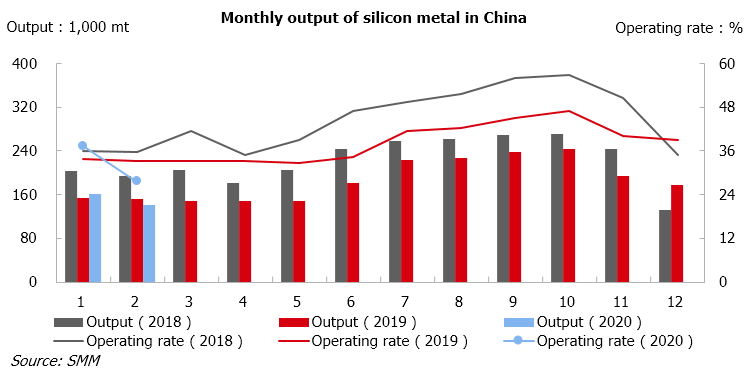

SHANGHAI, Mar 10 (SMM) – Operating rates across Chinese silicon metal producers fell to the lowest level since April 2016, standing at 27.5% in February, down 9.8 percentage points from a month ago and down 5.8 percentage points from a year ago, showed the latest SMM survey.

In early February, raw materials shortage due to suspended logistics and disrupted operations at mines weighed on production at silicon mills in Xinjiang, Sichuan, Guizhou and Heilongjiang. This outweighed ramped-up production in Fujian, Guangxi and Chongqing and accounted for the declines in overall operating rates in February.

Supply tightness of feedstock such as petroleum coke and coal, which was caused by the suspension of logistics, has eased as of March 9. However, silica and coal supply in Xinjiang and silica supply in Hubei have not improved, which could restrict the resumption of silicon production in Xinjiang and Sichuan in the near term. Silicon plants in Xinjiang cannot restart production immediately even as local mining of silica and coal resumes, as it requires some time for restarting a suspended submerged-arc furnace and the coronavirus (COVID-19) outbreak continued to affect the supply of explosives and the return of workers.

Some silicon producers in Nujiang, Yunnan province usually resume production in early March each year, but the epidemic and desulphurisation issues kept them shut as of March 9. These plants are expected to reopen in late-March if they obtain approvals from the environmental authorities. SMM expects the operating rates of silicon metal producers in China to remain at around 27% in March.

SMM data showed that China’s production of silicon metal stood at 141,000 mt in February, down 7.6% on a yearly basis. Silicon metal output in January-February shrank 1.6% on the year to 301,000 mt.

![Spot Market and Domestic Inventory Brief Review (February 12, 2026) [SMM Silver Market Weekly Review]](https://imgqn.smm.cn/usercenter/tSwaX20251217171735.jpg)

![Silver Market Price Review and Expectations Brief Commentary (February 12, 2026) [SMM Silver Market Weekly Review]](https://imgqn.smm.cn/usercenter/YKilH20251217171735.jpg)

![Platinum prices were in the doldrums during the day, with a strong holiday atmosphere and relatively sluggish spot trading. [SMM Daily Review]](https://imgqn.smm.cn/usercenter/gpWpd20251217171734.jpeg)