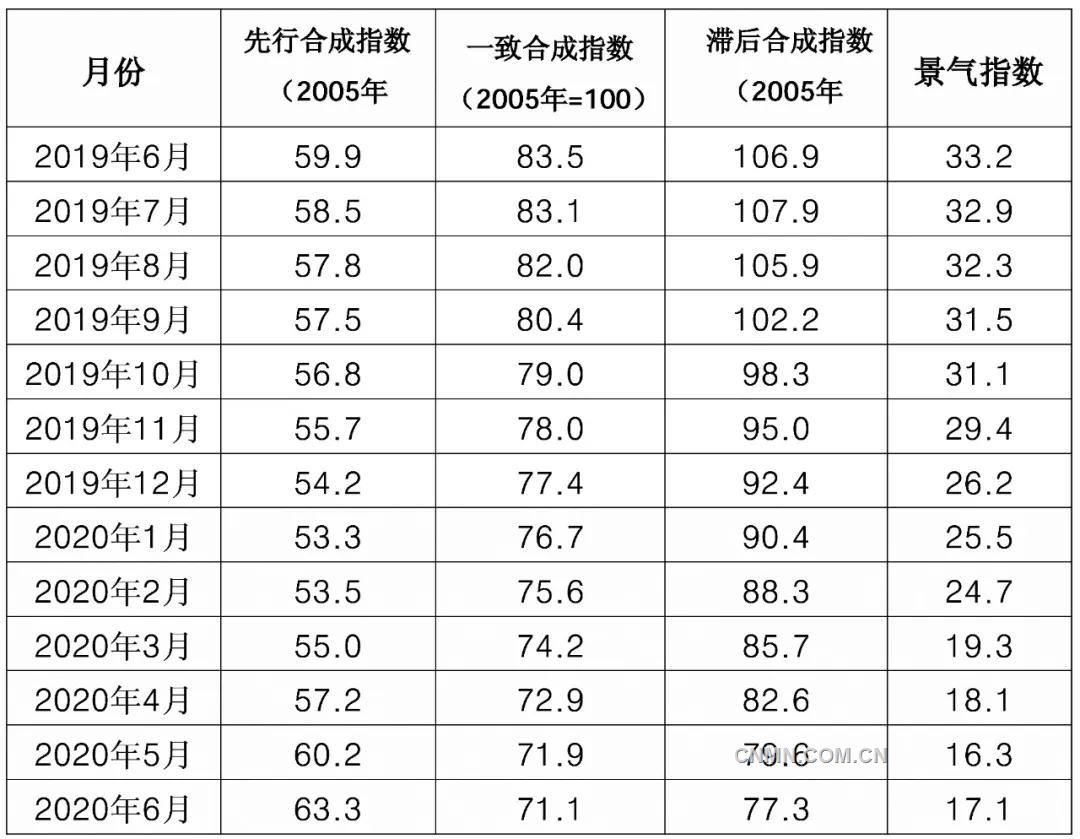

SMM News: table 1 Prosperity Index of China's Aluminum smelting Industry in recent 13 months

In June, the climate index of China's aluminum smelting industry was 17.1, up 0.8 points from the previous month, and the leading composite index was 63.3, up 3.1 points from the previous month. The prosperity index of China's aluminum smelting industry in the past 13 months is shown in Table 1. The monitoring results of the model show that the industrial climate index is still in a "cold" range in June, but shows a strong upward trend; the leading composite index has risen for many months in a row, showing a momentum of economic recovery. However, combined with the development stage of the global COVID-19 epidemic and the supply and demand fundamentals of the domestic aluminum smelting industry, the foundation of continuous improvement of prosperity remains to be consolidated.

The prosperity index is in the cold area.

Showing a strong upward trend

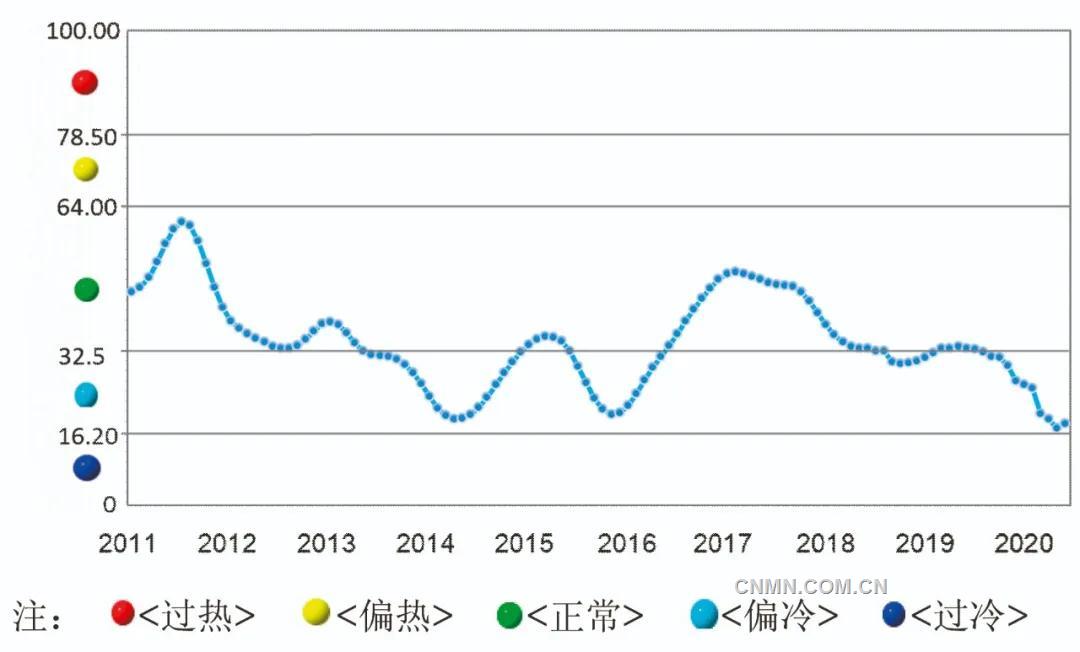

In June, the climate index of China's aluminium smelting industry rose 0.8 points from a month earlier to 17.1, the first time it had stopped falling and rebounded in nearly 13 months. The monthly prosperity index of China's aluminum smelting industry is shown in figure 1.

Fig. 1 trend chart of prosperity index of aluminum smelting industry in China

It can be seen from the boom signal light of China's aluminum smelting industry (see Table 2) that in June, among the 10 indicators that make up the industry climate index, LME aluminum settlement price, total aluminum smelting investment, commercial housing sales area, power generation, alumina output, main business income, total profits and total aluminum export volume are in the "cold" range; M2, electrolytic aluminum output and other two indicators are in the "normal" range. Although the LME aluminum price index is still in the "cold" range, domestic aluminum prices continue to show a strong upward trend, which is expected to lead the domestic electrolytic aluminum industry to make considerable profits.

Table 2 Prosperity signal light of China aluminum smelting industry

The rebounding range of the leading composite index continues to grow.

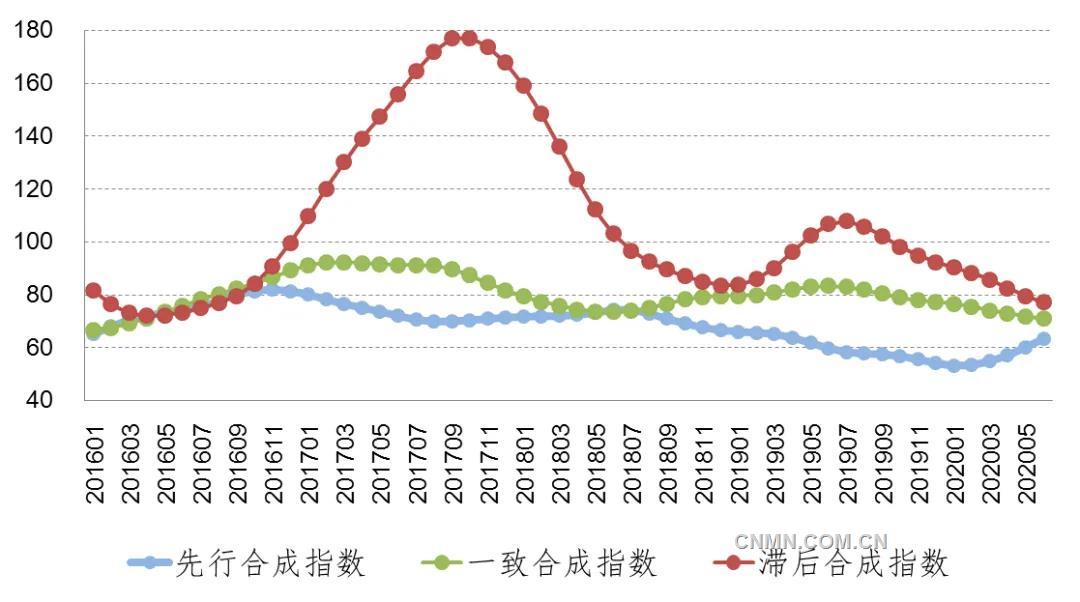

In June, the leading composite index of China's aluminum smelting industry was 63.3, rebounding for the third month in a row since April, rising 3.1 from the previous month, an increase of 0.1 points over the previous month. The composite index curve of China's aluminum smelting industry is shown in figure 2.

Fig. 2 Composite index curve of China's aluminum smelting industry

After quarterly adjustment, the five indicators that make up the leading composite index rose by 4 and fell from the previous quarter, of which M2, total investment in aluminum smelting, sales area of commercial housing and electricity generation increased by 1.2%, 4.8%, 0.7% and 0.2% respectively, and the LME aluminum settlement price decreased by 2.5%. Compared with the same period last year, the total investment in M2 and aluminum smelting increased by 11% and 14.5% respectively, and the settlement price of LME aluminum, the sales area of commercial housing and electricity generation decreased by 18%, 9.6% and 0.4%, respectively.

Analysis on the Operation characteristics and situation of the Industry

In June, the overall operation of the domestic aluminum smelting industry showed the characteristics of an increase in supply, an improvement in domestic demand, a decline in exports, a slow decline in inventory, a rise in aluminum prices, an increase in profits, and so on.

(1) overall increase in the supply of aluminum smelting products

1. The operating capacity showed an increasing trend, and the output increased compared with the previous month.

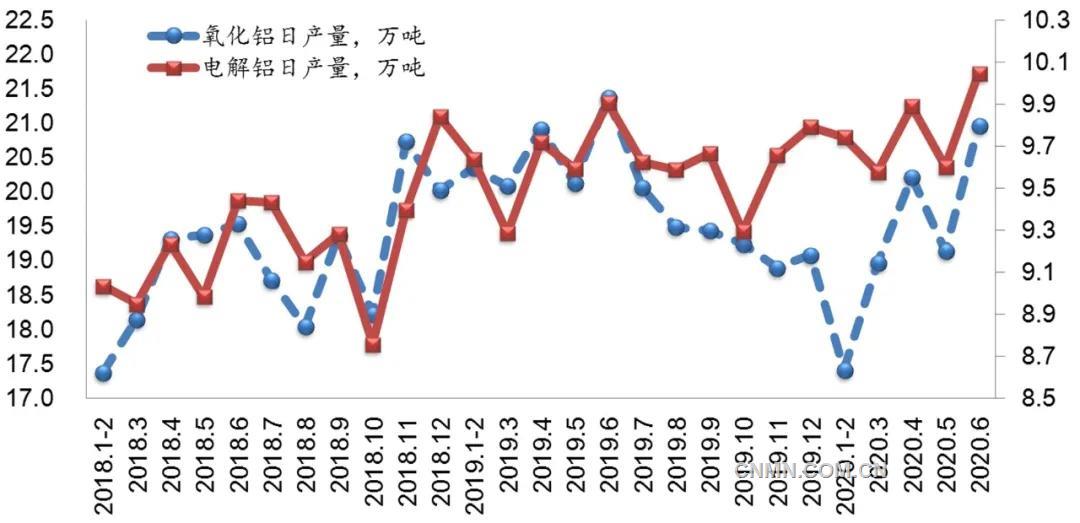

In June, the continuous rise in aluminum prices increased the operating capacity of electrolytic aluminum by about 400000 tons compared with the previous month; to a certain extent, the slow rise in alumina prices led to a small increase in alumina operating capacity in the northern region, and the national alumina operating capacity increased or decreased in parallel, and the overall operating rate was still low. In June, the monthly output of electrolytic aluminum was 3.02 million tons, with an average daily output of 100000 tons, up 4.6 percent from the previous month and 1.4 percent over the same period last year; alumina monthly output was 6.29 million tons, with an average daily output of 210000 tons, up 9.6 percent from the previous month, down 1.9 percent from the same period last year. The change of monthly average daily output of electrolytic aluminum and alumina in China is shown in figure 3.

Fig. 3 changes of monthly average daily output of alumina and electrolytic aluminum in China

two。 The price of the product is strong inside and weak outside, and the import volume increases.

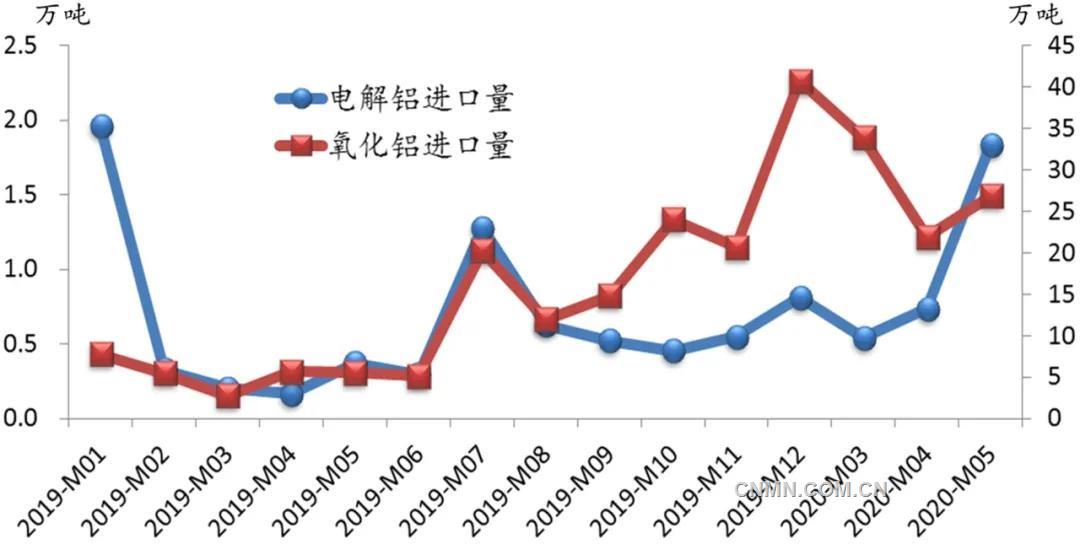

In June, aluminum prices continued to be strong inside and weak on the outside. The average three-month contract price of Shanghai Aluminum was 13196 yuan / ton, up 5.1% from the previous month; the average price of the three-month main contract of Lun Aluminum was 1564 US dollars / ton, up 6.1% from the previous month. From the spot price level, the domestic spot ton aluminum price rose by more than 500 yuan; the foreign spot ton aluminum price discount is about 30 US dollars. Affected by this, China's electrolytic aluminum imports continued to maintain rapid growth, with imports of 18000 tons in May, an increase of 149.4% from a month earlier and an increase of 400.2% over the same period last year, and a large number of imports are expected to be maintained in June.

At the same time, due to the resumption of some overseas production capacity and other factors, China's alumina imports continue to maintain a trend of growth. Imports in May were 270000 tons, a month-on-month increase of 22.7% and a year-on-year increase of 387.7%, of which alumina from Australia accounted for 78.7%, and the domestic supply gap narrowed. The monthly import volume of alumina and electrolytic aluminum in China is shown in figure 4.

Fig. 4 change of monthly import volume of alumina and electrolytic aluminum in China

(2) the growth rate of aluminum demand is different at home and abroad.

1. Domestic consumption environment continues to improve

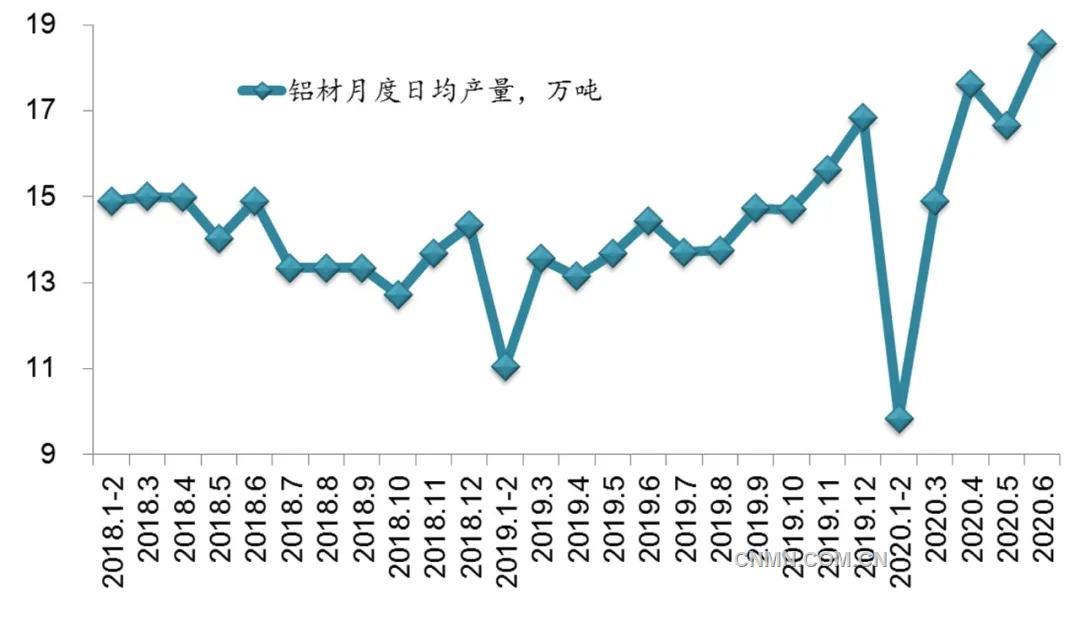

Compared with the first quarter of 2020, the growth rate of GDP in the second quarter changed from negative to positive at constant prices, with an increase of 3.2% over the same period last year. From a quarter-on-quarter point of view, after quarterly adjustment, GDP grew by 11.5% in the second quarter compared with the same period last year. The overall economy is showing a steady recovery. Among them, the effect of investment pull is relatively prominent, and real estate and infrastructure continue to maintain a high boom. In June, the national real estate industry was relatively well funded, the area of land purchase rebounded, sales gradually recovered, and the growth rate of new construction increased to 8.9%. In June, the automobile industry continued to pick up, with production and sales of 2.325 million and 2.3 million vehicles respectively, up 6.3 per cent and 4.8 per cent respectively from the previous month, and 22.5 per cent and 11.6 per cent respectively over the same period last year, both reaching record highs. In June, the national narrow infrastructure investment was subject to adverse factors such as the weather, and the growth rate fell 1.5 percentage points from the previous month to 6.8%. However, as the phased impact weakens, the effect of infrastructure investment will be further apparent. At the end of May, the cumulative investment in power grid projects decreased by 14.5 percentage points compared with the end of April (- 2.0%). It can be seen that with the improvement of the domestic epidemic situation, domestic aluminum consumption shows a restorative growth. In June, China's monthly aluminum production was 5.56 million tons, with an average daily output of 190000 tons, an increase of 28.4 percent over the same period last year and 11.4 percent month-on-month growth. The change of monthly average daily output of aluminum in China is shown in figure 5.

Fig. 5 change of monthly average daily output of aluminum in China

two。 The export environment of aluminum products is becoming more and more severe.

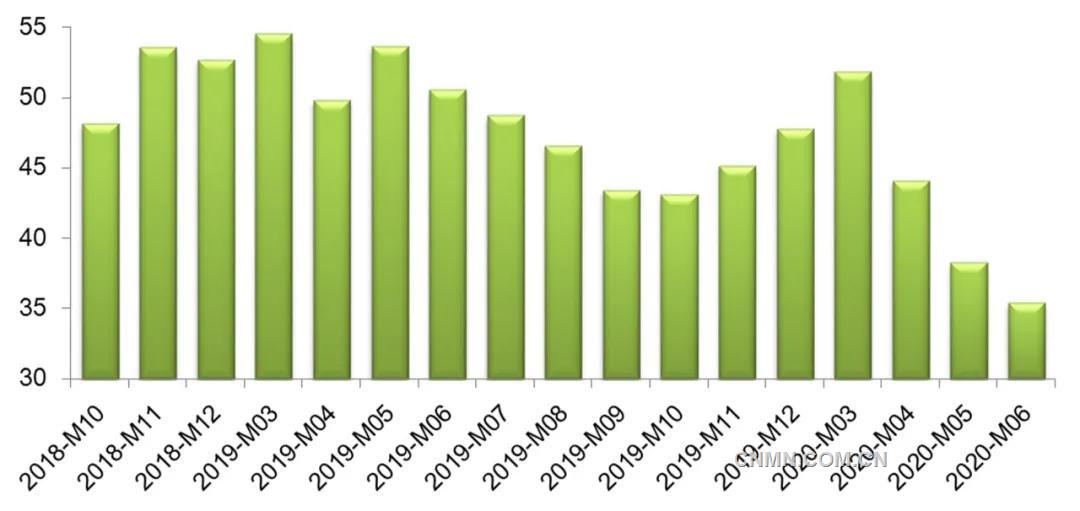

Affected by overseas epidemic and trade frictions, China's exports of unwrought aluminum and aluminum products have declined month by month since the end of the first quarter of 2020. In June, exports of unwrought aluminum and aluminum products fell to 350000 tons, down 31.4% from 510000 tons in the same period last year and 7.9% from 380000 tons in May this year. Exports fell to US $920 million, down 31.2% from US $1.34 billion in the same period last year and 7.1% from US $1 billion in May this year. From the perspective of major export markets, the decline in exports of Chinese aluminum products to Japan, South Korea and Southeast Asian countries such as Vietnam, Thailand and Indonesia continued to expand. In addition, in June, the Eurasian Economic Commission and India successively launched anti-dumping investigations on aluminum tableware, aluminum foil and other products; the European Aluminum Association issued a white paper accusing the development of China's aluminum industry of distorting the prices of European aluminum products and damaging the industrial chain as a result of subsidies, and called for corresponding measures to be taken as soon as possible. It can be seen that due to the impact of the epidemic, global trade frictions are becoming more and more intense, and the increasing momentum of trade protectionism in various countries highlights that the export situation of China's aluminum products will be more severe. The monthly export changes of unwrought aluminum and aluminum products in China are shown in figure 6.

Fig. 6 monthly export changes of unwrought aluminum and aluminum products in China

In June, under the superposition of domestic and foreign demand factors, aluminum social inventory continued to decline, from 860000 tons at the end of May to 700000 tons at the end of June, a monthly decline of 18.8 percent, but the rate of decline continued to narrow. The decline in June was 6.7 percentage points lower than that in May and 10.7 percentage points lower than that in April, which shows that the momentum of destocking has obviously slowed down.

(3) profitability in a large area of the whole industry

Benefiting from the continued rise in product prices, the aluminum smelting industry as a whole made a profit in May, including alumina, electrolytic aluminum and recycled aluminum, with a total profit of 750 million yuan and a sales profit margin of 1.4%. It is 0.8 percentage points higher than the cumulative sales profit margin of 0.6% in the previous five months, and the benefit is expected to further improve in June. From the perspective of sub-industries, the electrolytic aluminum industry has made a comprehensive profit, and the profit level is quite considerable, the average selling price of the product exceeds the full cost by more than 2000 yuan, and the price increase of alumina is less than that of electrolytic aluminum. the profit level of alumina enterprises in the north and south is different due to ore costs and other factors, the overall profit level of the industry is still low

To sum up, although the overall situation of the aluminum smelting industry has continued to improve recently, in view of the further increasing pressure on the supply of domestic aluminum products, domestic consumption is still in a state of recovery and the phenomenon of overdraft, coupled with the fact that the overseas epidemic situation has not been effectively controlled, the export of aluminum products may decline further, and the rate of destocking slows down significantly. Therefore, it is initially expected that the aluminum smelting industry will pick up rapidly in the "cold" range in the future, and will return to the "normal" range, but at the same time the foundation for continuous improvement needs to be consolidated.

"SMM online Q & A" has come to the market, price, information if you have any questions, feel free to ask!

Scan the QR code and join the SMM metal communication group.