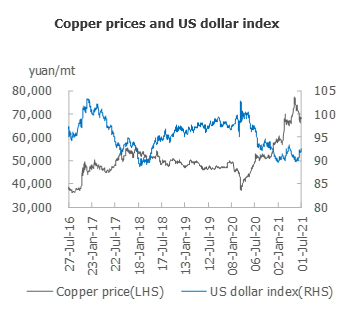

SHANGHAI, Jul 6 (SMM) — SHFE copper prices hovered in a narrow range around 68,300 yuan/mt last week. The US dollar index edged up and stood at 92.7 on Friday. The Fed will focus on the inflation rate and employment rate this year. PMI from China, Europe and the United States are scheduled for this week.

On fundamentals, domestic smelters gradually ended their concentrated maintenance. Lower-than-expected copper imports will keep domestic shipments arrivals at low levels. However, downstream buyers stood on the sidelines after stockpiling aggressively at 70,000 yuan/mt and 66,000 yuan/mt. The low season will put pressure on copper prices. Copper ore supply will be sufficient in view of the results of negotiations on spot copper concentrate TCs for H1 2022 between Antofagasta and Chinese smelters as well as large volumes of spot trades at $46-47/mt. The release of some new and expansion capacity also weighed on copper prices.

Technically, SHFE copper prices met resistance from the 20-day moving average, with strong support from 66,500 yuan/mt. SHFE copper prices are expected to move between 67,200-69,200/mt this week, and LME copper will trade between $9,180-9,480/mt.

Ample capital at the start of H2 combined with tight market supply will prompt sellers to hold back cargoes. The market trading logic will turn to the price spread between the SHFE front month and next month contracts. Spot premiums are expected to stand at 120-220 yuan/mt this week.