The price of the lithium industry chain continues to rise, and the closely watched price of lithium carbonate accelerates to jump and stand firm at the 300000 yuan / ton mark.

The average price of lithium carbonate stands at 300000 yuan / ton.

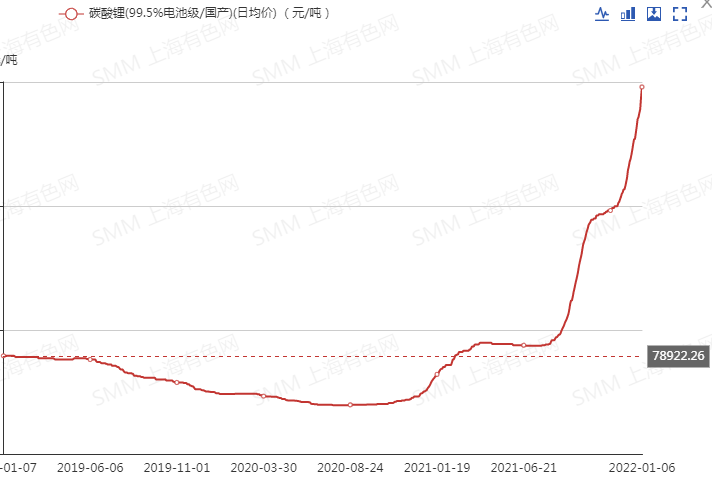

2021 can be described as a big year for the lithium battery industry, with prices rising sharply in many links of the industrial chain. According to SMM data, the prices of lithium carbonate and lithium hydroxide reached an annual increase of 418.87% and 349.49% respectively in 2021, making them the two best commodities in 2021. "View details

"Click to view the spot market of SMM new energy products.

It is worth noting that in 2022, this trend of price increases continues. Data released by Shanghai Iron and Steel Federation show that some lithium materials rose again yesterday, with cobalt tetroxide up 10000 yuan / ton and lithium hydroxide up 6000-8500 yuan / ton. Among them, lithium carbonate rose 7500 yuan / ton, the average price was 302500 yuan / ton, compared with the price of 280000 yuan / ton at the end of 2021, the price of lithium carbonate has increased by nearly 10% this year.

Price trend of Lithium Carbonate in recent years

"Click to view the historical price of SMM

According to the Zhongtai Securities Research report, the stock market at the end of the year pushed up the price of lithium carbonate to accelerate the upward. in addition, the prosperity of the global new energy industry continued to rise, the electric car market in China, the United States and Europe resonated, and the upward trend in upstream raw material prices continued to strengthen.

The battle for lithium resources begins

Chile announced in October last year that it would provide five quotas of 80, 000 tons to domestic and overseas companies, totaling 400000 tons of exploration and production contracts, and the winning bidder would be given seven years of exploration and development projects and 20 years of production time. the bid will end in mid-January.

However, with the importance of lithium resources highlighted, the tender is at risk of being terminated. On January 4, local time, Chilean lawmakers applied to the House of Representatives for an injunction aimed at preventing the outgoing government from accepting bids for lithium mining contracts. The lawmaker said that lithium is a strategically important natural resource and that the current government is putting the interests of the country as a whole at risk.

Huaxi Securities Research News pointed out that at present, countries all over the world regard lithium resources as strategic mineral resources, and it is very important to establish a local supply chain to ensure the supply security of lithium metal minerals. at the same time, with the continuous rise in the price of lithium concentrate, the profits of non-integrated lithium salt processing enterprises are gradually thinning, and most of the profits have shifted to the resource side. Under the current background, the integrated enterprises with the guarantee of upstream resources and the increment of resources are obviously more competitive.

The trend of concept stocks is "bumpy"

Although the price rise in the industry continues, the recent performance of lithium battery concept stocks is quite "bumpy". Concept stocks rebounded strongly yesterday, with stocks such as Tibet Mining, Mount Qomolangma and Tibet City Investment rising sharply.

However, just yesterday, the lithium battery plate is a different landscape, the plate fell sharply for two days in a row, Tibet Everest, Tibet City Investment and other stocks that rose sharply for two consecutive days have been adjusted sharply for two consecutive days, and the track stocks have become the "abandoned son" of the market.

The price deviates from the stock price performance, and the market's previous concern is the sustainability of the price increase, and whether the price increase will have a negative impact on the industrial chain. This game between the industry chains has been staged in the photovoltaic industry, the recent decline in silicon prices, not only did not boost the share prices of downstream component companies, but further affected the pessimism of investors towards the entire industry.