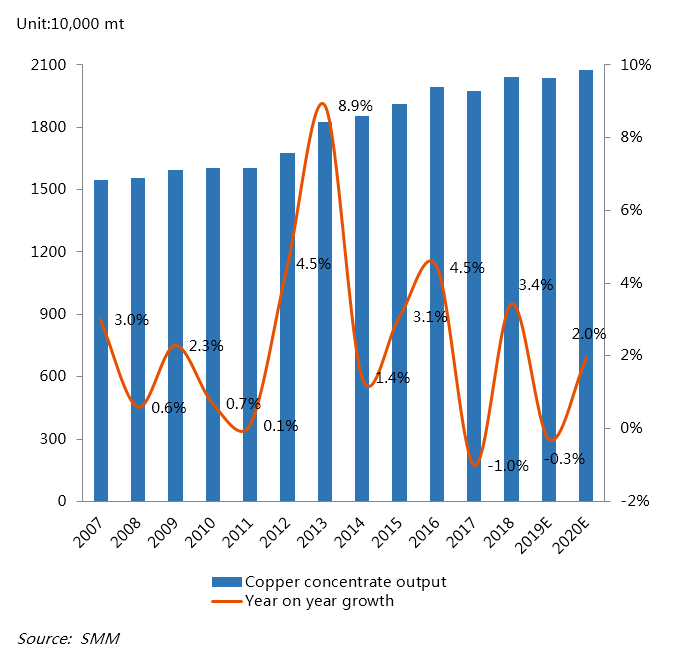

SHANGHAI, Nov 7 (SMM) – Copper raw material market has yet to see a shortage of supply, despite tightness, said Ye Jianhua, senior copper analyst at SMM, estimating a low growth rate of 2% for the global production of copper ore in 2020.

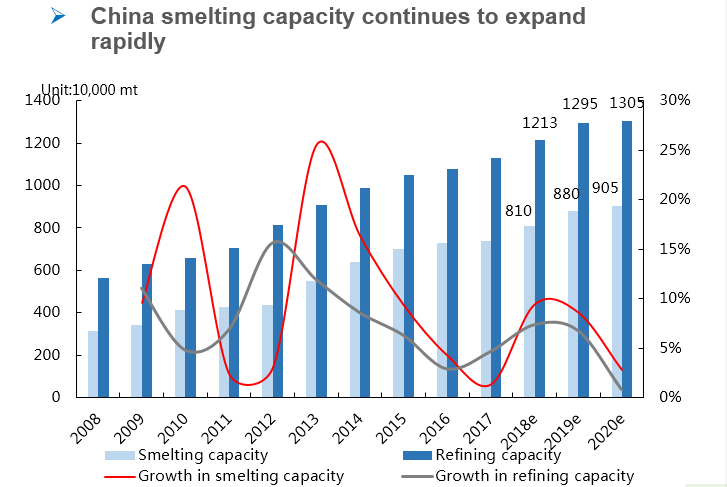

China accounted for most of the global greenfield and brownfield copper smelting projects in recent years, Ye told delegates at the South China Metals Summitc 2019, organised by SMM in Foshan of Guangdong province on November 7.

High treatment charges/refining charges (TC/RCs) and the aim to lift domestic copper self-sufficiency rate was behind the expansion of smelting capacity in China.

While TCs for spot copper concentrate came off from highs this year, domestic smelters were not affected significantly, said Ye, citing stable TCs under long-term contracts, which stood at $80.8/mt and secured profits at domestic large major smelters.

The analyst added that TCs under long-term contracts in 2020 between Chile’s Antofagasta, Jiangxi Copper and Tongling Nonferrous Metals stood at around $65/mt, well below $80.8/mt in 2019. This will be a reference for long-term contract TCs next year in China.

Customs data showed that China’s year-to-date copper concentrate imports through September rose 7% from a year ago, suggesting that concentrate supply is not yet in deficit.

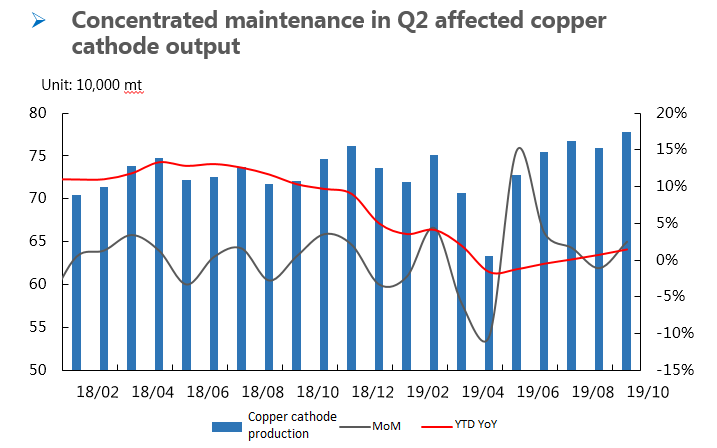

Domestic supply of copper cathode, meanwhile, was restrained by a shortage of blister copper and scrap, as well as environmental issues, Ye believed.

Closure and production cuts at medium-sized and small copper refineries since the second half of 2018 tightened the supply of blister copper, he said. Blister copper imports also shrank, by nearly 20% from a year ago in 2019.

As the world’s largest copper producer, China saw its refined copper output at 8.73 million mt in 2018, 40% of the global production. Strong domestic demand kept the net imports above 3 million mt last year.

The market share of refined copper produced from recycled materials narrowed to 16% in 2018 from 37% in 2008, pressured by the expansion of primary copper capacity and the government intensified controls on pollution and waste imports.

SMM cut its estimates for annual output additions of refined copper in China, to 300,000 mt, due to greater impact of maintenance, slower-than-expected release of new capacity and accidents at some smelters.

According to SMM data, China produced some 8.73 million mt of refined copper in 2018, a rise of 9.1% from the previous year.

Slower growth in copper cathode production and tight raw materials supply will continue to support copper prices, but unable to trigger a price rally, said Ye.

He expected demand for copper scrap in China unlikely to continue to be replaced by copper cathode, which will not make copper scrap the key factor to reverse copper fundamentals.

On the inventory front, destocking in China occurred mostly in the second quarter when a slew of smelters undertook maintenance, Ye said. But the inventory draw was mostly driven by lower supply rather than strong consumption.

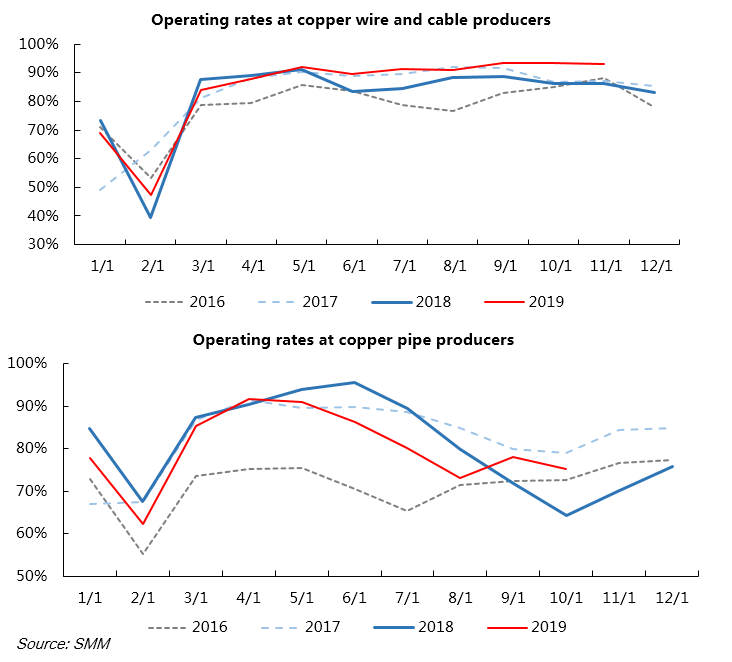

Copper consumption will remain sluggish in the fourth quarter, with operating rates across key downstream producers, including copper wire, cable, pipe and rod, standing lower from a year ago, according to SMM surveys.

Consumption will also receive limited support from the power investment, property market, and car sales for the rest of the year, Ye cited official data.