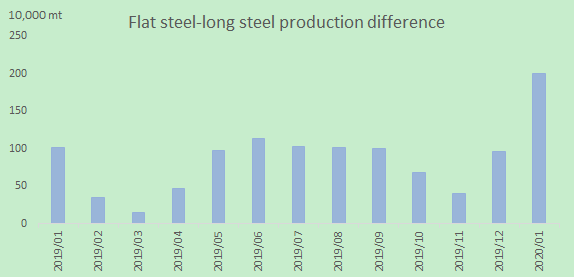

SHANGHAI, Jan 9 (SMM) – Chinese steelmakers are sharply stepping up production of flat products but trimming that of long products this month, as flat steel enjoys wider profit margins.

The latest SMM survey showed that Chinese steelmakers plan to produce 9.71 million mt of hot-rolled coils and plates in January, up 5.32% from the realised output in December. January’s flat steel output increase is larger than that in December, pointing to mounting supply pressure. About 427,000 mt would be exported, up 5.4% from a month earlier, and volumes slated to enter domestic markets are likely to increase 5.3% to 9.28 million mt.

Planned production of long steel, including rebar and wire rods, however, will shrink 2.1% from December to 10.69 million mt, according to the SMM survey. Output for domestic sales is planned at 10.42 million mt this month, down 1.98% on the month, with scheduled exports also lower by 6.8% to 275,000 mt.

Chart: Flat steel-long steel production difference (Source: SMM)

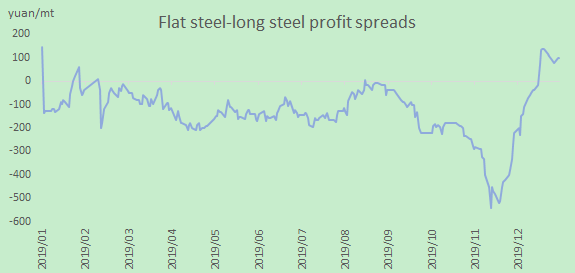

Rebar was more profitable than hot-rolled coil for much of the past year. The rebar-HRC profit spread peaked in late November as prices of construction steel jumped on certain product supply shortages, which prompted some mills to cut production of flat products and shift to long products.

Strong supply, coupled with seasonally weakening demand, later led to a pullback in prices of long steel however. Prices of long steel have been on the decline since late December, while those of flat steel have been firm, supported by supply shortfalls. This drove HRC profits to exceed those on rebar, and encouraged steelmakers to recover flat steel production.

Chart: Flat steel-long steel profit spreads (Source: SMM)

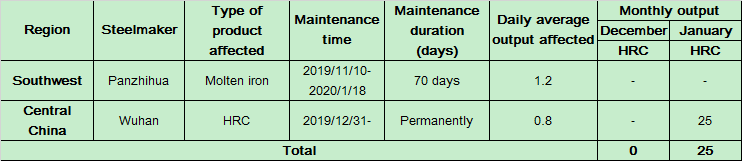

On the back of the divergence in profits between flat and long products, more long steel producers chose to conduct maintenance this month, while there is barely any maintenance scheduled at flat steel producers. Driven by enticing profits and healthy orders, flat steel mills will operate at full capacity this month and some even plan to put additional blast furnaces into operation to help ramp up production.

With end-user demand grinding to a halt ahead of the Chinese New Year holiday which falls in late January this year, spot prices of flat steel are set to weaken amid high supply. Prices of long steel, meanwhile, are expected to hover in a tight range on weakness in both demand and supply.

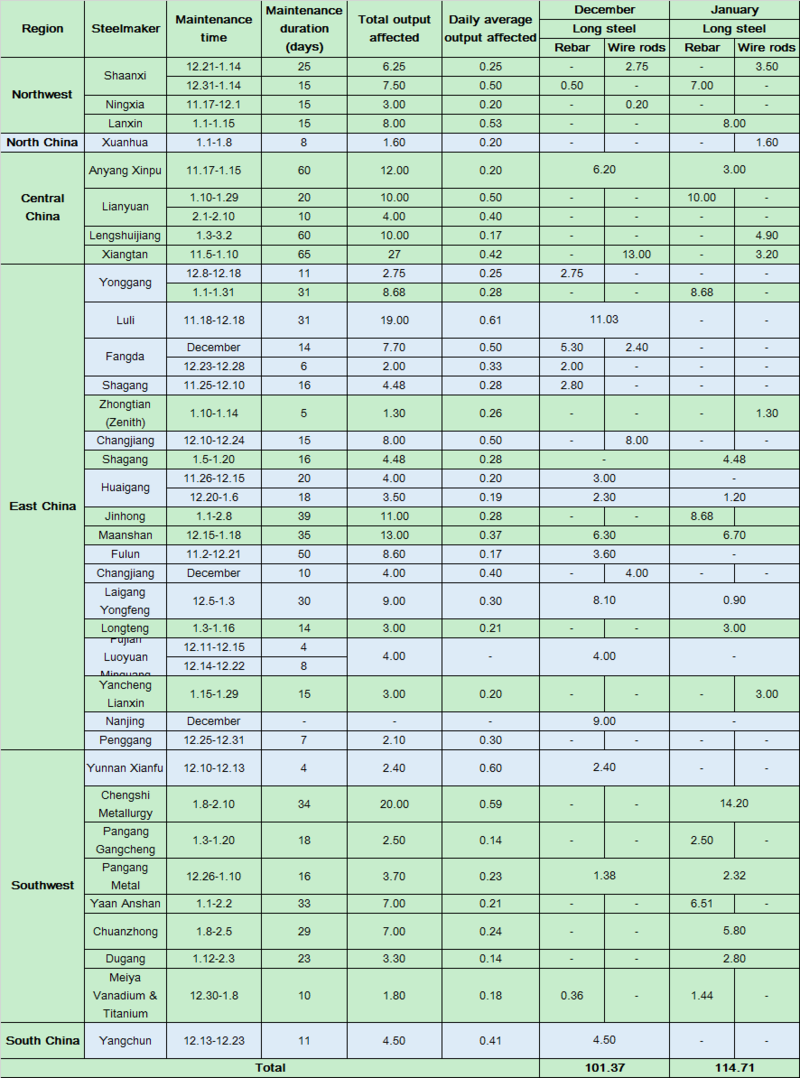

Chart: Maintenance at flat steel mills or facility shutdown (10,000 mt)

Chart: Maintenance at long steel mills (10,000 mt)