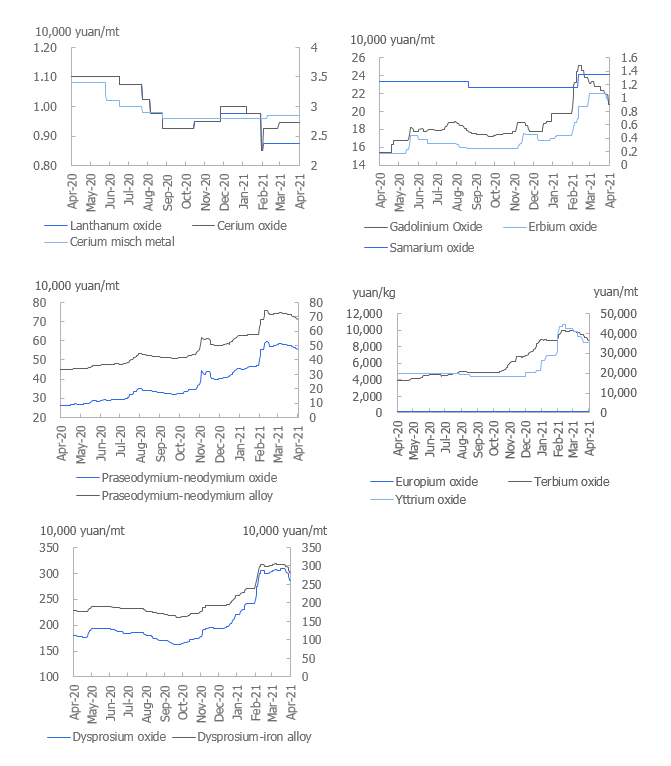

SHANGHAI, Apr 27 (SMM)—Rare earth prices were generally lower last week, with prices of many products including praseodymium-neodymium, terbium, dysprosium, and holmium down from a week ago, and transaction atmosphere cooled down significantly. Prices of praseodymium-neodymium oxide showed signs of stabilising, while prices of praseodymium-neodymium metal remained weak amid muted trades. Prices of terbium and dysprosium found no support and market participants generally hoped that large enterprises would stockpile. Prices of gadolinium and holmium diverged. Gadolinium received brisk inquiries, while holmium saw quiet trades. Prices of praseodymium were largely stable , while prices of neodymium continued to decline amid sluggish transactions.

In terms of light rare earth, praseodymium-neodymium oxide was quoted at 552,000-558,000 yuan/mt as of April 23, while mainstream traded prices were 550,000 yuan/mt, and some transactions were done below 550,000 yuan/mt, and the weekly average price fell 2.41% from a week ago. Neodymium-praseodymium metal was offered at 680,000-685,000 yuan/mt, with the weekly average price down 2.99%, and some sellers made offers at 670,000 yuan/mt for shorter payment period and 690,000 yuan/mt for longer payment period. Praseodymium oxide was offered at 535,000-540,000 yuan/mt, with the weekly average price up 1.23%, and mainstream traded prices were 535,000 yuan/mt. Neodymium oxide was offered at 556,000-560,000 yuan/mt, with the weekly average price down 3.18%, and some companies said buyers showed no interest even at 550,000 yuan/mt. Prices of lanthanum oxide and cerium oxide were relatively stable.

In terms of medium and heavy rare earth, europium oxide was offered at 190,000-200,000 yuan/mt as of April 23, with a slight increase in inquiries and few spot cargoes available in the market. Terbium oxide was offered at 8.7-8.8 million yuan/mt, with the weekly average price down 4.11%, and major producers had low willingness to make offers, with the low-end price around 8 million yuan/mt. Dysprosium oxide was offered at 2.86-2.88 million yuan/mt, with the weekly average price down 4.9%, and the low-end price around 2.8 million yuan/mt. Holmium oxide was offered at 820,000-870,000 yuan/mt, with the weekly average price down 4.64%, and traded price at 800,000 yuan/mt, with very few transactions. Price of gadolinium oxide rebounded, and producers were reluctant to sell at below 200,000 yuan/mt.

Mines reported poor sales. Separation plants and metal factories were cautious in making quotations and held offers firm, while traders were more willing to sell. Magnet material companies went bargain hunting.

According to SMM's survey, magnetic materials companies are still generally taking a wait-and-see stance. Some mid and high-end NdFeB manufacturers expanded production in April as downstream orders continued to improve. Some metal factories said that the recent price increase of gadolinium iron may be due to improving orders from mid and low-end magnetic materials companies. A few large rare earth permanent magnet traders said their new orders fell slightly recently, but orders on hand have been fully booked until July-August. The inventories of magnetic material companies range from half a month to two months. It is difficult to predict when magnetic material companies will make concentrated purchases.

Trades in the rare earth market are expected to be thin this week due to approaching Labour Day and upcoming announcement of China Northern Rare Earth (Group) High-tech’s selling prices for May. Prices of neodymium-praseodymium may remain hover around 550,000 yuan/mt, with limited downside room. In the absence of purchase by large companies, prices of terbium and dysprosium are likely to continue to weaken. Prices of gadolinium products are expected to rise slightly, while those of holmium are expected to inch lower. Prices of other rare earth products are likely to be largely stable.