SMM, May 20:

[analysis of Customs data in April]

According to customs data, in April 2020, China imported 153000 tons of lithium concentrate, down 18.8 percent from the same period last year, an increase of 17.9 percent from the previous month; the average import price was 458.7 US dollars / ton, down 34.1 percent from the same period last year, up 0.7 percent from the previous month; there was no import of lithium raw ore in April. Among them, the spodumene concentrate used to produce lithium salt was 130000 tons, up 12.5 percent from the same period last year and 18.5 percent from the previous year; the average import price was 457.7 US dollars / ton, down 32.5 percent from the same period last year and up 1 percent from the previous month. The price increase was mainly due to the relatively high import prices of some enterprises in April, slightly raising the average import price.

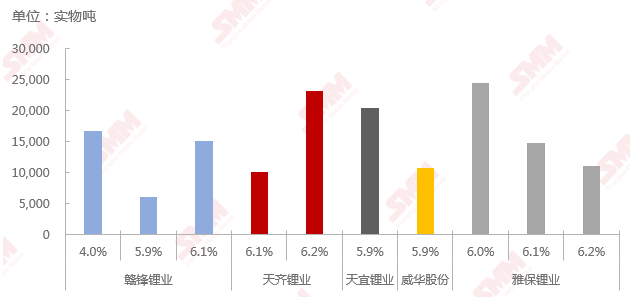

The following figure shows the import grade and quantity of lithium concentrate in April (some outliers have been excluded).

In April, the company that imported the largest amount of lithium concentrate used to produce lithium salt was Yabao Lithium Industry, which imported a total of 0.59 million tons of lithium concentrate. The second largest imported (CIF); was Ganfeng Lithium Industry, with a total import price of 0.45 million tons of lithium concentrate, with an average import price of 348.6 US dollars / ton. Considering that Tianqi, Ganfeng and Yabao prices are all long-term bargaining prices, excluding several import data, the average import price of lithium concentrate used to produce lithium salt in April was 448.3 US dollars per ton.

This month, Tianyi Lithium Industry and Weihua shares have imported lithium concentrate. Pilbara Minerals announced on March 25th that it had signed an underwriting agreement with Tianyi Lithium Industry for the Pilgangoora lithium-tantalum project in Western Australia. According to the agreement, Pilbara Minerals will supply up to 75000 tons of spodumene concentrate to Tianyi Lithium Industry every year for a period of five years. In August 2019, Altura announced that it had signed a binding underwriting agreement with Weihua, a Chinese lithium salt company, to supply Weihua with 50000 tons of lithium concentrate per year for the next five years. From the point of view of the two underwriting agreements, the original contract price has been adjusted accordingly based on the current market situation and the price of lithium carbonate; at the same time, although the number of underwriting is being carried out in accordance with the agreement, the pick-up time of the enterprise has been slightly delayed.

According to SMM understanding, the current overseas spodumene concentrate has a small amount of less than 400USD / ton transaction price; domestic ports are still stacked with a large number of spodumene ore, superimposed lithium carbonate shipment is not ideal, smelters also hold ore or lithium carbonate finished product inventory, spot transactions in the market are very few, the latest domestic port spodumene spot quotation in 2900 yuan / ton (including tax self-price increase).

From the point of view of the production cost of overseas mines, each mine currently adopts different strategies to maintain production operation. Due to severe financial pressure, Altura needs to control cash costs through technical / grade improvements and increase production and sales rates to maintain cash flow. Altura disclosed in its first quarterly report that its quarterly average cash cost has dropped to US $345 / tonne. (FOB), is currently the second lowest cost Australian miner, but it remains to be seen whether it can maintain low cash costs for a long time. Galaxy Resources, which has a relatively good cash flow, further controlled the mining operation rate, and its cash cost rose to $592USD / tonne (FOB) in the first quarter. From the observation of historical data, the production cost of the mine will fluctuate due to mining and mineral processing technology, mine grade, recovery rate, operating rate and so on. Cost optimization can be achieved in the short term, but long-term stability needs to be improved in many aspects. At present, the limited number of mines with cash costs below $400 / ton can provide some cost support for concentrate prices and lithium carbonate prices.

From the perspective of downstream smelting capacity and demand, due to weak demand and low prices, most of the new domestic smelters are in a state of production reduction and shutdown, new construction plans have been repeatedly postponed, and ore smelting capacity conversion is insufficient. Under the condition that the operating rate of the mine is controlled, the pressure of ore inventory will be transferred to the lithium salt plant in the future.