Panorama of Aluminum Inventory During the Double Holiday: Mild Overall Buildup with Significant Regional Divergence

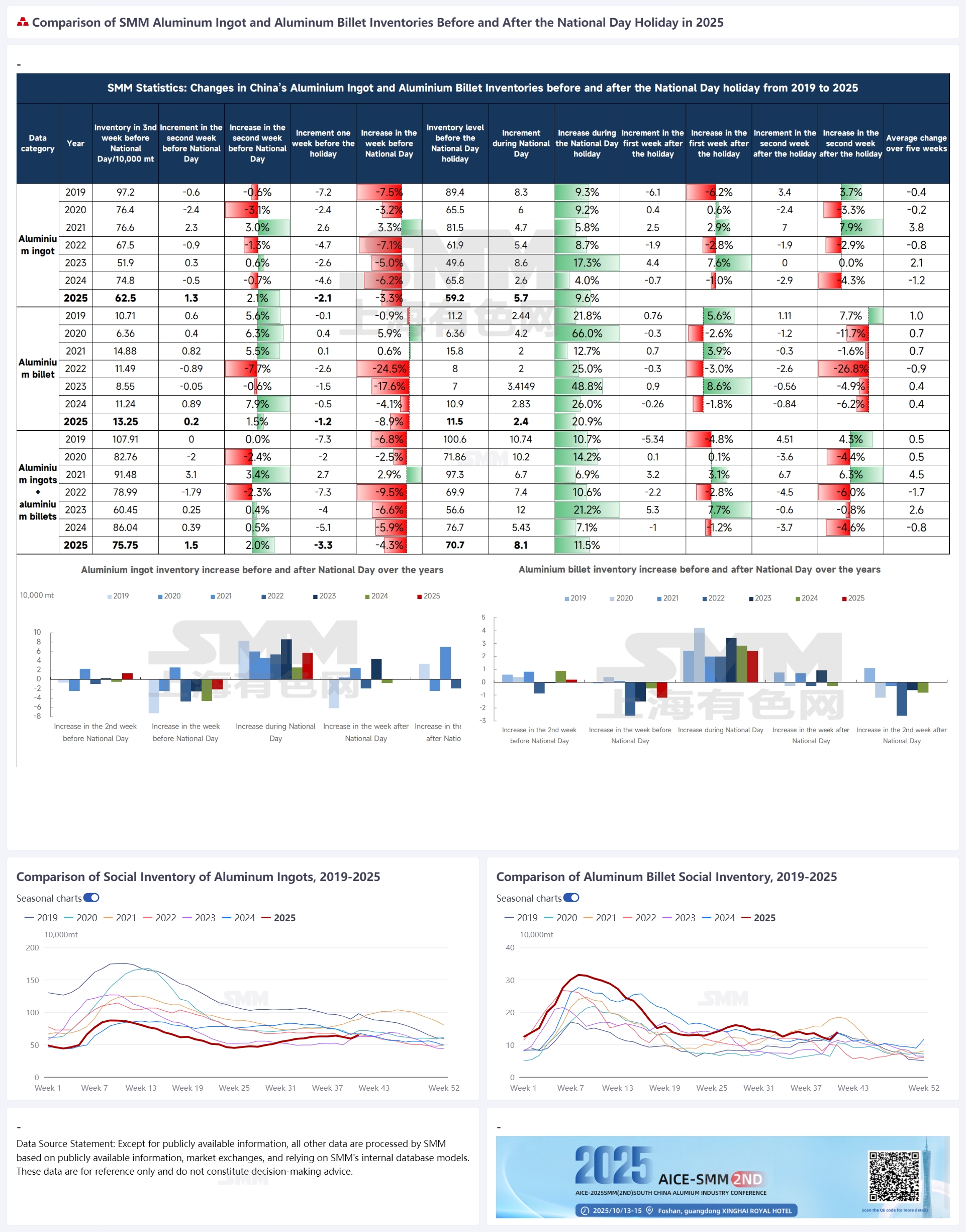

Following the 8-day Double Holiday, SMM monitored changes in China's aluminum ingot and aluminum billet inventories before and after the National Day holiday. In 2025, domestic aluminum ingot inventory increased by a total of 57,000 mt, up 9.6%, while aluminum billet inventory rose by 24,000 mt, up 20.9%. Combined aluminum ingot and billet inventories accumulated by 81,000 mt, an increase of 11.5%. The inventory buildup generally aligned with pre-holiday expectations, with no surprises. In early October, the domestic aluminum industry chain inventory exhibited the core characteristics of "controllable total volume and regional divergence," as detailed below:

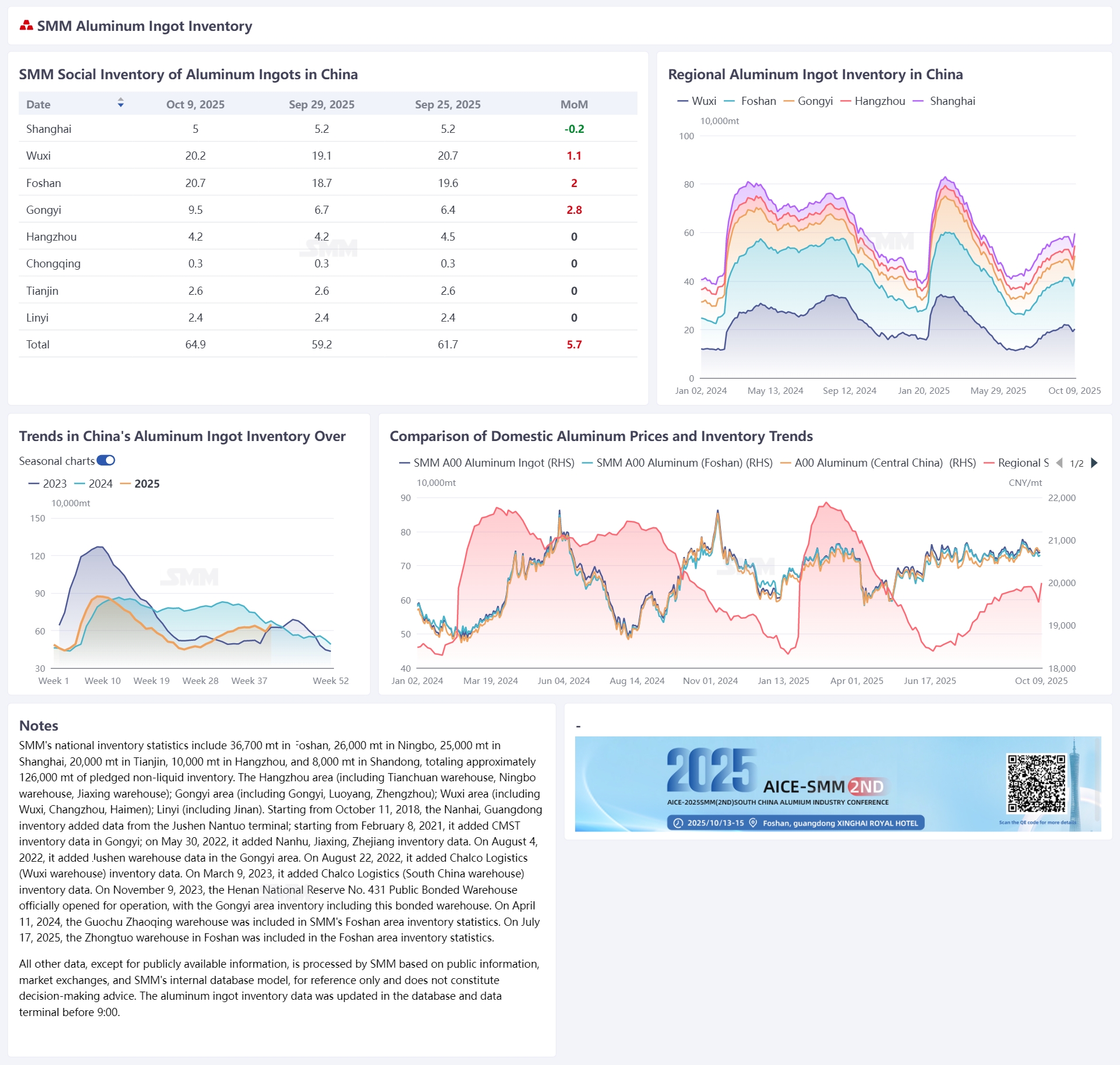

Aluminum Ingot Inventory: Holiday Inventory Buildup Falls at the Lower End of Expectations

Following the extended holiday, SMM statistics show that aluminum inventory in mainstream consumption areas in China reached 649,000 mt on October 9, increasing by 57,000 mt compared to pre-holiday levels (September 29). On a YoY basis, inventory decreased by 28,000 mt compared to the same period last year but increased by 23,000 mt compared to the same period in 2023. SMM believes that the 57,000 mt inventory buildup during this year's 8-day holiday was basically in line with, or slightly lower than, the pre-holiday expectation of 60,000-80,000 mt, which may have a positive impact on maintaining relatively strong aluminum prices post-holiday. The 9.6% increase in inventory is at an average level over the past six years.

By region, Gongyi saw a holiday buildup of 28,000 mt, exceeding pre-holiday expectations, mainly due to concentrated shipments from Northwest China attracted by price advantages in central China before the holiday, with arrivals increasing by 40% compared to expectations. Wuxi recorded a holiday buildup of 11,000 mt, significantly lower than expected, as arrivals were relatively low, and warehouse withdrawals remained resilient during the holiday. Foshan's holiday buildup of 20,000 mt precisely matched pre-holiday expectations. Shanghai bucked the trend with a slight destocking, becoming the only mainstream consumption area with a decline in inventory, while other regions remained basically flat compared to pre-holiday levels.

Overall, the inventory buildup during this year's 8-day holiday is relatively optimistic. Although some in-transit cargoes and delayed warehouse entries may cause minor disruptions in the 3-4 days after the holiday, leading to a slight inventory buildup by next Monday, SMM expects aluminum ingot inventory to be around 650,000-680,000 mt in the first half of October, based on historical data, warehouse feedback, and input from aluminum smelters. However, with the proportion of liquid aluminum expected to rise further in October, aluminum ingot supply pressure is limited, and demand may become the key factor influencing future inventory performance. For now, SMM anticipates that domestic aluminum ingot inventory may resume a destocking trend in the second half of October. Still, attention should be paid to the actual post-holiday demand performance as the peak season progresses and whether high aluminum prices will impact subsequent warehouse withdrawals.

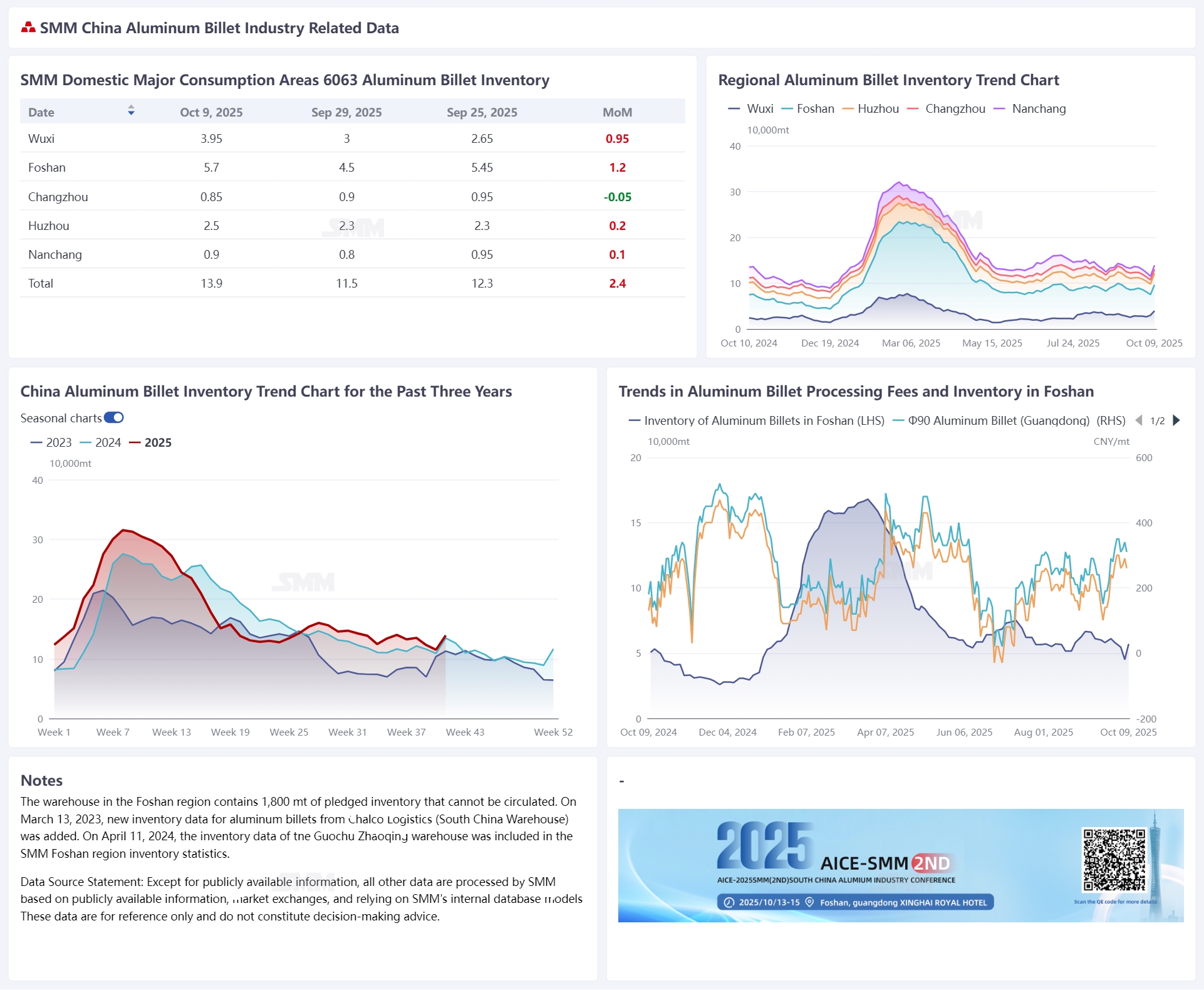

Aluminum Billet Inventory: Holiday Inventory Buildup Marks the Smallest Increase for the Same Period in Three Years

Turning to aluminum billet inventory. According to SMM statistics, domestic aluminum billet inventory increased to 139,000 mt, up 24,000 mt from pre-holiday levels, primarily due to the holiday impact and a sharp decline in withdrawals from warehouses caused by logistics disruptions, leading aluminum billet inventory to enter a buildup phase as expected. However, with an increasing proportion of road transportation in the market, the increase in social inventory of aluminum billets was smaller than the 28,000 mt rise seen during the same period last year. In terms of withdrawals, domestic aluminum billet withdrawals totaled 57,000 mt in the week before the holiday, up 9,500 mt WoW, reflecting a recovery in stockpiling sentiment for aluminum billets ahead of the holiday, while only sporadic withdrawals occurred during the holiday period.

SMM believes that current market conditions feature both recovering arrivals and restocking driven by rigid demand. On one hand, inventory accumulated at aluminum billet plants is gradually being shipped out; on the other hand, aluminum prices fluctuating at highs are suppressing speculative demand, which will somewhat inhibit restocking based on downstream rigid demand. Looking ahead, the September peak season has passed, giving way to the October peak season. With continued rigid procurement, aluminum billet withdrawals are expected to be supported. However, against the backdrop of aluminum prices holding up well, which dampens market consumption sentiment, aluminum billet inventory is projected to maintain a sideways movement, fluctuating within the range of 130,000-150,000 mt in the short term, with a rapid destocking trend unlikely to emerge by mid-to-late October.