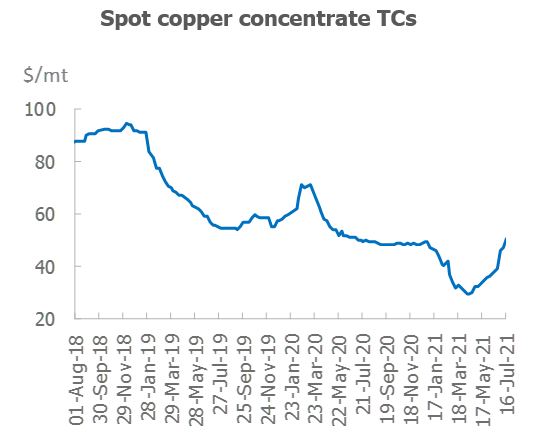

SHANGHAI, Jul 19 (SMM) - As of Friday July 16, the SMM Imported Copper Concentrate Index (weekly) stood at $50.82/mt, $3.74/mt higher than a week earlier, rising for 14 consecutive weeks. Most of the current market offers are spot shipments scheduled for September, with hardly any demand for shipments scheduled for August. Actual trades with spot TCs of at $51-52/mt occurred.

A copper smelter in eastern Shandong resold copper concentrate in the market after a sudden failure of equipment, which sidelined buyers and pressured on sellers. Spot TCs rose from over $38/mt to exceed the $50/mt mark in a month, sidelining buyers and sellers. For spot shipments scheduled for September, most of offers stood above $48/mt. Counteroffers stood at around $60/mt amid adequate inventory. Concentrate traders hardly accepted TCs of over $50/mt which stands close to their long-term contract TCs.

Cargoes that were required for delivery in September were normally purchased ahead of mid-July. Currently, purchases were delayed to the second half of July or August for better TCs, which leads to potential risks for buyers and sellers. The current output of overseas copper mines continues to rise. Spot TCs are likely to rise further amid weak new demand. The current pricing coefficient of domestic copper concentrate (Cu 20%) remained unchanged between 89-91% (spot cargoes, delivery to factory) for domestic smelters.

![Chile’s Copper Export Revenue Surged in February; Overnight LME Copper and SHFE Copper Both Closed Higher [SMM Copper Morning Meeting Minutes]](https://imgqn.smm.cn/usercenter/oeWiG20251217171714.jpeg)

![BC Copper 2604 Contract Closed Lower After Choppy Trading, Nonfarm Payrolls and Geopolitical Disruptions Weighed on Copper Prices [SMM BC Copper Commentary]](https://imgqn.smm.cn/usercenter/XBbTq20251217171709.jpg)