เข้าเข้าสู่ระบบ

THThe NPI Supply will be Gradually Surplus and the Pure Nickel Supply was still Tight

คำชี้แจงแหล่งที่มาของข้อมูล: นอกจากข้อมูลที่เปิดเผยต่อสาธารณะแล้ว ข้อมูลอื่นๆ ทั้งหมดได้รับการประมวลผลโดย SMM จากข้อมูลสาธารณะ การสื่อสารกับตลาด และการพึ่งพาแบบจำลองฐานข้อมูลภายในของ SMMข้อมูลเหล่านี้มีไว้เพื่ออ้างอิงเท่านั้น ไม่ถือเป็นข้อเสนอแนะในการตัดสินใจ

หากมีข้อสงสัยหรือต้องการทราบข้อมูลเพิ่มเติม กรุณาติดต่อ: lemonzhao@smm.cn

หากต้องการข้อมูลเพิ่มเติมเกี่ยวกับวิธีการเข้าถึงรายงานการวิจัยของเรา โปรดติดต่อ:service.en@smm.cn

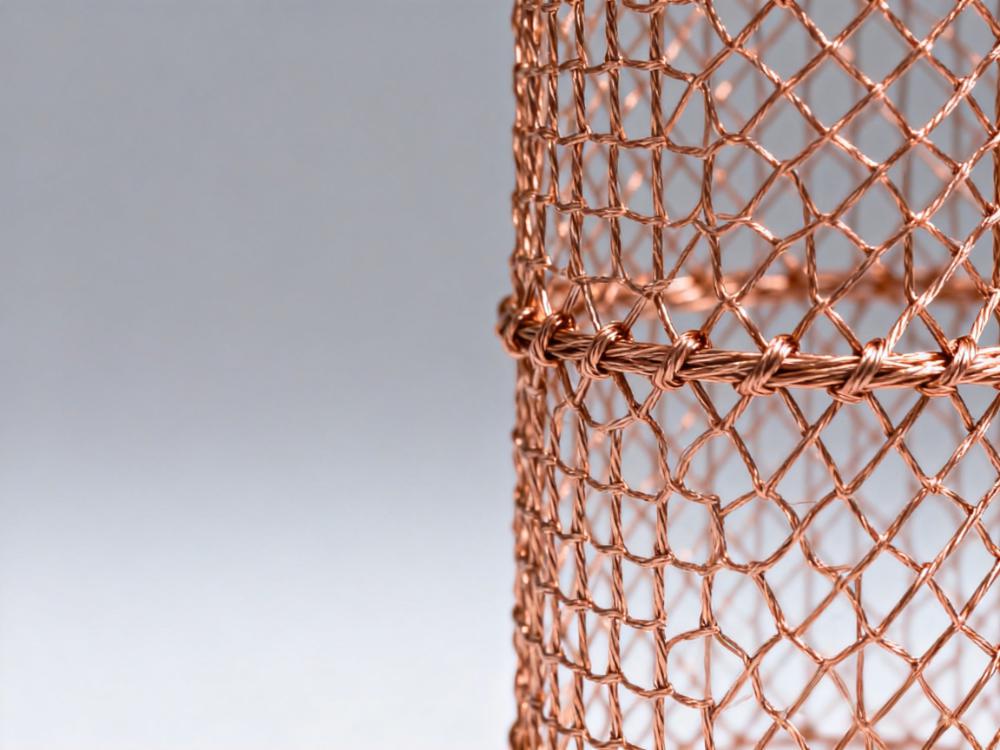

![[การวิเคราะห์ SMM] ราคานิกเกิลผันผวนจากเป้าหมายอินโดนีเซียและแนวโน้มตลาด](https://imgqn.smm.cn/usercenter/fzwTi20251217171733.jpg)