SMM: recently, Jianrui Wareng released its semi-annual report for 2020, the company realized revenue of 16.6985 million yuan in the first half of the year, down 92.86% from the same period last year; the net profit was a loss of 48.96 million yuan, compared with a loss of 1.829 billion yuan in the same period last year.

Jian Ruiwoneng said that the company's restructuring plan was successfully implemented in the first half of the year, and through judicial restructuring, the company completely eliminated its debt burden and optimized its asset-liability structure. Compared with the same period last year, the scope of the merger has changed greatly due to the bankruptcy liquidation procedures of Shenzhen Watma Battery Co., Ltd. in 2019 and the judicial auction of the equity of Daming Technology Co., Ltd. the corresponding income, costs, expenses, impairment losses, liquidated damages and so on have been greatly reduced.

The battery network learned that the main products of Jianrui Woneng are 32700 small cylindrical lithium iron phosphate batteries. Before the reorganization, the company has the cell capacity of 13GWh, which is the largest small cylindrical iron phosphate cell production capacity in the country; after the reorganization, the company has quickly resumed the production of high quality 4GWh capacity in the two factories, and is still in the leading position in the small cylindrical phosphate core manufacturers. Large-scale production can ensure the consistency and stability of product quality, at the same time, it can give full play to the advantages of scale and obtain lower material procurement cost and production cost. The small cylindrical battery has a high degree of standardization, a more mature process, a high degree of automation of production equipment and fewer personnel, and the scale effect in mass production will be more obvious.

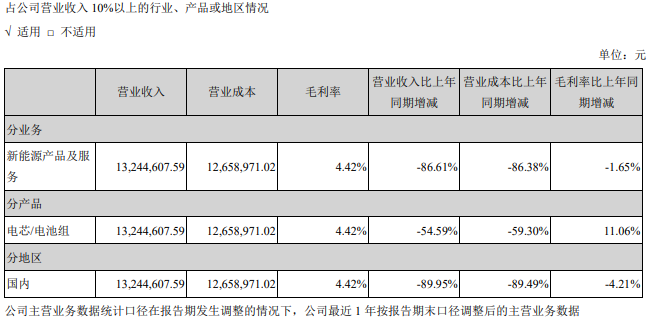

According to the semi-annual report, in the first half of the year, in terms of cell / battery products, Jianruiwoneng achieved operating income of 13.2446 million yuan, down 54.59% from the same period last year.

In addition, in the process of judicial restructuring, Jianrui Woneng successfully introduced Changde ZTE into the master. Gao Baoqing, the actual controller of Changde ZTE, is the actual controller of the company (a single major shareholder) and has successful enterprise management experience. He has been engaged in chemical technology, warehousing management, business planning and comprehensive management in large state-owned chemical enterprises.

Gao Baoqing joined Hunan Zhongli New Materials Co., Ltd. (hereinafter referred to as Hunan Lithium) in 2012 as the general manager of Hunan Lithium, and was fully responsible for the operation of Hunan Lithium in 2013, Jian Ruiwoneng said. In four and a half years, she turned an indebted enterprise into profit.In 2017, Changyuan Group, a domestic main board listed company, made a bid of 2.4 billion yuan to acquire Hunan Zhongli. Gao Baoqing has strong capital strength, provides financial support for the development of the enterprise, and has the profound resources of the new energy vehicle industry chain to provide guarantee for the development of the company. at the same time, familiar with the company's newly introduced management team and the original Watma management personnel, the strategic planning of the company was designed and completed in a short time, and has gone deep into the daily management of the company.

On the evening of August 19th, Jianrui Woneng also announced that in order to meet the needs of strategic planning and business development after the restructuring of the company, the company plans to change its name to "Baoli New Energy Technology Co., Ltd." for short, it will be changed to "Baolixin". The company's securities code remains unchanged, still "300116". The registered capital of the company was changed from 4.5 billion yuan to 4.281 billion yuan.

Click to understand and sign up for the 2020 China Automotive New Materials Application Summit Forum.

Scan the QR code above to view the business cards of the participating companies and sign up online

Scan the QR code and follow the official account of Wechat, a new energy source of SMM, cobalt and lithium.