SHANGHAI, Apr 7 (SMM) - 2021 is an extraordinary year for China's molybdenum market, with unexpected events such as stainless steel tax rebates, heavy rainfall in the main producing areas and the shutdown of large mines, and domestic molybdenum prices continued to hit new highs.

The year 2022 began with domestic molybdenum prices continuing to march forward, with the conflicts between Russia and Ukraine and the tight supply of raw materials. In March, with the end of a new round of molybdenum mine auction, domestic ferromolybdenum prices reached 180,000 yuan/mt along with the prices of molybdenum concentrate, creating a new historical high in a decade.

Looking ahead to 2022, has domestic molybdenum prices already peaked? Is there room for future price hike?

Pessimism over raw material supply offers upside momentum

If we open up the molybdenum industry chain, the first thing that comes into mind is molybdenum concentrate, and the mining and supply of which plays a pivotal role in the market operation of molybdenum. The supply of downstream products such as ferromolybdenum and molybdenum metal is largely dependent on the availability of molybdenum concentrate.

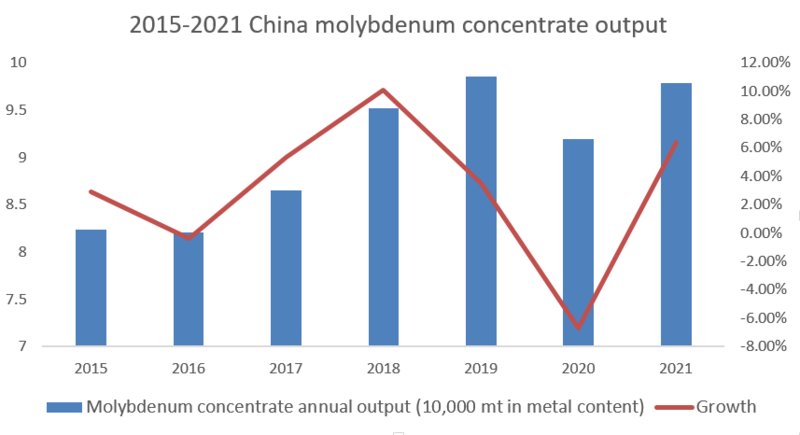

In recent years, the domestic supply of molybdenum concentrate has not been very optimistic, and with the mining of major mineral areas, the grade of ore will fall and the difficulty of beneficiation will increase significantly. At the same time, due to the tightening of national controls on safe production and environmental protection in recent years, the difficulty of obtaining mining permits has also increased significantly, as is in the case of the Shapinggou molybdenum mine in Anhui, which has repeatedly postponed its production date due to local natural resource protection policies. It is also easy to see through years of data that domestic molybdenum concentrate output has decreased significantly since 2018, with negative growth occurring for the first time in 2020 due to various reasons such as the pandemic.

In the first quarter of 2022, molybdenum concentrate was still in extremely tight supply. But due to repeating pandemics in many places, mining and transportation of molybdenum mines in Jilin were both restricted, even tightening the supply of molybdenum concentrate. Domestic molybdenum market prices have tracked that of molybdenum concentrate and experienced several rounds of hikes after the Chinese New Year.

Looking ahead into this year, the development of the pandemic is still unknown, and the supply of a number of mines in north-east China is still blocked. Tianchi Jide molybdenum mine will be delayed in commissioning due to funding problems. And the international situation is still complicated, resulting in global molybdenum prices at a high level. As such, the domestic supply of molybdenum concentrate is expected to continue to be tight amid multiple factors, offering strong support to molybdenum prices.

Optimistic demand gives prices wide "imaginations"

In terms of domestic molybdenum market price pricing power, the smelters, who are in the midstream of the chain, have relatively little say in the market prices, and those play a dominant role are mainly upstream large mines and downstream major steel mills. From the amount of steel mills’ bidding in recent months, the domestic molybdenum market has undoubtedly managed a good start in a new year.

As can be seen from the chart above, over the past three years, the monthly bidding of steel mills are always rising in Q1, especially in March 2022, when, due to concerns about the continued impact of the pandemic and constantly rising prices earlier, domestic steel mills advanced their purchases of ferromolybdenum, and the tender volume increased by nearly 100% year-on-year.

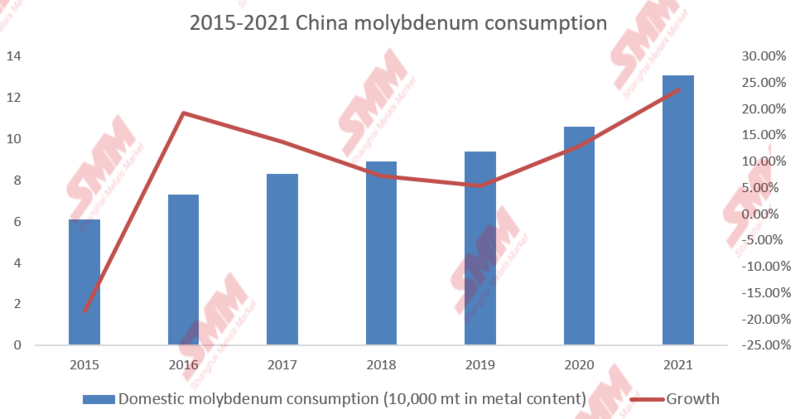

At the same time, domestic molybdenum market consumption has also been growing. According to SMM statistics, domestic consumption of molybdenum products is about 131,000 mt, with a compound growth rate of about 13.5% in 2015-2021, whil the compound growth rate of molybdenum concentrate supply for the same period is about 2.9%. Rapid growth in consumption has pulled domestic molybdenum prices.

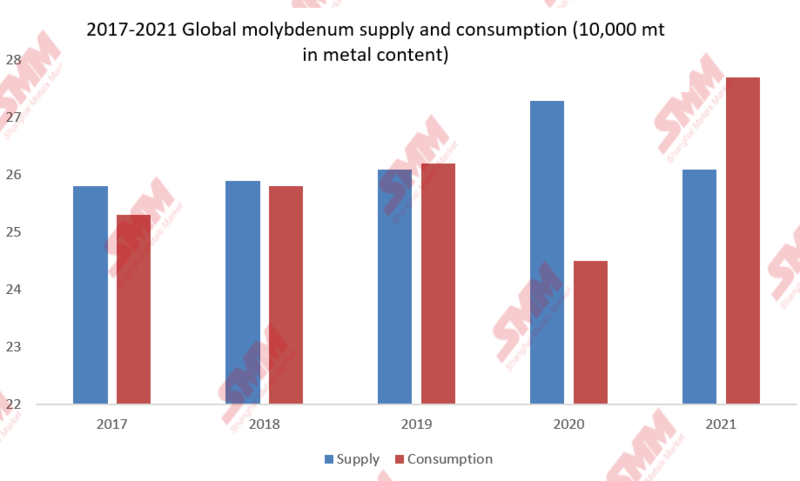

Not only has domestic demand boomed, but global molybdenum consumption has also grown at a much higher rate than its supply in recent years due to its irreplaceability for high-quality alloy steels and the influence of global economic development. According to data from the International Molybdenum Association, global molybdenum consumption grew at a compound rate of around 2.29% from 2017 to 2021, while its supply grew at a compound rate of around 0.29%, with global molybdenum production even falling back in 2021. The tension between international supply and demand has led to rising international molybdenum prices. What’s more, the 300-500 mt (in metal content) of Russian ferromolybdenum exports per month were restricted in 2022 due to the conflict between Russia and Ukraine, which exacerbated the supply tightness in the international market. Rising international molybdenum prices will in turn offer a strong support for domestic molybdenum prices.

Where lies the peak of molybdenum prices?

For the future of molybdenum, SMM believes that there is still potential in the downstream of molybdenum in China, with high-end stainless steel and alloy steel as the main downstream of molybdenum, which currently accounts for only about 10% of crude steel production in China, and still has 10-15 percentage points of upside compared to developed countries. At the same time, the mismatch between consumption and supply growth rates also predetermines that China's molybdenum market will be the seller's market in the long run. And based on the current market prices, compound growth rate of consumption and supply, and feedback from all parties in the market, SMM expects the domestic ferromolybdenum will peak at around 200,000 yuan/mt in 2022.