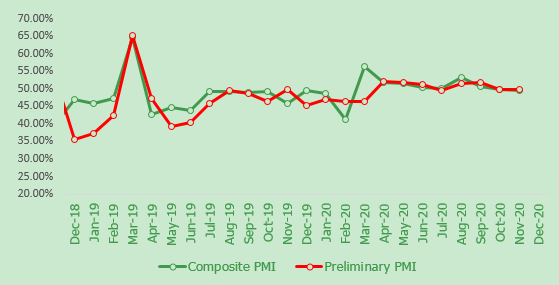

SHANGHAI, Dec 1 (SMM) – SMM data showed that the purchasing manager's index (PMI) for downstream nickel industries, including stainless steel, electroplating, alloy and battery, stood at 49.55 in November, down 0.13 points from a month ago. A reading below 50 indicates a contraction.

Production sub-index in contractionary territory, large-scale stainless steel factory in North China changed 300 series to 400 series

The composite sub-index for production in November was down 3.08 points from a month ago at 47.78, falling into the contraction range. The production sub-index in the stainless steel sector stood at 45.71. With the change of market conditions, the profit level of the 400 series is obviously higher than that of the 300 series in the month, and a large stainless steel factory in North China has changed the steel series. The production sub-indexes of other sectors are all in expansionary territory, but stainless steel still has an overwhelming advantage in domestic primary nickel consumption, so the sub-index falling into the contraction range mainly related to the stainless steel sector. In the electroplating sector, the production sub-index stood at 58.49%. Although there is still a gap in the output compared with last year, production has reached the highest level in the year, and even a small number of large electroplating plants in South China are adding new production lines for more orders.

New orders sub-index turning to expansion with good performance of orders in the electroplating sector

The overall sub-index for new orders across downstream nickel sectors rose 1.38 points on the month to 50.6 in November, turning to expansion. The stainless steel sector stood around 50, and the new orders sub-index of other sectors stayed in expansion. The overall sub-index for new orders was slightly higher than 50. The new orders sub-index in the stainless steel sector came in at 50, staying in expansion. After the weakening of orders in October, the sales pressure of 300 series cold-rolled coils continued in November. In the electroplating sector, the new orders sub-index stood at 58 and new export orders sub-index stood at 51.17%. Although the pandemic abroad still inhibits exports, there are still stable orders from Europe and America in the fields of hardware, sanitary ware and automobiles, while domestic demand in other fields is better than that in the early stage.

Raw materials inventory sub-index remained in contraction, with sluggish procurements of stainless steel mills

The composite sub-index for raw materials inventory in November gained 0.61 point month on month to 48.79, remaining in contraction. The raw materials inventory sub-index in the stainless steel sector stood at 48.1%, remaining in contraction as well. The obvious increase of stainless steel sales pressure mainly occurred in October, but the continuous price reduction by large stainless steel plants took place in November. The intensification of market competition between steel mills and the competition between steel mills and raw materials end for profits led to price reduction. Other sectors performed relatively well, such as the alloy sector. In November, most alloy factories actively restocked at low prices, and domestic social stocks of refined nickel declined sharply. The purchasing volume sub-index in the stainless steel sector stood at 54.38 in November, and the raw materials inventory sub-index came in at 54.82, both higher than that of October.

Finished goods inventory sub-index was still in expansion

The overall sub-index for finished goods inventory rose 3.3 points on the month to 50 in November, staying in expansion. The finished goods inventory sub-index in the stainless steel sector stood at 50 in November. With high output of stainless steel, the consumption of downstream products was also stable, leading to stable stainless steel inventories. The finished goods inventory sub-index of other sectors were also stable in November.

For more information on the Chinese domestic nickel market, please subscribe to China Nickel Weekly.