing into China after customs clearance, leading to further decrease of inventories in the bonded zone.

Zinc Social Inventories Expanded 6800 mt on Week

SMM data showed that social inventories of zinc ingots across Shanghai, Tianjin, Guangdong, Jiangsu, Zhejiang, Shandong and Hebei increased 6800 mt from last Friday August 6 to 124100 mt, and rose 3900 mt from Monday (August 9).

Among them, inventories in Shanghai added due to restocking as arrivals were stable and downstream purchase was depressed by rising zinc prices; Guangdong rose slightly amid expanded fall in market deliveries though market arrivals were sluggish due to power curtailment in Yunnan and Guangxi; Tianjin increased more significantly as previously released government reserves entered market and downstream demand decreased due to high prices.

In conclusion, social inventories in Shanghai, Guangdong and Tianjin increased 7000 mt, while inventories across seven markets up 6800 mt.

Shanghai Bonded Refined Nickel Stocks Flat on Week

The SHFE to LME nickel ratio kept rising this week. The import opportunities for spot nickel in the bonded zone lingered until Friday, and spot nickel plates and briquettes in the bonded zone are expected to flow into China market next week.

On the other and, spot transactions this week were high, bringing down nickel plate inventories to a comparatively low level. Follow up SHFE to LME nickel ratio is likely to keep momentum, creating profits for imports.

Another 500 – 800 mt nickel plates are schedule to arrive in China next week, supplementing domestic demand. While nickel briquettes arrivals are likely to fall from this week. According to SMM, nickel plates under warrant were still highly quoted in US dollars at around $190 – 200/mt, Norwegian godown warrants were offered at $200 – 210/mt, while the quotations of non-ex-factory nickel briquettes in the bonded zone stand at $230 – 240/mt.

Nickel Ore Inventories at Chinese Ports Shrank 255,000 wmt to 5.512 Million wmt

Nickel ore inventories across all Chinese ports decreased 255,000 wmt from August 6 to 5.512 million wmt as of August 13, SMM data showed. In Ni content, the stocks stood at 43,300 mt.

SMM data also showed that nickel ore stocks across seven major Chinese ports shrank 104,000 wmt during the same period to 3.505 million wmt.

Domestic iron plants maintained hectic production schedules, as demand stayed high. Therefore, inventories at ports were still low in face of busy shipments. However, downloading at ports slowed down due to stricter pandemic control.

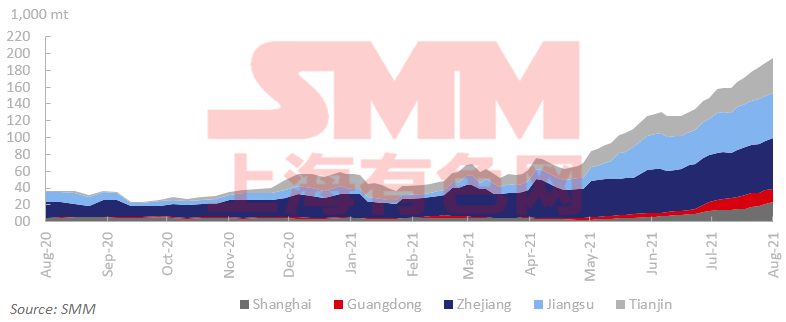

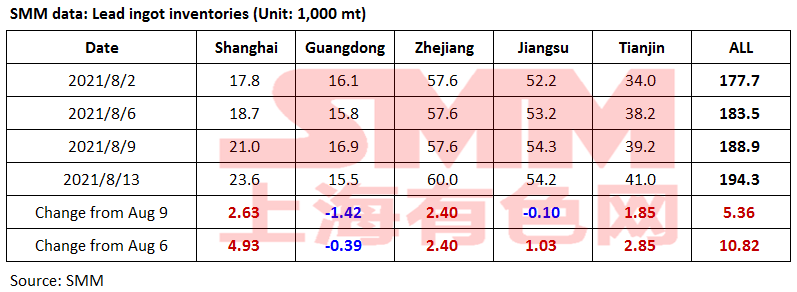

Lead Ingot Social Inventories Expanded 10,800 mt on Week

Social inventories of lead ingots across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin expanded 10,800 mt from last Friday August 6 to 194,300 mt as of August 13. This was up 5,400 mt from Monday August 9 and registered a new high since April 2014.

The lead ingot inventories in major delivery warehouses increased this week with the approaching of the settlement of August contracts.

The stocks in Guangdong declined, as the supply of secondary lead was limited under the environmental inspections, and the resources from Hunan declined amid power curtailment.

The stocks in Jiangsu increased from last Friday, but declined from Monday this week. The COVID-19 pandemic restricted the logisctics from Jiangsu to other regions, which increased its consumption of local stocks. The production of some downstream battery companies was also restricted.

SHFE 2108 lead contracts will be settled next Monday, and more goods are expected to be delivered to warehouses this weekend. The power curtailment in Henan and Hunan has not been fully lifted. The increase in the social inventories of lead ingots is likely to slow down slightly.

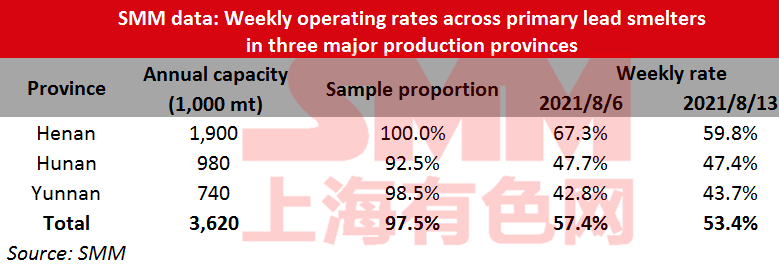

Operating Rates of Primary Lead Smelters Down 3.91% on Week

Operating rates across primary lead smelters in Henan, Hunan and Yunnan provinces lost 3.91 percentage points from the previous week to 53.4% in the week ended August 13, showed an SMM survey.

Many smelters were affected by the power curtailment in Henan. Whether the power rationing will continue depends on the local power consumption. Henan Xinling halted the crude lead production under power cut, which led to the suspension of refined lead production. Jiyuan Wanyang’s production of crude lead and refined lead was affected by the power rationing, and the output of refined lead declined, which is expected to partially recover next week. Jinli’s crude lead production was affected, but the output of refined lead remained normal. Yongning Gold Lead reduced production by arounf 20%.

In Hunan, Shuikoushan Jinxing partly recovered production as planned, but is likely to slightly reduce production for lack of crude lead. Yuteng initially resumed production after the maintenance this week.

In Anhui, Tongguan started production this week, and the output is likely to partly recover next week. Gejiu Chuangyuan resumed production this week, but not in full capacity.

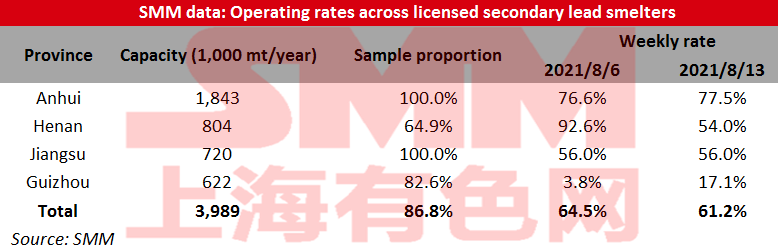

Operating Rates of Secondary Lead Smelters Down 3.32% on Week

Operating rates across licensed smelters of secondary lead in Jiangsu, Anhui, Henan and Guizhou averaged 61.18% in the week ended August 13, down 3.32 percentage points from the previous week, showed an SMM survey.

The shipments of some smelters in Anhui was impeded due to the pandemic control, and the production declined amid higher inventories.

Jinli’s dismantling line was restricted amid strengthened power curtailment in Henan, and the production was reduced. Ahui Dadao resumed production as planned, and Guizhou Huoqilin increased production, but the overall operating rates steel went down.

The impact of pandemic and power curtailment is hard to be alleviated next week. However, Guizhou Huoqilin is expected to further increase production after the commissioning, and the operating rates may rebound slightly.

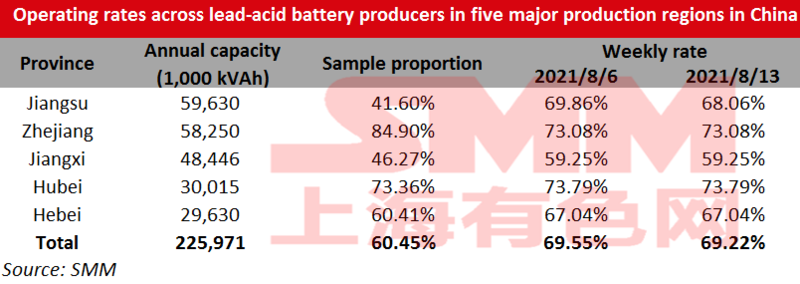

Operating Rates of Lead-acid Battery Plants Down 0.33% on Week

Operating rates across lead-acid battery producers in Jiangsu, Zhejiang, Jiangxi, Hubei and Hebei provinces lost 0.33 percentage point from August 6 to 69.22% as of August 13.

The consumption in the lead-acid battery market was mild, and most companies maintained stable production.

The lead-acid battery output in Jiangsu continued to decline under the pandemic control, as the transportation in high-risk areas such as Yangzhou and Gaoyou was restricted, and the raw material inventories were gradually consumed. Some companies in Jiangsu are not included in SMM sample, so the actual decrease in the operating rates was wider.

The impact of the pandemic and power curtailment on the production of lead-acid battery will be further monitored.

Silicon Social Inventories Up 4,000 mt on Week

Social inventories of silicon metal across Huangpu port, Kunming city and Tianjin port shrank increased 4,000 mt from the previous week to 44,000 mt as of Friday August 13.

The inventory at Tianjin Port stood flat. The stocks in Kunming increased in the wet season, but was 40.7% lower than the same period in 2020. Huangpu Port saw slight increase in the inventory as traders were actively restocking.

Some companies have the intention to restock. The social inventories of silicon are expected to rise slightly next week.

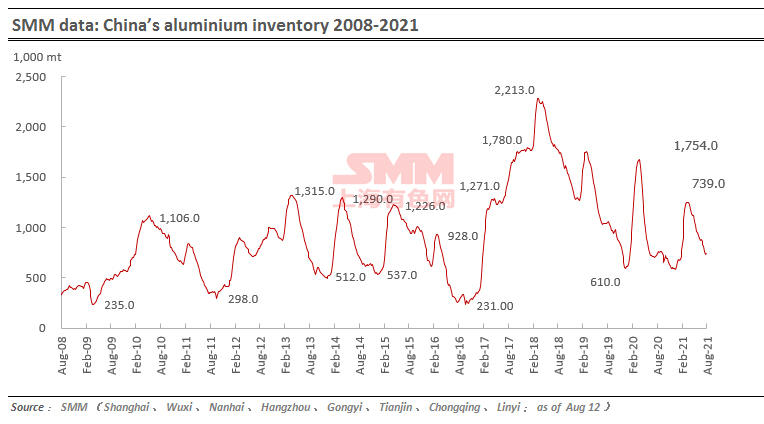

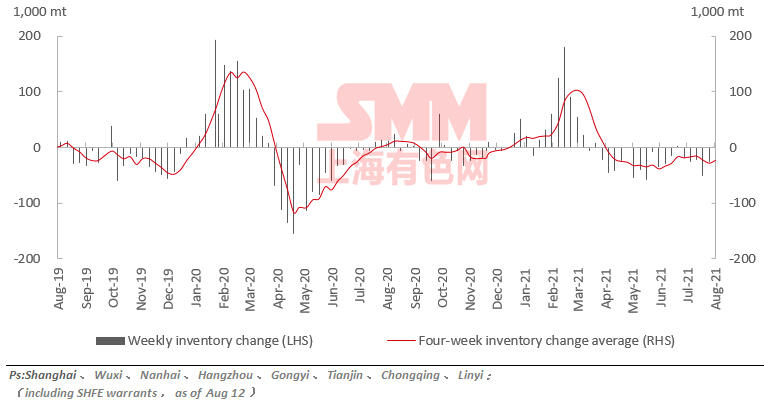

Primary Aluminium Inventories Increased 7,000 mt on Week

SMM data showed that China's social inventories of aluminium across eight consumption areas increased 7,000 mt on the week and rose 15,000 mt from Monday to 739,000 mt as of August 12.

The inventories in Wuxi and Hainan rose slightly. The shortage of arrivals eased in Wuxi, and the outbound volume declined on the week, as downstream purchase was maintained on rigid demand amid high aluminium prices. At the same time, Hainan received a large amount of aluminium ingot from north-west regions.

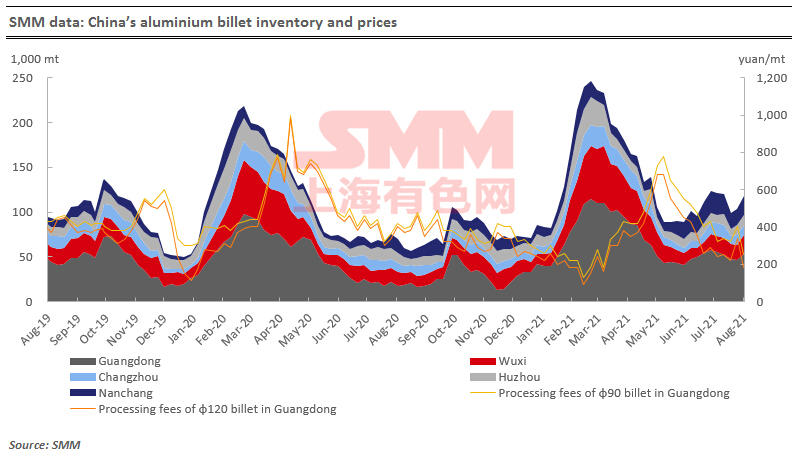

Aluminium Billet Inventories Up to 117,600 mt on Week

The stocks of aluminium billet in five major consumption areas increased by 14,400 mt to 117,600 mt on Thursday August 12 from the previous week, an increase of 14%. Among them, inventories in Foshan saw the greatest increase of 7500 mt or 16% on the week, while the growth rate in Wuxi was the highest of 18% (3100 mt) on a weekly basis.

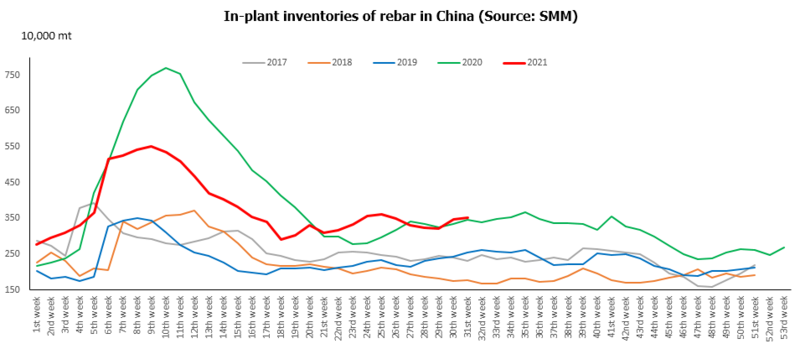

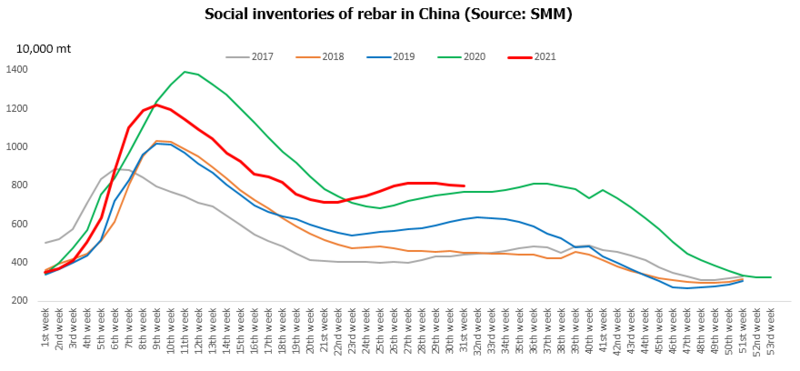

China Steel Rebar Inventory Down 36,100 mt on Week

Inventories of rebar across Chinese steelmakers and social warehouses stood at 11.48 million mt as of August 12, down 36,100 mt or 0.31% from a week ago. Stocks are up 325,300 mt or 2.94% from a year earlier.

Inventories at Chinese steelmakers rose 42,700 mt or 1.23% on the week and stood at 3.51 million mt. Stocks are up 37,900 mt or 1.09% from a year earlier.

Inventories at social warehouses declined 78,800 mt or 0.98% on the week and stood at 7.97 million mt, up 287,000 mt or 3.74% from a year ago.

China HRC Inventory Up 20,200 mt on Week

SMM data showed that HRC stocks across social warehouses and steel makers rose 20,200 mt or 0.5% on the week, an increase of 2.3% than a year ago, to 4.02 million mt in the week ended August 12.

Inventories across social warehouses increased 34,400 mt or 1.13% week on week to 3.08 million mt. This was 11.3% higher than the same period last year.

Stocks at Chinese steel makers came in at 949,000 mt, down 14,200 mt or 1.47% week on week and 18.94% year on year.

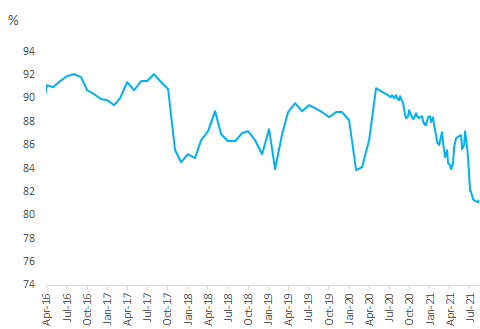

Operating Rates of Blast Furnaces across Chinese Steelmakers Up 0.2% on Week

Operating rates of blast furnaces at Chinese steelmakers inched up this week and stabilized at low.

An SMM survey showed that the average operating rate of BFs at steel mills in China edged up 0.2% from the prior week and inched down 0.1% on the month to 81.3%, the first slight increase in two months, and basically stabilised at low.