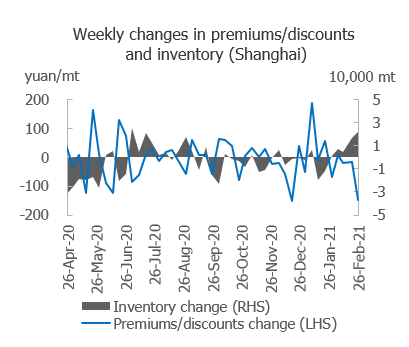

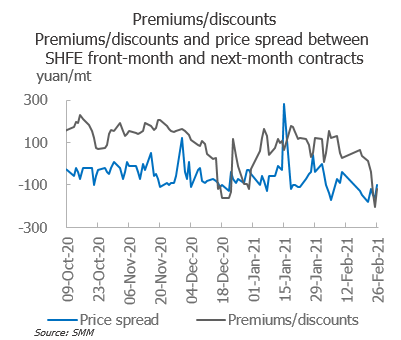

SHANGHAI, Mar 2 (SMM)—Spot premiums in Shanghai rose to 70 yuan/mt on February 18 from zero ahead of CNY due to costs during CNY holidays. However, spot premiums turned into wide discounts as of February 25 as SHFE copper prices surged, which stood at around 250 yuan/mt, a decline of nearly 460%. This signified that investors were selling aggressively to generate cash amid cash flow issues. Downstream inquiries were brisk but sellers refrained from lowering their quotes, with spot discounts stabilising between 150-140 yuan/mt.

Downstream buying interest in Shandong and surrounding areas was significantly depressed after SHFE copper prices surged nearly 10,000 yuan/mt. Under the capital pressure, smelters lowered spot discounts from around 70 yuan/mt to below 200 yuan/mt at the end of the week. But trades failed to improve, which were subdued except for long-term contracts. In this scenario, stocks at traders accumulated slightly. Spot quotes are likely to fall further should SHFE copper prices rise further.

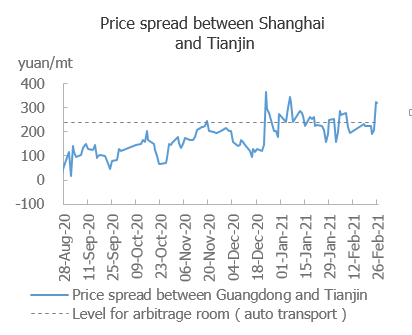

In north China, spot premiums trended lower last week. Spot copper was quoted with discounts of 210-170 yuan/mt, or an average discount of 190 yuan/mt, on February 19, and was quoted with discounts of 470-410 yuan/mt, or an average discount of 440 yuan/mt on February 26, down 250 yuan/mt. Most of the downstream buyers stood on the sidelines as copper prices rose sharply. Some of the plants have postponed production resumption until March. Some of the sellers were forced to lower spot premiums significantly due to cash flow issues at the month-end, but trades remained subdued. Spot quotes are expected to rise in early March as this situation improves.

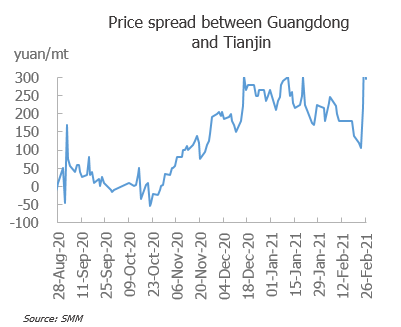

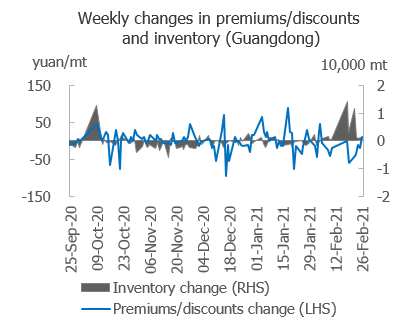

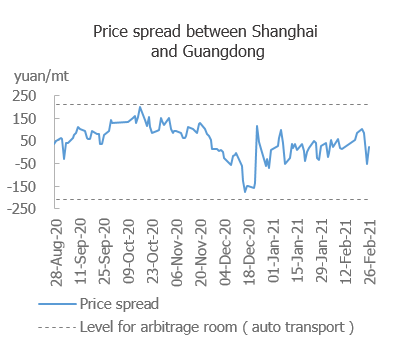

In Guangdong, spot quotes continued to trend lower last week, driven by continued inventory accumulation and the surge in copper prices. As of February 26, spot discounts for high-quality copper fell 50 yuan/mt from February 19 to 70 yuan/mt, and discounts for standard-quality copper stood at 220 yuan/mt, a decline of 140 yuan/mt. Hydro-copper was quoted with discounts of 260 yuan/mt, down 130 yuan/mt from a week earlier. On Friday, the price spread between the price spread on standard-quality copper between Shanghai and Guangdong widened 80 yuan/mt to 70 yuan/mt, leaving no opportunities for cargo transfer.

As of February 26, total inventories in Guangdong stood at 67,000 mt, an increase of 15,700 mt from February 19. Arriving shipments stood at 28,900 mt last week, well above the weekly average 18,200 mt for 2020, driven by concentrated arriving shipments post-CNY, around 80% of which were domestic copper. Shipments from Guangdong stood at 13,100 mt, well below the weekly average of 18,100 mt for last year. The surge in copper prices sidelined downstream buyers, purchasing as required. Most of the plants have kept operating rates at low levels. We expect copper prices to hover rangebound at high levels this week. As such, downstream consumption should pick up. Lesser shipments arrivals combined with improved downstream consumption should slow inventory accumulation this week, bolstering spot quotes.