Understanding Scrap Metals

Definition and Types of Scrap Metals

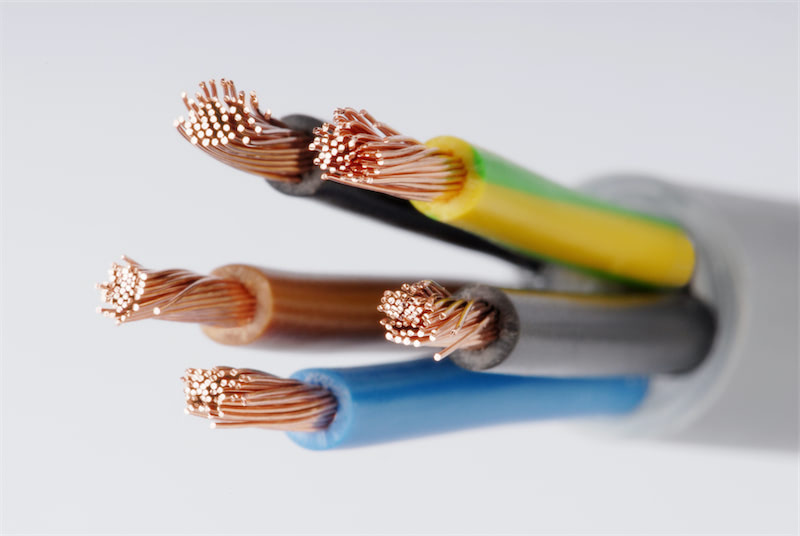

Scrap metals include a variety of metal materials that have lost their usefulness in their original state. These can range from household items like aluminum cans to industrial components such as copper wiring. Scrap metals can be classified into different types, including ferrous metals such as iron and steel, which are magnetic, and non-ferrous metals like aluminum, copper, lead, zinc, and precious metals. Each category of scrap metal has unique properties and market values, making proper classification essential for recycling and resale purposes.

Common Sources of Scrap Metals

Common sources of Scrap Metals include both post-consumer products and industrial byproducts. Residential sources often involve recycled household items such as aluminum cans, appliances, and old vehicles. Industrial sources, on the other hand, include construction and demolition debris, manufacturing waste, and obsolete equipment. The constant turnover and disposal from these sources ensure a steady supply of Scrap Metals into the recycling stream.

Key Economic Factors Influencing Scrap Metal Prices

Demand and Supply Dynamics

Global Industry Demand

The price of Scrap Metals is heavily influenced by global demand. Industries such as construction, automotive, aerospace, and electronics are significant consumers of these materials. When there is a surge in infrastructure projects or technological advancements, the demand for Scrap Metals increases, driving up prices. Conversely, economic slowdowns or a decrease in industrial activity can lead to a decline in demand, causing prices to drop.

Seasonal Variations in Supply

Seasonal variations play a crucial role in the supply of Scrap Metals. For instance, construction halts in winter in many regions, leading to lower collection rates of scrap materials. Similarly, the agricultural sector's off-season might limit machinery and equipment disposal. These seasonal impacts result in fluctuations where the available supply of Scrap Metals can dip or surge, thus influencing pricing trends.

Production Costs and Their Impact on Prices

Energy Costs

Energy expenses play a crucial role in setting the prices of Scrap Metals. The recycling procedure includes melting and reshaping metals, which demands a considerable amount of energy. Changes in energy costs, including those for oil and electricity, can have a direct impact on processing expenses. When energy prices go up, the heightened production costs are usually transferred to consumers as increased metal prices.

Labor Costs

Labor costs also critically impact the pricing of Scrap Metals. The collection, sorting, processing, and transportation of scrap materials are labor-intensive activities. Wage rates, labor availability, and related expenses can vary by region and have a profound effect on the overall cost structure. An increase in labor costs generally leads to higher prices for Scrap Metals as businesses aim to cover their operational expenses.

International Trade Policies and Tariffs

Import and Export Regulations

International trade policies, including import and export regulations, significantly impact Scrap Metals pricing. Restrictions or bans on the import/export of metal scrap can lead to supply shortages or surpluses in different regions. Countries heavily reliant on imported scrap materials might face price spikes if regulations become stringent, while those exporting significant amounts might deal with lower prices domestically due to excess supply.

Tariffs Effects on Pricing

Tariffs imposed on Scrap Metals can create additional costs that affect prices. When tariffs are high, the cost of exporting or importing metal scrap increases, which in turn can raise prices for end-users. This is especially evident in markets where tariffs are implemented to protect domestic industries from foreign competition. The ripple effect of tariffs can be felt globally, influencing the economic landscape of scrap metal pricing across multiple markets.

As an expert in Metals and a comprehensive non-ferrous metal Internet platform provider, Shanghai Metals Market (SMM) provides a comprehensive Internet platform for metal mining benchmark prices, analysis, news, consulting and conferences. In addition, we will provide you with the most authoritative information on a variety of metals.

Market Trends Shaping Scrap Metal Prices

Technological Advancements in Recycling Processes

The progression of recycling technologies significantly influences the pricing dynamics of Scrap Metals. Contemporary advancements have made it possible to process scrap materials more efficiently, thereby reducing the costs tied to recycling. New machinery and automation technologies enable faster sorting and cleaning, allowing more scrap to be prepared for resale at an accelerated rate. These efficiencies can result in lower prices, as the supply chain from collection to reprocessing becomes more streamlined and cost-effective.

Additionally, innovations in separating mixed metal alloys have enhanced the quality of recycled metals, making them more attractive to industries requiring high-quality input materials. The enhancement of these recycling processes contributes to a more consistent supply, which can stabilize prices over time. As these technologies continue to develop, the economic landscape of Scrap Metals will likely see even more profound shifts.

Innovations in Material Usage and Alternatives

Innovations in material usage also play a crucial role in shaping the prices of Scrap Metals. For instance, industries are increasingly exploring the use of alternative materials that could either supplement or replace traditional metals. The rise of composite materials, which can sometimes offer superior properties over conventional metals, influences demand levels. As these substitutes gain popularity, the demand for certain types of Scrap Metals may diminish, leading to potential price adjustments.

Furthermore, advancements in additive manufacturing or 3D printing have introduced new ways to utilize metal powders and filaments, changing the demand dynamics. These technological strides provide industries with more options, potentially reducing dependence on scrap metal and affecting its market valuation. As industries pivot towards these innovative solutions, the implications for Scrap Metals pricing will continue to unfold.

Role of Environmental Regulations

Impact of Eco-Friendly Practices on Pricing

Environmental regulations play a crucial role in shaping the pricing dynamics of scrap metals. Governments around the globe are progressively pushing for sustainable practices, requiring adherence to a range of environmental standards. While companies that implement eco-friendly measures might face higher upfront costs, these practices can also lead to financial incentives and tax benefits that help offset expenses over time.

The adherence to green practices can lead to an increase in operational costs for scrap metal businesses, influencing the final pricing of their products. However, this compliance also ensures a better market position, as eco-conscious consumers and enterprises are willing to pay a premium for sustainably sourced materials. This dual impact of cost and demand associated with green practices plays a crucial role in the economic landscape of Scrap Metals.

Green Certifications and Standards Compliance

Green certifications and standards compliance create additional layers of complexity in the pricing of Scrap Metals. Attaining certifications such as ISO 14001 or LEED can be a costly endeavor, requiring significant investment in sustainable technologies and practices. However, these certifications also serve as a benchmark for quality and environmental responsibility, making certified Scrap Metals more appealing to certain market segments.

Businesses that achieve these green benchmarks can often command higher prices, offsetting the initial investment costs. The compliance with these standards also ensures that companies remain competitive in an increasingly eco-conscious market. As more businesses strive to meet these green certifications, the overall market may see a shift towards higher quality and potentially higher-priced Scrap Metals.

To sum up, the cost dynamics of Scrap Metals are affected by a wide array of factors, including technological progress and material breakthroughs, as well as environmental laws and green certifications. These elements interact to form the market landscape, making it a complex yet intriguing sector to study. By grasping these influences, stakeholders can more effectively navigate the economic climate of Scrap Metals and make well-informed decisions.

Macroeconomic Indicators Affecting Scrap Metal Pricing

Changes in GDP and Industrial Growth Rates

Changes in Gross Domestic Product (GDP) and industrial growth rates are pivotal macroeconomic indicators that influence the pricing of Scrap Metals. When a country's GDP rises, it typically signals economic health and expansion, which in turn enhances industrial production. An increase in industrial activity naturally elevates the demand for raw materials, including Scrap Metals, leading to higher prices. Conversely, during periods of economic recession or stagnation, GDP growth slows down or contracts, resulting in lower industrial production and diminished demand for metals. This reduced demand exerts downward pressure on the prices of Scrap Metals.

Additionally, industrial growth rates in sectors such as construction, automotive, and technology have a direct correlation with scrap metal prices. A robust growth rate in these sectors translates into increased consumption of recycled metals for infrastructure projects, vehicle manufacturing, and electronic products. The synergy between GDP growth and industrial expansion creates a compounded effect on the overall demand for Scrap Metals, making economic forecasts a crucial tool for predicting price trends.

Currency Fluctuations and Exchange Rates

Currency fluctuations and exchange rates are significant factors impacting the global pricing of Scrap Metals. Since Scrap Metals are traded internationally, the value of a country's currency relative to others affects the export and import dynamics. A stronger domestic currency makes a nation's exports more expensive and less competitive on the global market, leading to a potential surplus of Scrap Metals domestically and thus driving prices down. On the flip side, a weaker currency can boost export demand, reducing local surplus and causing an increase in prices domestically.

In addition, numerous countries determine Scrap Metals prices in U.S. dollars, making exchange rates pivotal for global transactions. When the U.S. dollar strengthens, buyers from nations with weaker currencies may end up paying more in their local currency, which could decrease demand and affect worldwide pricing. On the other hand, a weakening dollar makes U.S. exports more affordable and appealing to international buyers, boosting demand and potentially raising prices. This dynamic between currency strength and exchange rates introduces another layer of complexity to the economic factors that influence Scrap Metals pricing.

Shanghai Metals Market (SMM) Headquartered in Shanghai, with branch office in Shandong and Guangdong province. We have extensive network and deep-rooted relationships in SMM nonferrous, ferrous and EV metal industries. At SMM, we help you Know the real China from a global perspective.

Conclusion: The Future Outlook for Scrap Metal Prices

In conclusion, the pricing dynamics of Scrap Metals are driven by an intricate interplay of macroeconomic indicators, market trends, technological advancements, and environmental regulations. Understanding these multifaceted economic forces is essential for stakeholders in the industry. As the global economy continues to evolve, the demand and supply dynamics shaped by GDP growth, industrial activity, currency fluctuations, and trade policies will keep influencing the market.

Technological innovations in recycling processes and the adoption of alternative materials will further drive changes in market behavior. The emphasis on eco-friendly practices and compliance with green certifications will also shape the future pricing landscape. Stakeholders must remain vigilant to these trends to navigate the volatile yet promising market of Scrap Metals.

As we move forward, the ability to adapt to rapidly changing economic conditions will be crucial. Policymakers, businesses, and investors must leverage economic indicators and market insights to make informed decisions. By understanding the underlying economic forces, we can better forecast future trends and capitalize on opportunities within the Scrap Metals industry.

![[SMM Analysis]What Impact Does the Middle East Situation Have on the Recycled Copper Raw Materials Market?](https://imgqn.smm.cn/usercenter/MXbup20251217171745.jpg)

![Macro sentiment retreats amid expectations of supply recovery the most-traded SHFE tin contract falls over 7% [SMM Tin Noon Review]](https://imgqn.smm.cn/usercenter/qWcEp20251217171751.jpeg)