SHANGHAI, May 5 (SMM) - China rare earth ore imports recorded 12,000 mt in March 2022, down 11% YoY which mainly attributed to middle and heavy rare earth.

In terms of import structure, the imports of rare earth metal ore took up the largest proportion and stood at 11,000 mt in March, a year-on-year increase of 6.15%, all of which came from the United States. The imports of rare earth metal ore were 9,750 mt in February, and the imports in March rose 17.4% MoM.

It is reported that the operating capacity of MP mine in the US will remain stable in 2022, and the contract renewal with Shenghe Group has been smooth. In light of strong demand for downstream applications and the rising prices of mainstream rare earth products, the unit price of imported rare earth metal ore in March rose 25.4% month-on-month. China's rare earth metal ore imports are expected to increase slightly in April.

The total imports of mixed rare earth carbonate and unlisted rare earth oxide were 521 mt in March, a year-on-year decrease of 80.55%. The imports mainly came from Vietnam, Malaysia and other Southeast Asian countries and regions, while the decrease was mainly found in imports from Myanmar. Affected by the pandemic in China and abroad, the China-Myanmar border has not yet been opened. The imports of the above-mentioned two kinds of middle and heavy rare earth ores stood at 371 mt in February, and the import volume in March increased by 150 mt month-on-month. The import of mixed rare earth carbonate and unlisted rare earth oxide has stagnated since the China-Myanmar border port was closed in December 2021. As the rainy season in Southeast Asia is coming, hence even if the auxiliary materials can be imported by Myanmar, the production situation in the mining area is not optimistic. It is expected that China imports of middle and heavy rare earth ore in April will be low.

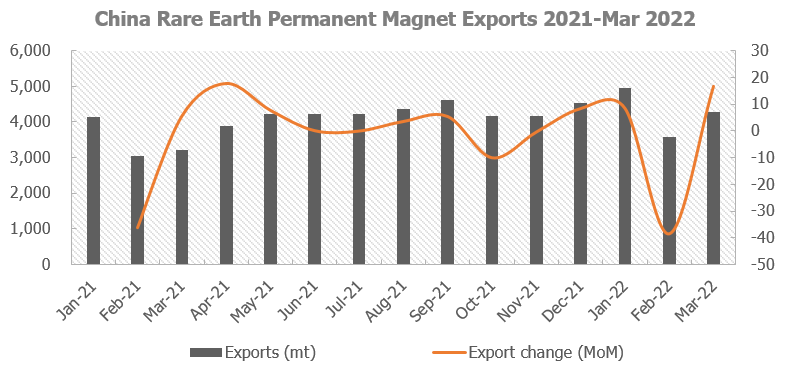

China exports of rare earth permanent magnets totalled 4,273 mt in March, up 24.8% YoY. The exports in March rose 16.55% from last month.

The main export directions of China's rare earth permanent magnets are Europe, the United States, Japan, South Korea. Among the export structure in March, 978 mt of rare earth permanent magnets were exported to Europe, accounting for 22.9% of China’s total exports; 575 mt to the United States, accounting for 12%; 448 mt to South Korea, accounting for 10.5%; and 120 mt to Japan, accounting for 2.8%.

The downstream demand for rare earths from sectors such as overseas new energy vehicles and wind turbines is growing with the lessening of COVID-related policies overseas, and it is expected that China's rare earth permanent magnet exports will draw an upside trend in 2022.

Affected by the rising prices of domestic rare earth products, the unit export price of China's rare earth permanent magnets has also risen from $66,600/mt in February 2022 to $74,300/mt in March, a month-on-month increase of 10.4%. And compared with 2021, the unit price rose 27.46% in March 2022 from $54,000/mt in the same period last year.

Although rare earths account for a relatively large proportion of the cost of wind turbines, there are currently no low-cost substitutes for NdFeB magnetic materials such as samarium cobalt permanent magnets for overseas wind turbine orders. It is expected that China's rare earth permanent magnet exports will continue to grow in April.